Strategic Insights on Key Companies and Segment Growth in the Rigid Food Packaging Market

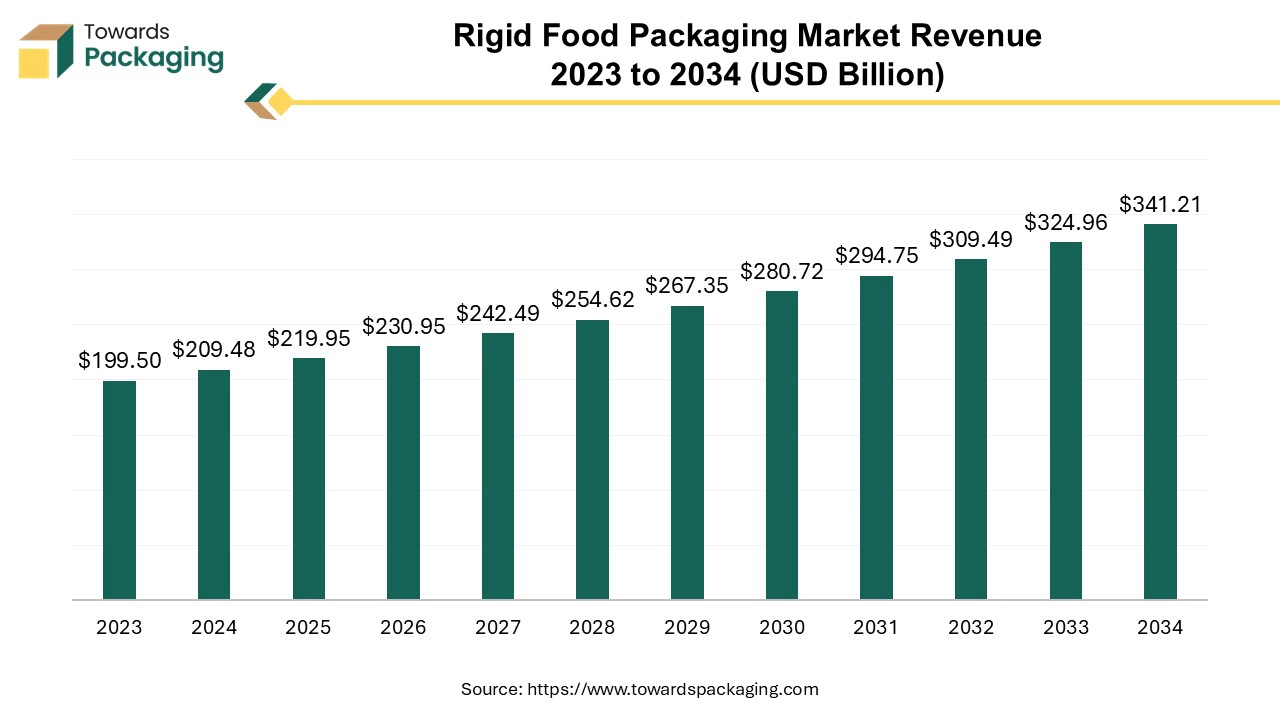

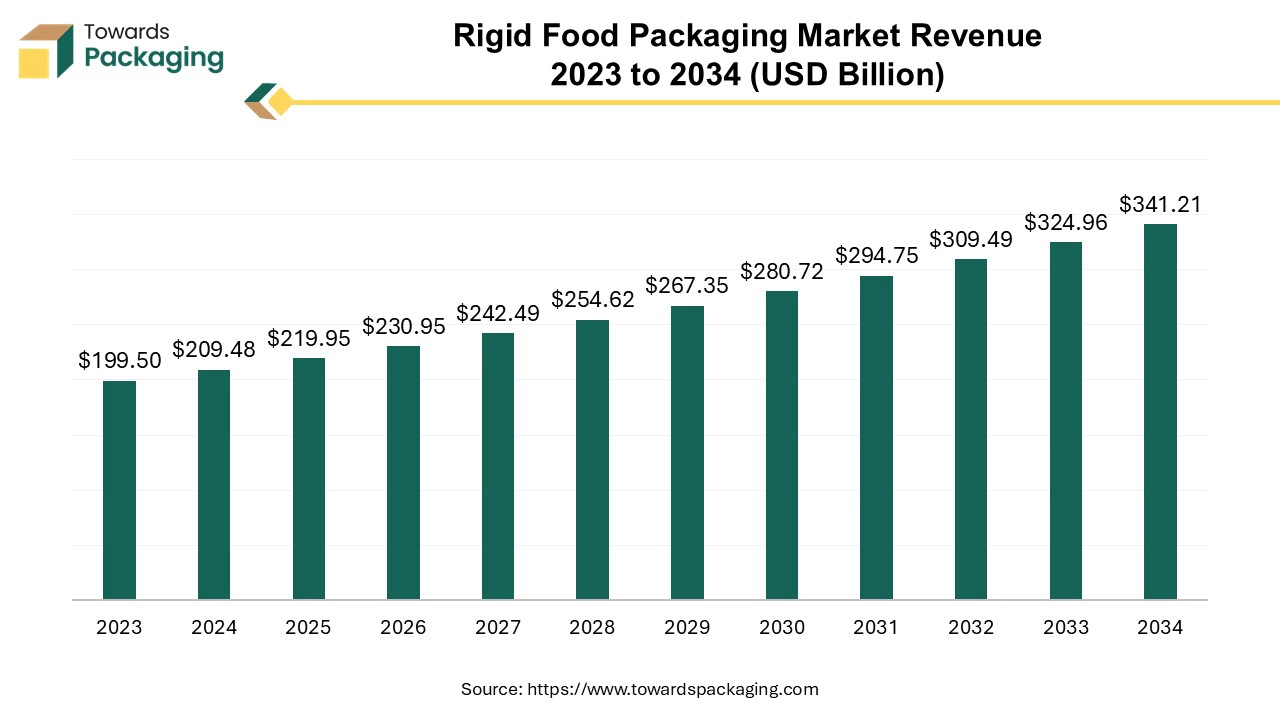

The rigid food packaging market is forecasted to expand from USD 230.95 billion in 2026 to USD 358.28 billion by 2035, growing at a CAGR of 5% from 2026 to 2035. This report covers a detailed breakdown by material (plastic, paper & paperboard, metal, glass, bagasse), packaging type (boxes & cartons, trays & clamshells, bottles & jars, cans, cups & tubs), and application (meat, poultry & seafood; dairy; bakery; ready-to-eat; baby food; produce).

Regional insights span North America, Europe, Asia Pacific, Latin America, and MEA, highlighting Asia Pacific’s 2024 leadership and North America’s rapid growth. It also features in-depth profiles of major players like Amcor plc, Berry Global Inc., Greif Inc., Silgan Holdings Inc., and Sealed Air Corporation, alongside value chain mapping, trade data, and supplier/manufacturer landscapes.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing rigid food packaging which is estimated to drive the global rigid food packaging market over the forecast period.

Major Key Insights of the Rigid Food Packaging Market

- Asia Pacific dominated the rigid food packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By material, the plastic segment dominated the market with the largest share in 2024.

- By packaging type, the boxes & cartons segment is expected to grow at significant rate during the forecast period.

- By application, the meat, poultry & seafood segment dominated the rigid food packaging market in 2024.

Structural Integrity of the Rigid Food Packaging Market

Rigid food packaging is a category of packaging designed to offer a solid, inflexible structure to protect food products. Unlike flexible packaging, which can be bent or folded, rigid packaging maintains its shape and provides a stable barrier to external factors. Rigid packaging maintains its shape and does not collapse or bend. This rigidity assists in safeguarding the food from physical damage and contamination.

The materials utilized for rigid packaging are typically sturdy, strong and resistant to impacts, ensuring that the food inside remains safe during transportation and storage. Rigid packaging offers a solid barrier against external factors such as air, moisture, light, and contaminants. This helps in preserving the freshness and extending the shelf life of the food. Rigid packages frequently feature easy-to-use designs, such as resealable lids or easy-pour spouts, which enhance the consumer experience. Many rigid packaging materials, such as glass and metal, are recyclable or reusable, contributing to environmental sustainability.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

