April 2025

.webp)

Principal Consultant

Reviewed By

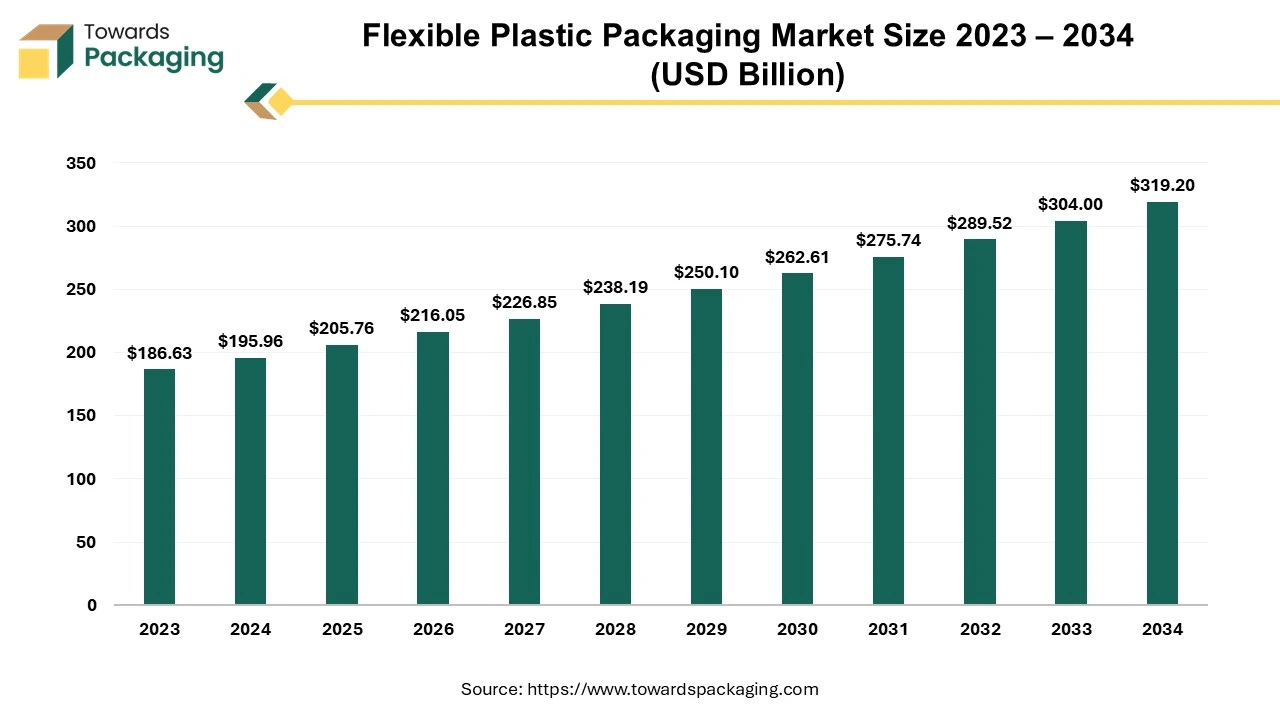

The flexible plastic packaging market is projected to reach USD 319.20 billion by 2034, growing from USD 205.76 billion in 2025, at a CAGR of 5.0% during the forecast period from 2025 to 2034.

Packaging materials composed of various flexible plastic materials that may conform to the shape of the item being packaged are referred to as flexible plastic packaging. It consists of a variety of plastic packaging shapes, mostly meant for home use, that are flexible or semi-flexible, like bags, films, pouches, and tubes. Because of their cost-effectiveness and versatility in the supply chain, plastic polymers generated from fossil hydrocarbons are commonly used to create these packaging solutions.

There are significant economic and ecological benefits to switching from rigid to flexible packaging formats. Because of its decreased weight and lower material consumption, flexible packaging improves supply chain efficiency and reduces costs. The transition to flexible packaging can result in significant environmental benefits, with potential material and energy savings reaching 50% when compared to rigid packaging options.

