April 2025

Principal Consultant

Reviewed By

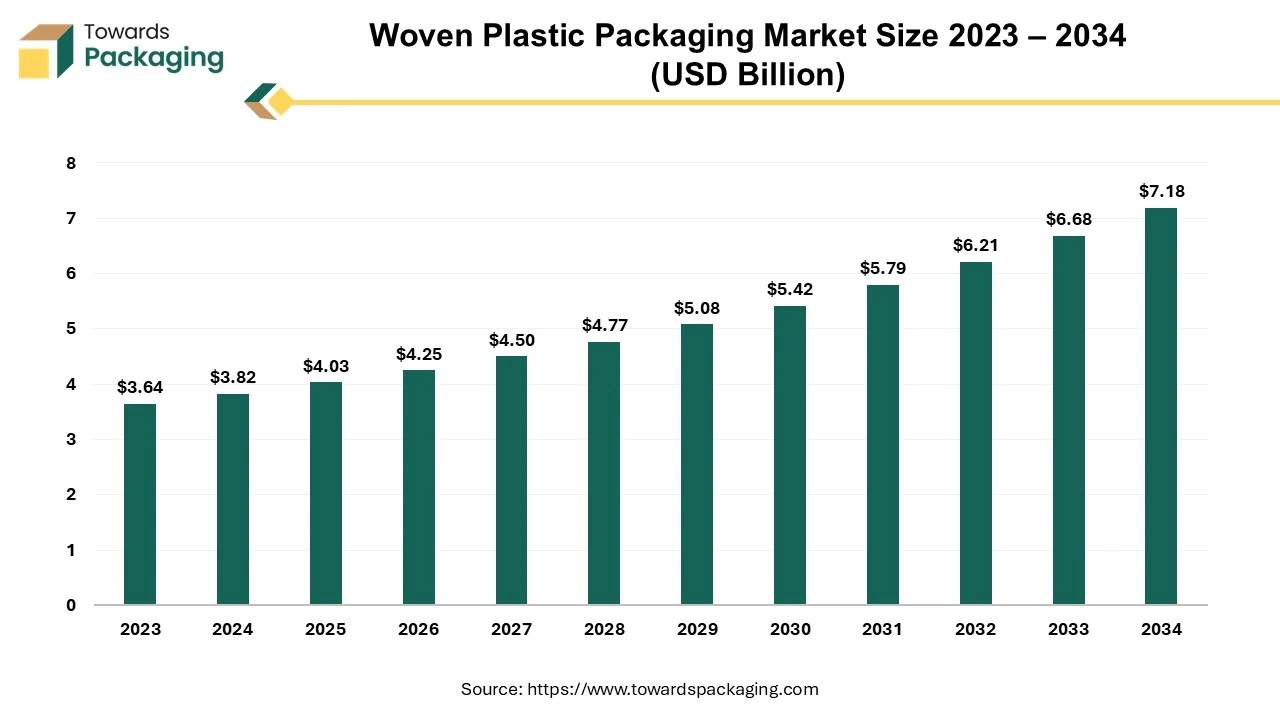

The global woven plastic packaging market is estimated to reach USD 7.18 billion by 2034, up from USD 3.82 billion in 2024, at a compound annual growth rate (CAGR) of 6.40% from 2025 to 2034.

The woven plastic packaging market is set to grow rapidly in the near future. Woven plastic packaging is a type of durable and flexible packaging made-up of woven polypropylene (PP) and polyethylene (PE) strips. These strips are interlaced to develop a strong lightweight fabric that is utilized to make bags, sacks and other packaging materials. Woven plastic packaging, known for its high tensile strength, tear resistance as well as moisture protection, is widely utilized in industries such as agriculture, food, construction and chemicals.

It is specifically well-suited for storing and carrying bulk goods such as grains, fertilizers, cement, and animal feed due to its capacity to handle enormous weights and harsh climatic conditions. Furthermore, advances in the coating and lamination have improved its protective characteristics and this makes it a viable and cost-effective alternative to the other packaging materials.

The rising demand from the agriculture sector for packaging grains, fertilizers and seeds along with the growing need for cement, sand and other building materials in the construction industry is expected to augment the growth of the woven plastic packaging market during the forecast period. Furthermore, the increasing preference for the cost-effective and reusable packaging over single-use plastics as well as the advancements in the lamination and coating technologies are also anticipated to augment the growth of the market. Additionally, the rapid industrialization and urbanization in the emerging economies as well as the growing e-commerce and retail sector coupled with the technological innovations in the manufacturing such as automation and improved weaving techniques is also projected to contribute to the growth of the market in the near future.