US$ 219.95 Billion |

| Projected Market Size in 2035 |

US$ 358.28 Billion |

| CAGR (2025 - 2035) |

5% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material, By Packaging Type, By Application and By Region |

| Top Key Players |

Amcor plc, Greif Inc., Crown Holdings, Inc., Mauser Packaging Solutions, Berry Global Inc., Silgan Holdings Inc. |

5 Key Factors Driving Growth in the Rigid Food Packaging Market

- The key players operating in the market are focused on geographic expansion and launching their brand in other countries which is expected to drive the growth of the rigid food packaging market in the near future.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

- Emerging markets and trends for rigid food packaging is expected to drive the growth of the global rigid food packaging market over the forecast period.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

- Increasing in adoption of the advanced technology for the production of rigid food packaging is estimated to drive the growth of the global rigid food packaging market in the near future.

- Stringent regulations regarding food safety and packaging standard drive adoption of high-quality rigid packaging solutions, which is projected to drive the rigid food packaging market in the near future.

How is AI Revolutionizing Rigid Food Packaging for Innovation, Efficiency, and Sustainability?

AI-driven tools can analyze consumer preferences and market trends to create more effective packaging designs. Machine learning algorithms can optimize packaging shapes, sizes, and materials for improved functionality and appeal. AI-powered vision systems can detect defects and inconsistencies in packaging during production, ensuring high-quality standards and reducing waste. AI-powered vision systems can detect defects and inconsistencies in packaging during production, ensuring high-quality standards and reducing waste.

AI can optimize supply chain logistics by predicting demand, managing inventory, and streamlining distribution processes, which can reduce costs and improve delivery times. AI can optimize supply chain logistics by predicting demand, managing inventory, and streamlining distribution processes, which can reduce costs and improve delivery times. AI can optimize supply chain logistics by predicting demand, managing inventory, and streamlining distribution processes, which can reduce costs and improve delivery times. AI can monitor equipment performance and predict potential failures or maintenance needs, minimizing downtime and improving operational efficiency.