Two of the most common polymers used in flexible packaging are linear low-density polyethylene (LLDPE) and low-density polyethylene (LDPE). In Australia, almost 223,000 tonnes of LDPE packaging were used; 32 percent of this amount was recycled, according to data from the Plastics and Chemicals Industries Association (PACIA). The market for flexible plastic packaging is witnessing a surge in the significance of sustainability measures, as recycling programmes seek to reduce ecological footprints and foster circular economies.

| Product | Country of Origin | Quantity | Unloading Port | Weight |

| Package Film | China (CN) | 1600 CTN | Long Beach, CA (2709) | 19,664 KG |

| Plastic Stretch Films | China (CN) | 1432 CTN | Long Beach, CA (2709) | 16,904 KG |

| Stretch Films (14 Micron x 750 mm, GI 10 Micron x 500 mm) | India (IN) | 2160 ROL | Charleston, SC (1601) | 39,586 KG |

| Bubble Mailer Bag Zipper Bag | China (CN) | 1023 CTN | Long Beach, CA (2709) | 14,510 KG |

| Package Film, Package Tape | China (CN) | 1517 CTN | Long Beach, CA (2709) | 24,078 KG |

AI integration is set to significantly enhance the Flexible Plastic Packaging Market. By incorporating AI, companies can achieve improved quality control through real-time monitoring, detecting defects with greater precision. AI facilitates optimized design and customization by analyzing consumer preferences and trends, enabling the creation of tailored packaging solutions. Predictive maintenance powered by AI helps anticipate equipment failures, reducing downtime and maintenance costs, which ensures smoother production processes.

AI enhances supply chain management by forecasting demand, optimizing inventory, and streamlining logistics, leading to cost savings and more efficient distribution. Moreover, AI-driven analytics support sustainability by identifying opportunities for using recyclable materials and minimizing plastic waste. Overall, AI's integration will drive innovation, efficiency, and sustainability in the Flexible Plastic Packaging Market, aligning with evolving consumer and environmental expectations.