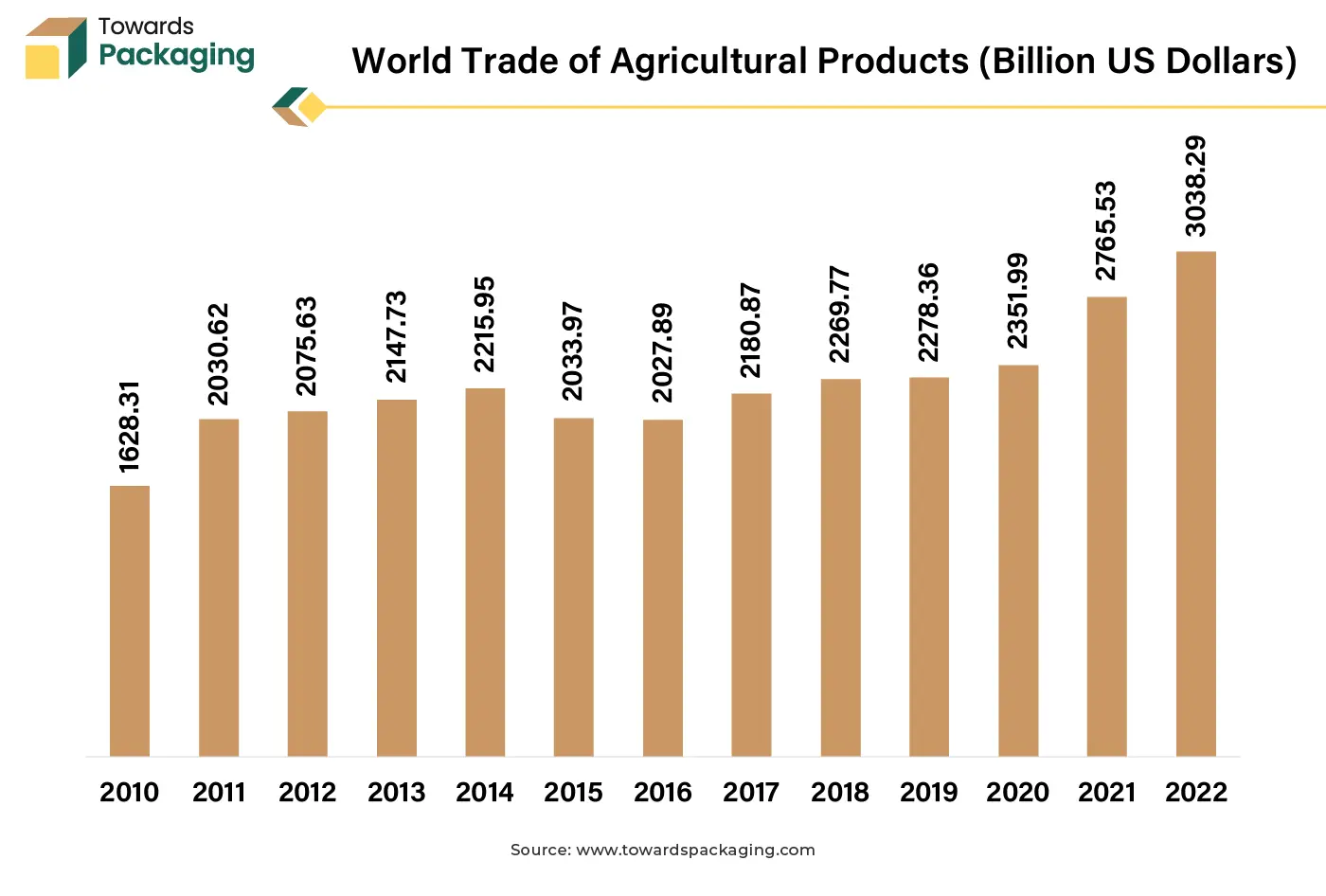

The increasing agriculture and industrial sectors as well as rising trade of the agricultural products owing to the growing global population and rising food demand is anticipated to support the growth of the woven plastic packaging market during the estimated timeframe.

A substantial upsurge is seen in 2021 and 2022 due to the trade liberalization, supply chain expansion and rising worldwide demand. This implies a strong as well as expanding agricultural trade sector across the world. In agriculture, woven polypropylene (PP) and polyethylene (PE) bags are widely utilized for storing and transporting grains, seeds, fertilizers and animal feed. As worldwide food manufacturing and the trade of agricultural products increase, so does the demand for cost-effective, long-lasting packaging products. Similarly, the industrial sector utilizes woven plastic sacks.

These packaging alternatives provide strong load- bearing capability, tear resistance as well as environmental protection. The rapid expansion of the infrastructure and construction projects in the emerging economies has increased the demand for long-lasting woven plastic packaging within the estimated timeframe.