AI analytics can provide insights into consumer behaviour and preferences, allowing companies to tailor their packaging strategies and marketing efforts more effectively. AI can help in developing and implementing more sustainable packaging materials and processes by analyzing environmental impact and optimizing resource use.

AI can enable more efficient and cost-effective customization of packaging for different markets or products, enhancing brand differentiation and consumer engagement. Overall, AI integration can drive innovation, improve efficiency, and enhance the overall quality and sustainability of rigid food packaging.

Driver

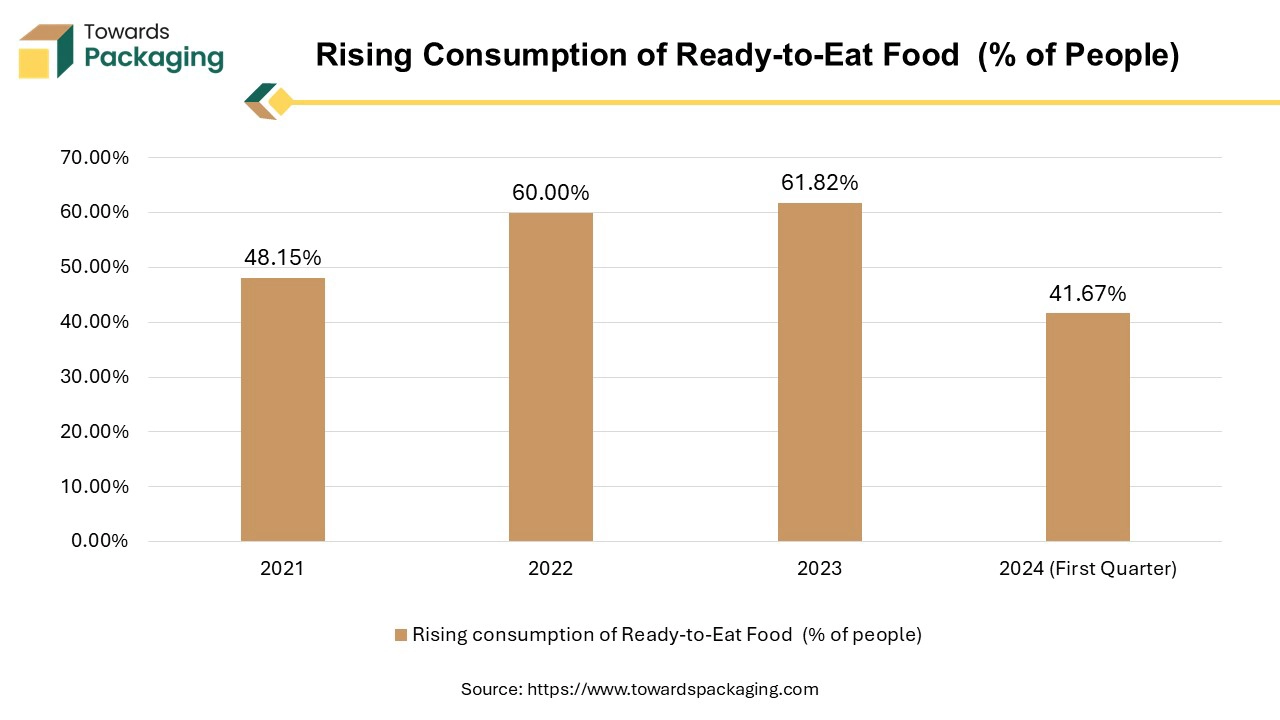

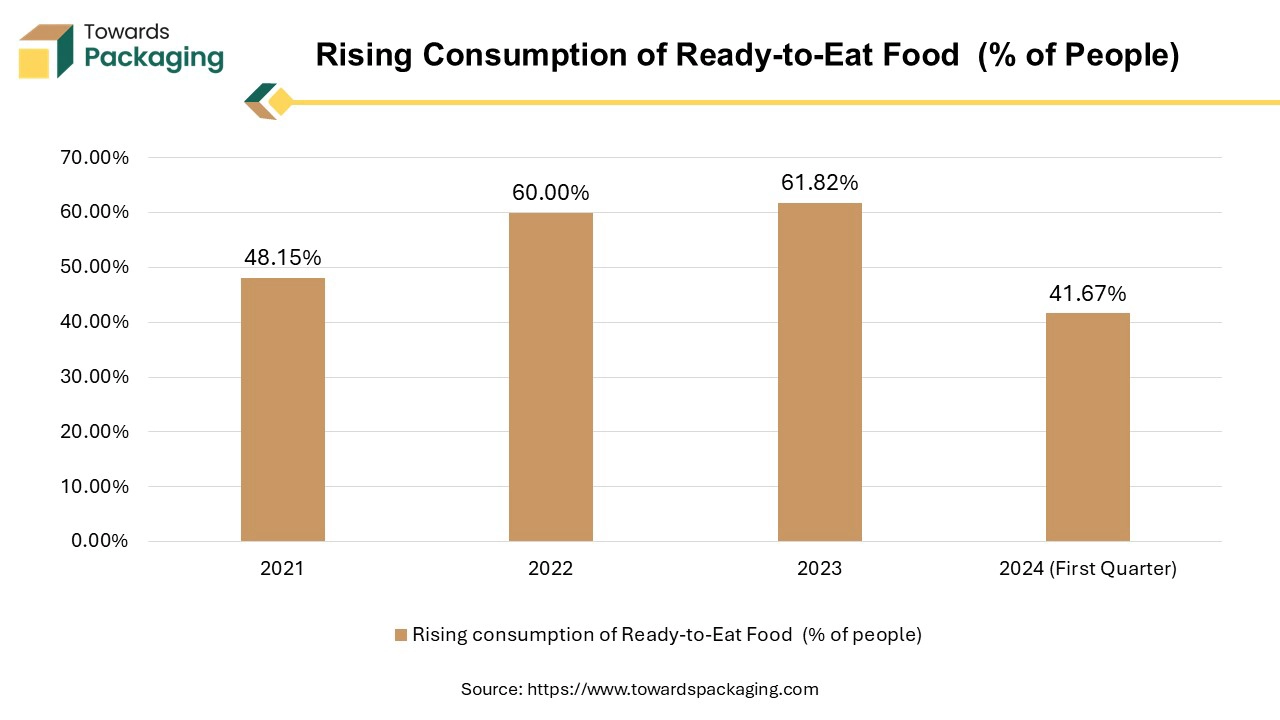

How is Consumer Demand for Convenience and Ready-to-Eat Food Shaping the Packaging Industry?

The rising consumer preference for ready-to-eat and on-the-go food products drives the need for convenient and durable packaging solutions. Busy life-style and modern consumers, particularly in urban areas, lead fast-paced lives with limited time for meal preparation, boosting the demand for convenient food options. As more people work long hours and commute, there's a greater demand for quick, easy meal solutions that fit into a busy schedule. Growing urban populations often have higher disposable incomes and are more likely to seek convenient food options available at their fingertips. There is a growing demand for healthier options in the ready-to-eat category, driving innovation in this segment and making it more attractive to health-conscious consumers.

Restraint

How Are Flexible Packaging and Technological Limitations Affecting the Rigid Food Packaging Market?

The key players operating in the market are facing competition from flexible packaging solutions as well as high cost of technology for manufacturing rigid food packaging is restrict the growth of the rigid food packaging market. The production and material costs for rigid packaging can be higher compared to flexible packaging, impacting affordability and overall market growth. While there are advancements in sustainable packaging, traditional rigid packaging materials can contribute to environmental pollution and waste, leading to regulatory pressures and consumer demand for eco-friendlier solutions.