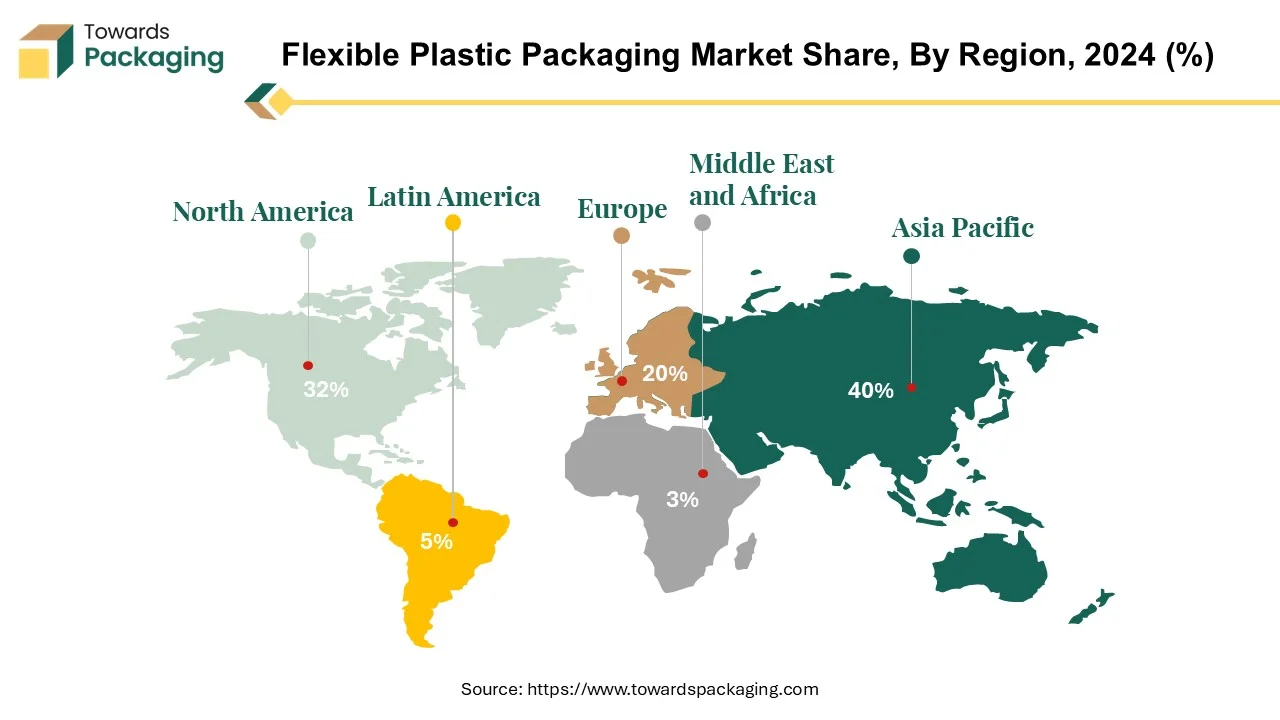

Asia has a dominant position in the flexible plastic packaging market. The Asia-Pacific region offers distinct prospects for brand owners to leverage flexible packaging for their brands, as markets are developing at different rates. US, Australia and New Zealand are developed economies with established customer bases. Similarly, Japan, while mature, faces unusual market dynamics affected by an ageing population, with more than a quarter of the population aged 65 and up. This group prefers lightweight, easy-to-open, and reseal packaging with clear, legible labels, which corresponds to their choice for health-focused items.

Consumers respond to user-friendly packaging that improves their overall experience throughout the region, including China. China's market for flexible packaging is driven mainly by the country's large plastic manufacturing and the growing popularity of packaged food. The flexible packaging industry is expanding due to the combination of China's dominance in plastic manufacture and the desire for easy-to-use packaging solutions. The proliferation of global legislation involving eco-friendly packaging underscores the urgency of resolving environmental problems, particularly those regarding to plastics.

Asia-Pacific's flexible packaging industry is dynamic, with a variety of market situations and shifting client demands. Brand owners must alter their packaging strategies to comply with these the flexible packaging market in the Asia-Pacific area is dynamic, with a range of market conditions and shifting consumer expectations. Owners of brands modify their packaging tactics to meet these with a variety of market circumstances and shifting consumer demands, the flexible packaging industry in the Asia-Pacific area is dynamic. Brand owners need to adjust their packaging strategy to accommodate these distinctions in order to achieve criteria for sustainability while preserving consumer satisfaction. Making use of flexible packaging's benefits is one way to achieve this. nuances, making the most of flexible packaging's advantages to satisfy customer.

North America region is the second largest in flexible packaging market. Flexible plastics share in north America expected to grow at approx. 2.3% in 2022. Plastics are still a major substrate in the market. New developments in technology and the trend towards lighter clothing are driving this expansion. Because of their lightweight appearance and great consumer appeal, stand-up pouches, for example, are recommended for new product introductions.

Board substrates are expanding in the region, supported in part by the increase of internet retail. But it's important to remember that Americans consume far more plastic on average than people in many other nations. Given the recent increase in consumption, it is evident that the North American market is heavily dependent on plastic packaging.

Flexible plastics continue to remain in high demand primarily because of consumer preferences and their practical advantages, even in the face of growing sustainability concerns. The plastic packaging solutions sector is always innovating and utilising technical developments to improve the functioning and appeal of their products. To lessen the negative effects of plastic usage on the environment in North America, there has been increasing pressure on companies to adopt more ecologically friendly processes and materials, despite the increased focus on sustainability.

For Instance,

Polyethylene material leading in the flexible packaging market and hold largest share in the packaging market. An innovative material that is widely used in the flexible plastic packaging market is polyethylene, particularly low-density polyethylene (LDPE). LDPE's flexible, lightweight and softness appreciated. For applications where rigidity, high temperature obstructions, and structural strength are not the main concerns, this material's low temperature flexibility, toughness, and corrosion resistance make it perfect. Because of its advantageous qualities, including strong chemical and impact resistance, ease of fabrication and shaping, and cost-effectiveness, LDPE is used in orthotics and prosthetics.

The versatile and reasonably priced flexible PVC is a material that is frequently utilised in plastic extrusions. Flexible PVC comes in several grades and colours, including clear alternatives, and can be found in a wide variety of softness and hardness degrees, including semi-rigid forms. Its versatility and affordability make it a preferred option for a wide range of applications in various industries.

In February 2023, exports showed an apparent downturn, even though plastic films and sheets are widely used across a range of industries. The decline was ascribed to a decline in sales of films and sheets with self-adhesive, rigid and flexible propylene polymer sheets, flexible polyethylene terephthalate sheets and films, metallized sheets and films, and laminated sheets and films. Because of the slowdown in global demand and huge levels of inventory, Indian manufacturers also saw a decline in production in tandem with the export decline.