The fluctuating prices of the raw materials are anticipated to hamper the growth of the woven plastic packaging market during the estimated timeframe. The woven plastic packaging is dependent on polypropylene (PP) and polyethylene (PE) and they are derived from the petroleum-based sources. As a result, any fluctuations in the crude oil prices directly impact the cost of raw materials used in manufacturing. The volatility in the crude oil prices is influenced due to the global factors such as geopolitical tensions, OPEC policies as well as changes in the demand for fossil fuels.

Furthermore, the issues related to oil keep on dominating the Middle East region. Price volatility is likely to increase owing to the disputes between large oil producers and interruptions to the supply channels like the Strait of Hormuz. Political unrest in the countries that export oil also makes market movements more unpredictable. Additionally, the complex association between the United States and China has a huge effect on the energy markets. Crude oil availability as well as price are shaped due to the trade policy, energy infrastructure investments, and strategic alliances.

Tension resolutions or escalation might substantially alter market expectations. These uncertainties make it difficult for the manufacturers to plan production and pricing strategies, limiting their ability to fulfill customer demand effectively. Such volatility in the crude oil prices has a direct impact on the costs of PP and PE, which affects both production expenses as well as profit margins in the woven plastic packaging industry.

The increasing adoption of flexible intermediate bulk containers (FIBC) is expected to create substantial opportunity for the growth of the woven plastic packaging market in the near future. The flexible intermediate bulk bags are made-up of woven polypropylene fabric and are huge, flexible bags. These bags have been utilized for transporting and storing huge quantities of products. Due to its strength and adaptability, FIBC bags are now an essential component of contemporary logistics. To maintain their nutritional value for an extended period of time, agricultural items such as seeds and grains need a dry, moisture-free atmosphere. Jute gunny sacks were once the standard option, but they weren't always practical. Nevertheless, it was found that bulk bags deliver the greatest convenience and have every characteristic required for the secure storage of grains and seeds.

Furthermore, FIBCs have a function that helps the filled bags to be sealed. By doing this, the bags' contents are shielded from moisture and mold growth is avoided. This specific feature protects the components from any dampness outside while extending their lifespan. Additionally, the bag makers provide a wide range of customization choices like lining, ventilation, top and bottom construction, spouts, etc. that can suit any type of the sector.

Granular or powdered chemicals can be transported in large quantities using FIBCs with effective liners and flawless sift-proof seams. As these bags are collapsible, they guarantee the safe storage and transportation of chemicals while enabling minimal air contamination and saving storage space. As companies pursue more cost-effective, space-saving, and long-lasting packaging options, demand for FIBC bags is likely to rise, propelling long-term growth in the woven plastic packaging market.

The emerging artificial intelligence (AI) technologies are changing the present situation by speeding up the process of finding alternatives without the exorbitant costs and timelines associated with traditional techniques. The woven plastic packaging industry is expected to adopt AI as a game-changer and bring a new era of efficiency as well as innovation. AI-powered automated weaving and printing systems are improving the production speed, reducing the raw material waste and lowering the manufacturing costs.

For instance, HP Inc. recently unveiled HP Print AI, which has been described as the first intelligent print experience in the market. The new technology that incorporates a feature known as Perfect Output that is still in the beta testing and aims to streamline the printing operations from setup to support. Furthermore, machine learning algorithms helps in predictive maintenance through identifying the potential equipment failures, minimizing downtime and improving the productivity.

AI-based computer vision systems are also being utilized in quality control, detecting defects in the products with high precision, guaranteeing superior product consistency. Beyond manufacturing, AI smart packaging options further improve the traceability, customization as well as branding opportunities, meeting the increasing demand for personalized and visually appealing woven plastic bags.

In the era of the sustainable packaging, AI is proving to be invaluable through analyzing the material compositions, improving the recyclability and helping in the development of the lightweight durable woven plastic alternatives. As the market shift towards the automation and eco-conscious packaging, companies that utilize AI stand to gain a competitive edge through cost reduction and faster adoption of the market changes. As AI is constantly evolving, its role in changing the woven plastic packaging sector will grow, opening the way for intelligent production and next-generation packaging technologies.

The polypropylene (PP) segment held largest share of 70.51% in the year 2024. Woven polypropylene bags made up of a durable, synthetic material that is not easily torn or stretched. They are therefore the best option for packing bulky or delicate objects. These bags are a great option for marketing since they may be printed with the organization's logo as well as any other branding details. To meet the needs of the company, they are available as well in a range of colors and sizes.