Opportunity

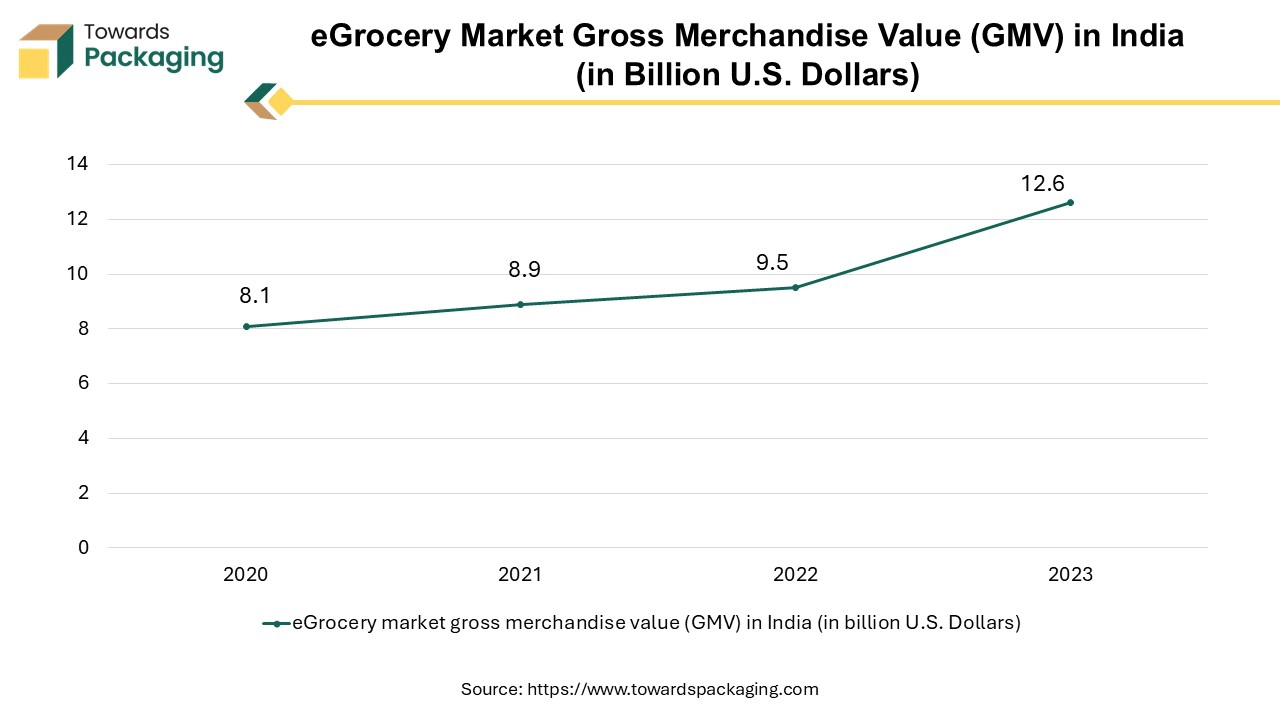

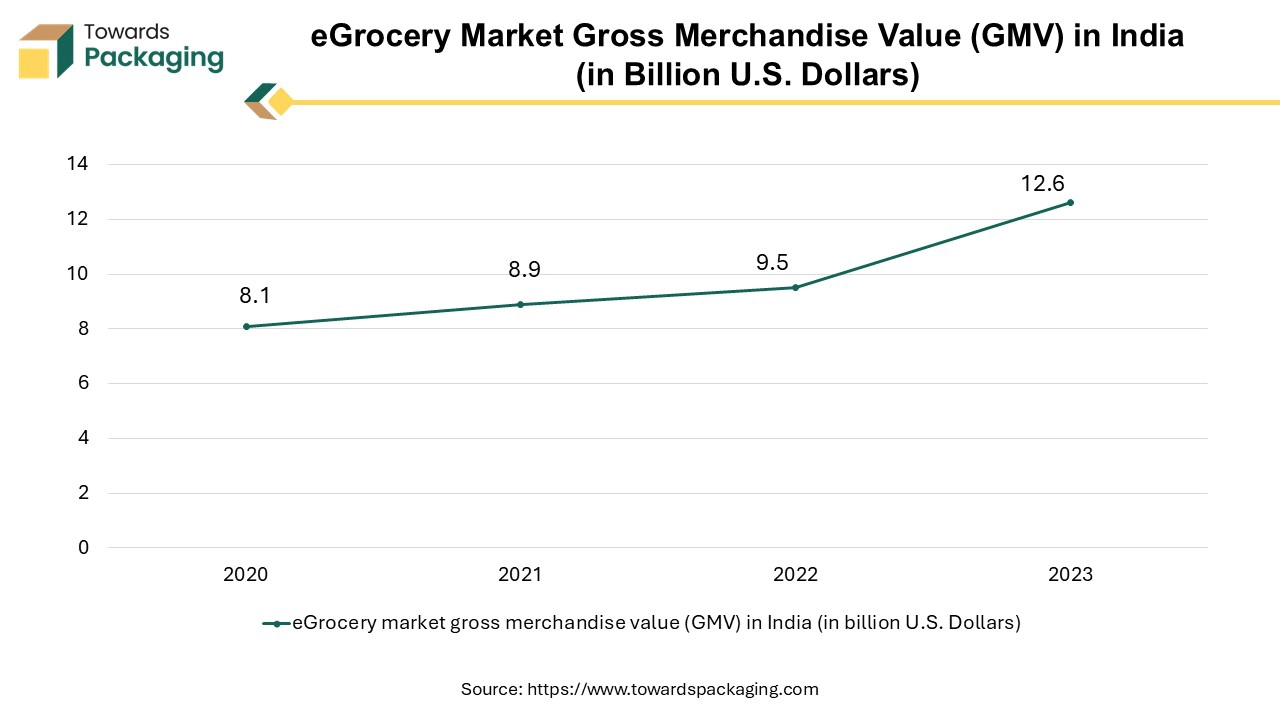

How E-commerce Growth is Driving the Demand for Protective Rigid Food Packaging

As grocery shopping and online food ordering trend is growing, there is increased demand for protective and packaging solutions suitable for shipping. As the e-commerce industry expands, the demand for ready-to-eat food products is observed to rise. E-commerce involves shipping food products over long distances, often requiring multiple handling points. Rigid packaging provides the necessary protection to prevent damage, ensuring that food items reach consumers in optimal condition. This demand for protective packaging drives the need for more rigid packaging solutions.

Klöckner Pentaplast Group Leads the Way in Recycling Plastic Waste for Sustainable Rigid Food Packaging

- In January, 2024, Klöckner Pentaplast Group, packaging company headquartered in German, UK, signed partnership agreement with Keep Sea Blue, international organization keeping the Mediterranean Sea plastic-free, to develop rigid food packaging by recycling coastal plastic waste using authenticated technology and methods. Through its partnership with Keep Sea Blue, Klöckner Pentaplast Group contributes to the closure of the loop on plastic waste by using Recycled Coastal Plastics, a certified post-consumer recycled raw material recovered from within 10 kilometers of the Mediterranean basin's shoreline.