For Instance,

Flexible spouted pouches are becoming a growing trend in the flexible plastic packaging sector due to their low environmental effect and support for refilling choices. These pouches utilise 90% less plastic than typical HDPE bottles, which means that their carbon footprint is reduced by 65% and their packaging weight is reduced by 90%. This corresponds with the increasing inclination towards reusable packaging options, especially for consumables like detergents, soap, and cleaners. Brands encourage a circular economy and lessen waste by providing refill pouches, which allow customers to reuse their current bottles and containers.

Refill pouches and other flexible plastic packaging are appealing because they fit neatly in customers' recycling containers. Refill models' enhanced sustainability appeals to buyers who care about the environment, many of whom value conservation above all else and are prepared to pay extra for eco-friendly packaging.

The growing cost-of-living problem throughout Europe is driving up demand for refill pouches as consumers look for less expensive options. Because of this, companies are switching from bulky HDPE bottles to flexible packaging alternatives like spouted pouches or adding refill pouches to complement their current bottles.

Brand owners are emphasising distinctive materials and pouch shapes in order to stand out in the market. They are also implementing cutting-edge resealing technologies that provide easy access to the contents while prolonging shelf life. In order to draw in customers looking for economical, environmentally friendly packaging options, firms use this strategic differentiator.

For Instance,

Food and beverage largest end users of flexible plastic packaging. Flexible packaging such as pouches, bags, films and wrappers, which is required for the safe and hygienic transportation of agricultural good and food products. It prolongs product life, reduces food waste, and protects goods from harm. Recycling plastic packaging that is flexible poses an immense challenge. It increases the shelf life of products, helps to reduce food waste and protects products from insects and others.

India ranks as one of the largest generators of agricultural products and food in the globe. India has the largest farming economy, with 3.5% growth predicted in 2022–2023. India is a major producer of pulses, dairy products, wheat, rice, and other food grains.

Food and drink products make up around two thirds of all packaging, and they use about 90% of all flexible packaging. Flexpack's growth into new product categories is being driven by its advantages. Setting this in perspective, flexible packaging presently accounts for roughly 19% of the US market and 39% of the worldwide packaging business. The benefits and versatility of flexible plastic packaging continue to promote its significance as the worldwide packaging market approaches $1 trillion yearly, especially in the food and beverage sector.

For Instance,

The supply chain in the flexible plastic packaging market is a complex, multi-tiered system that ensures the efficient production and distribution of packaging solutions. It starts with the procurement of raw materials such as polyethylene, polypropylene, and other polymers. Suppliers of these materials play a critical role in providing high-quality inputs that meet the specific requirements of flexible packaging.

These raw materials are transported to manufacturing facilities where they are processed into various forms of flexible packaging, including films, pouches, and laminates. Production involves advanced technologies like extrusion and co-extrusion, which are closely monitored to ensure product quality and consistency.

After production, the packaging products move through a network of distributors and wholesalers who manage logistics to deliver the finished goods to various end-users. This segment includes food and beverage companies, pharmaceuticals, personal care, and other industries that rely on flexible packaging for product protection and consumer convenience.

Efficient supply chain management in this market involves coordinating material supply, optimizing production schedules, and ensuring timely distribution. Employing technologies for real-time tracking, inventory management, and demand forecasting helps in addressing market fluctuations and maintaining a smooth flow from production to end-use.

The competitive landscape of the flexible plastic packaging market is dominated by established industry giants such as Sealed Air Corporation, FlexCollect, Mondi Group, Berry Global Group, Amcor Ltd., Constantia Flexibles Group GmbH, DS Smith Plc, Bemis Company, Oyj Huhtamäki, Sonoco Products Company, Inc, AR Packaging Group AB. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Amcors offers creative, eye-catching, and environmentally friendly flexible packaging options to make companies stand out and better while also protecting the environment. Apart from its reduced ecological footprint, lightweight packaging presents noteworthy advantages in terms of logistics. However, not every pouch is equally prepared to satisfy the needs of e-commerce supply chains (particularly with regard to liquid-containing pouches). By making your flexible packaging more e-commerce-friendly, you can prevent product damage and protect your brand's reputation.

For Instance,

FlexCollect will contribute to the development of a thorough understanding of the most effective ways to maximise recovery and recycling by integrating flexible plastic packaging into currently available household collection services, spanning various regions and demographics.

For Instance,

By Material

By Packaging Type

By End Use

By Region

April 2025

April 2025

March 2025

March 2025