Additionally, PP is highly resistant to pollutants and toxins, guaranteeing the secure storage and transportation of commodities. For organizations searching for economical and environmentally friendly packaging options, its cost-effectiveness and capacity for recycling make it a desirable choice. They are also the perfect option for packaging goods that must be kept in storage for extended periods of time. The bags shelf life is further increased by the fact that they can be used repeatedly

The agriculture segment held largest share of 35.15% in the year 2024. This is due to the growing demand for the food globally, advancements in the technology along with the increase in the government support and the sustainable farming practices. Furthermore, the growing population and rising incomes in the emerging economies coupled with the higher consumption of the food products as well as the innovations like precision farming, automation, and genetically modified crops is also likely to support the growth of the segment in the global market.

Additionally, the shift towards the organic farming and climate-smart agriculture along with the expanding export potential and digitalization in farming operations is expected to contribute to the segmental growth of the market during the forecast period.

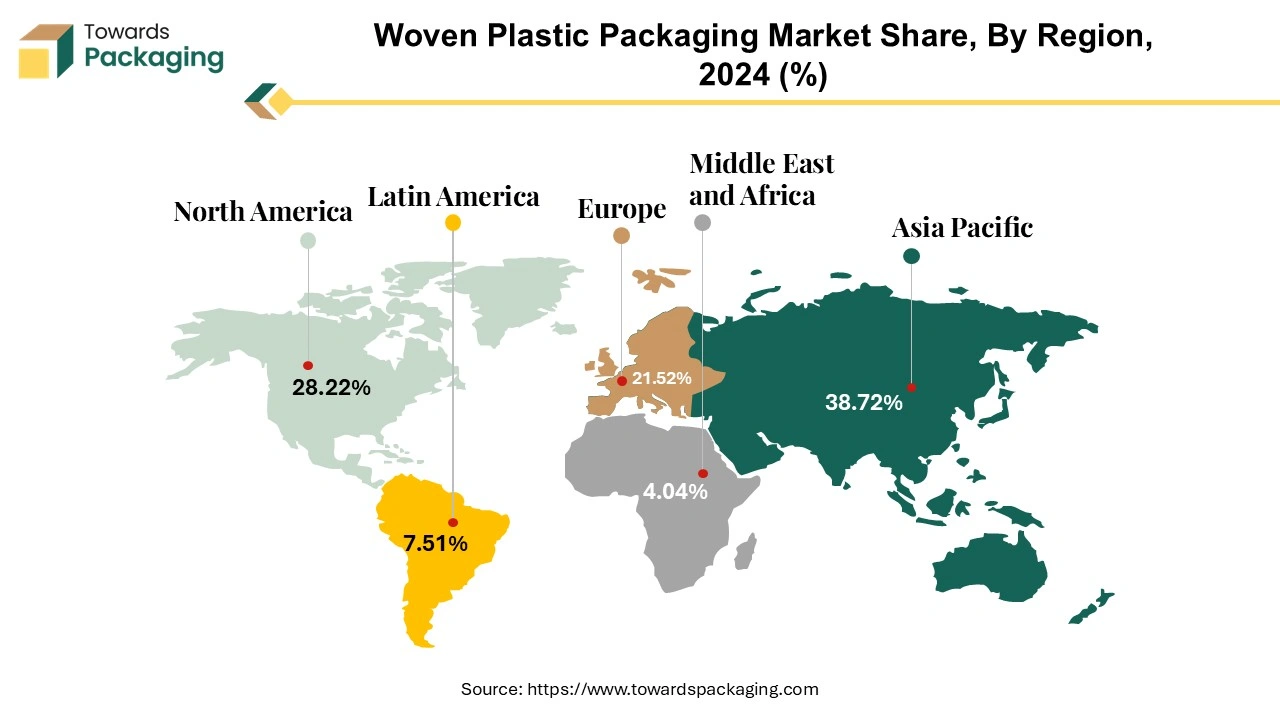

North America held considerable market share of 28.22% in the year 2024. This is due to the presence of strong chemical and agrochemical sector across the region. Additionally, the stringent packaging regulations like compliance with FDA and EPA standards for food-grade and hazardous material packaging along with the growing exports and imports are also further expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at a considerable CAGR of 8.26% during the forecast period. This is due to the increasing infrastructure development in India, China and Southeast Asian countries. Additionally, the growing production and exports of grains, seeds and fertilizers are also expected to contribute to the regional growth of the market. According to the Ministry of Agriculture, the predicted total food grain output in India is 3288.52 LMT, which is 211.00 LMT more than the average for the previous five years. The predicted total amount of rice produced is 1367.00 LMT, up 9.45 LMT from 2022–2023's 1357.55 LMT.

By Material

By Product

By End-use Industry

By Region

April 2025

April 2025

April 2025

March 2025