Using the more than 800 tonnes of recycled (polyethylene terephthalate) PET waste gathered by this program, KP made new packaging in 2023. It highlights Klöckner Pentaplast Group 's mission to promote environmental stewardship and sustainably designed packaging solutions. It is the equivalent of repurposing 14 million polyethylene terephthalate (PET) bottles. With the use of Oracle technology and Keep Sea Blue's Blockchain platform, the kp team is able to do thorough quality checks and confirm the origin, date, and location of plastic collection. The recycling procedure complies with RecyClass, ISO 9001, and BRC certifications.

Segment Insights

Plastic Segment Dominates Rigid Food Packaging Market in 2024 with Sustainable Innovations

The plastic segment held the dominating share of the rigid food packaging market in 2024. Plastic rigid packaging is perfect for ready-to-eat food goods and is very durable and user-friendly. Packing expenses can be kept down by using plastic since it is often less expensive to make and carry than some other materials. Food goods can have their shelf life extended and their freshness preserved with the help of plastic packaging's efficient barrier qualities. Because plastic packaging is lightweight, handling and transportation expenses are lowered.

Since plastic can be molded into a wide range of sizes and shapes, it may be used to develop custom designs and packaging that can accommodate a variety of food products and consumer preferences. Features that improve food safety are frequently included in plastic packaging design, such as airtight closures and tamper-evident seals. The key players operating in the market are focused on developing and launching plastic rigid food packaging solution to meet the rising demand by the consumers.

- In April, 2024, Klöckner Pentaplast Group, packaging company, revealed the introduction of the kp Tray2Tray, first food packaging trays comprising 100% recycled polyethylene terephthalate-PET (rPET) deriving significantly from trays.

Boxes & Cartons Segment to Capture Significant Share in Rigid Food Packaging Market with Sustainable Solutions

The boxes & cartons segment accounted for a considerable share of the rigid food packaging market in 2024. Cartons and boxes provide a convenient and safe way to store and transport food. They offer protection against contamination, spoilage, and physical damage. The increase of online food delivery and grocery shopping has significantly increased the need for robust and reliable packaging solutions to ensure food reaches consumers in good condition. Many food companies are shifting towards eco-friendly packaging options.

Cartons and boxes, especially those made from recycled materials, are often seen as more sustainable compared to plastic alternatives. Packaging plays a crucial role in branding and marketing. Boxes and cartons offer ample space for branding and information, helping companies stand out in a competitive market. The key players operating in the market are focused on adopting inorganic growth strategies like partnership to launch rigid box packaging, which is estimated to drive the growth of the segment over the forecast period.

- In June 2024, Saica Group, a company providing sustainable solutions for rigid paper and cardboard packaging, signed partnership with Mondelez International, Inc., food company, to introduce a new rigid cardboard based product targeting multipack products for the chocolate, biscuits and confectionery markets. The Saica Group reported it have been designed and developed to meet the sustainability standards set by the Confederation of European Paper (CEPI).

Meat, Poultry & Seafood Segment Drives Significant Growth in Rigid Food Packaging Market with Innovation in Sustainable Solutions

The meat, poultry & seafood segment held the dominating share of the rigid food packaging market in 2024. As incomes increase, particularly in developing countries, people can afford to purchase more meat and fish, which are often seen as premium food items. Many cultures and diets place a high value on meat and fish as primary sources of protein and essential nutrients. This cultural preference drives consumption patterns. Urban areas tend to have better access to diverse food products, including meat and fish.

Urban lifestyles also often lead to higher consumption of convenience foods, which frequently include meat and fish. Increased global trade and food availability have made meat and fish more accessible worldwide. Global supply chains make it easier for consumers to access a variety of meat and fish products. Proper packaging is crucial for maintaining the freshness and safety of meat and fish products. Effective packaging helps prevent contamination, spoilage, and extends shelf life, which is increasingly important to consumers and retailers. The key players operating in the market are focused on developing biobased compostable rigid packaging for meat, poultry & seafood.

- In February 2024, Sealed Air, packaging company revealed the introduction of the biobased compostable protein trays for poultry and fresh meats businesses.

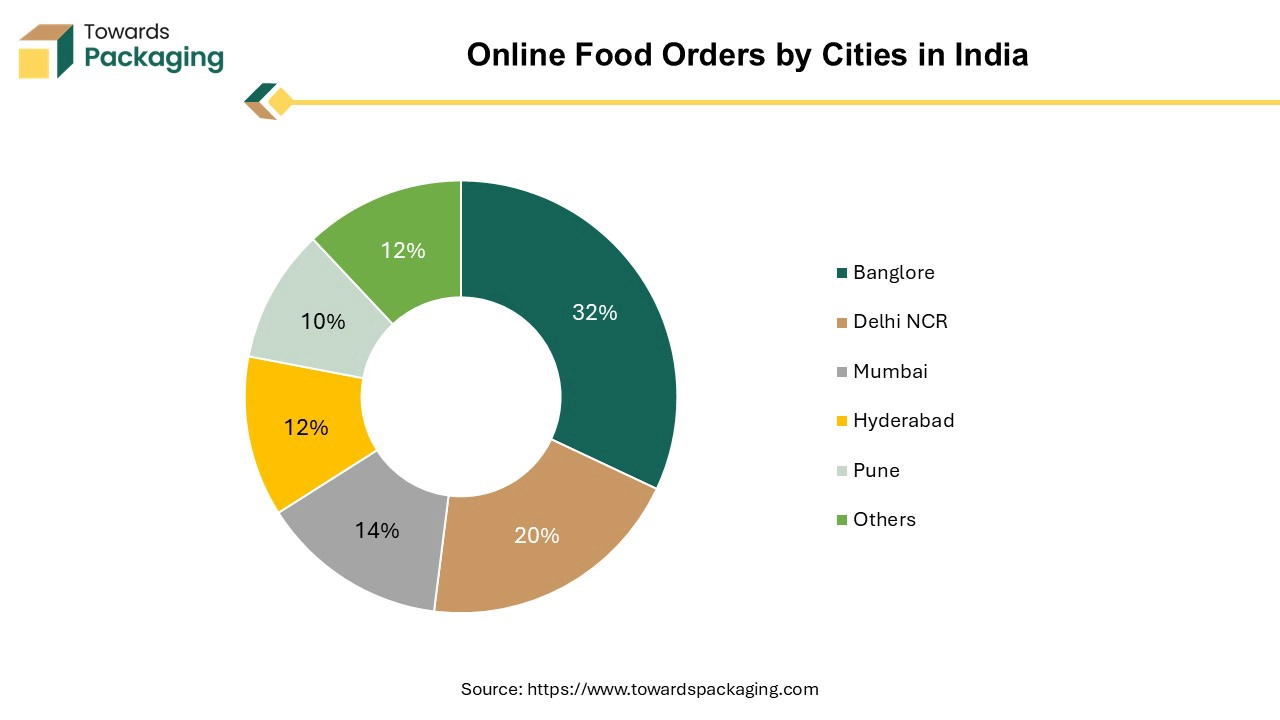

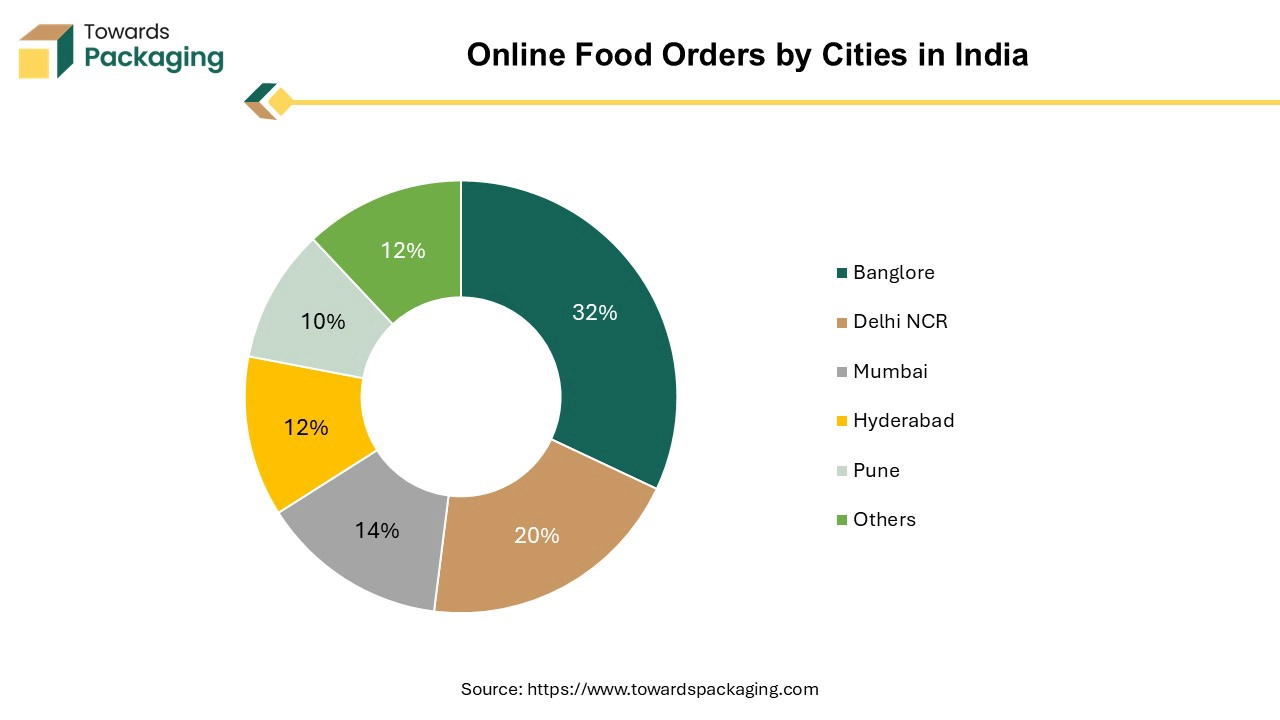

Asia’s Urbanization and Economic Growth Propel the Expansion of Rigid Food Packaging Market

Asia Pacific held the largest share of the rigid food packaging market. Rapid economic development in countries like China, India, and Southeast Asian nations has increased disposable incomes, leading to higher spending on packaged foods. Accelerated urbanization in the region is driving demand for convenient and packaged food options. Urban consumers often prefer the convenience and extended shelf life provided by rigid packaging. The expanding middle class in Asia-Pacific is adopting Western eating habits and increasing their consumption of packaged foods, which boosts demand for rigid packaging solutions. Increased consumption of processed and ready-to-eat foods drives the need for effective rigid packaging that preserves freshness and extends shelf life.

Moreover, the key players operating in the market are focused on launching rigid food packaging for meat and fishes, which is estimated to drive the rigid food packaging market in Asia Pacific region.

- In May 2024, Tops, grocery chain in Thailand, Southeast Asian country, revealed the introduction of an eco-friendly meat rigid plastic packaging for its chilled meat sections and cans for fish packaging.

India

In India, the market is experiencing significant growth, which is driven by the expanding food processing industry, changing consumer lifestyle and preferences, and increasing demand for sustainable and convenient packaging solutions. The rise in e-commerce and the retail sector further helps the market to grow. Overall, the growth is seen due to technological advancement, evolving consumer preferences, and the regulatory framework.

North America's Rising Retail Sales and Innovation Propel Growth in Rigid Food Packaging Market

North America region is estimated to grow at fastest rate over the forecast period. Continuous innovation in food products, including new flavours, formulations, and packaging, attracts consumers and drives market growth. North America’s diverse population has led to a wide variety of food preferences and increased demand for specialty and international food products. The growth of various retail formats, including discount stores, specialty shops, and convenience stores, provides more options for consumers and drives market growth. The key players operating in the market are focused on launching food in rigid packaging for retail sales, which is estimated to drive the growth of the rigid food packaging market in North America over the forecast period.

In North American region, U.S. is expected to show a steady growth for the rigid food packaging market. The rise in demand for plant-based food products in the country is expected to drive market growth in the forecast period. This demand creates new opportunities for rigid food packaging solutions. The rigid packaging is also more sustainable like metal can or bottles that can be reused or even recycled, offering consumers the complete package.

- For instance, Sabert Corporation, food packaging company headquartered in New Jersey, U.S., unveiled the introduction of the Pulp 2S Produce Tray which is new line of compostable rigid trays designed for meat, fish proteins and produce food. The Pulp 2S Produce Tray is developed to cater to the blending meal planning, hybrid cooking trend, ready-to-eat item and meal kits. It is suitable for both full and cut fruits, vegetables, and fresh ingredients, and has ability to remain refrigerator safe for up to seven days as it is engineered with Sabert Corporation’s Pulp Plus molded fiber blend.

- In April 2024, Faerch opened a processing plant that will have the capacity to recycle 60,000 tonnes of rigid food packaging. The company aims to process used trays of PET from household waste in Benelux, Germany and Sweden.

Canada

Canada's rigid food packaging market is experiencing steady growth, which is driven by technological advancements and increasing consumer demand for eco-friendly and sustainable packaging solutions in the country. The government initiatives and support for advancement in process and manufacturing practices help in the expansion and overall growth of the market in the country.

Recent Strategic Development in Rigid Food Packaging Market

- In March 2025, LyondellBasell, a leader in the global chemical industry, announced the launch of Pro-fax EP649U, a new polypropylene impact copolymer which is designed for the rigid packaging market. This product is formulated for thin-walled injection molding, This innovative product makes it ideal for application in food packaging.

- In July 2024, Versalis and Forever Plast launched REFENCE, a range of recycled polymers for food contact packaging. The product is produced using NEWER technology, and also meets the EU and FDA regulations. The collaboration supports the company’s circular strategy and also enhances the portfolio. This initiative is also a significant milestone in polystyrene recycling.

- In October 2024, Novolex, an industry leader in packaging choice, innovation, and sustainability, Launches TamperFlag Rigid Containers for Increased Food Security, which keeps the food fresh and secure, which also supports consumer preference and demand.

- In June 2024, Saica and Mondelez join forces to launch a paper-based product for food market this new launch and packaging solution is designed such that it is recyclable, which contributes in reducing the plastic waste which helps meet the sustainable goal. The product offers top quality ensuring to keep the food fresh and under optimal conditions according to the consumer needs.

- In March 2024, DS Smith plc, rigid packaging and fiber-based packaging solutions providing company based in UK, revealed the launch of the Shop.able Carriers Recyclable Box Solution a line of recyclable, reusable boxes for supermarkets that replaces plastic shopping bags for transporting groceries. The Shop.able Carriers Recyclable Box Solution is manufactured using water-resistant and food-safe Greencoat coating technology of the DS Smith plc company.

Rigid Food Packaging Market Companies

Rigid Food Packaging Market Segments

By Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Bagasse

By Packaging Type

- Boxes & Cartons

- Trays & Clamshell

- Bottles & Jars

- Cans

- Cups & Tubs

- Others (Bowls, Cutlery)

By Application

- Meat, Poultry & Seafood

- Dairy Products

- Bakery & Confectionary

- Ready-to-eat Food

- Baby Food

- Produce Food

- Other Foods (Spices, Sauces)

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait