April 2025

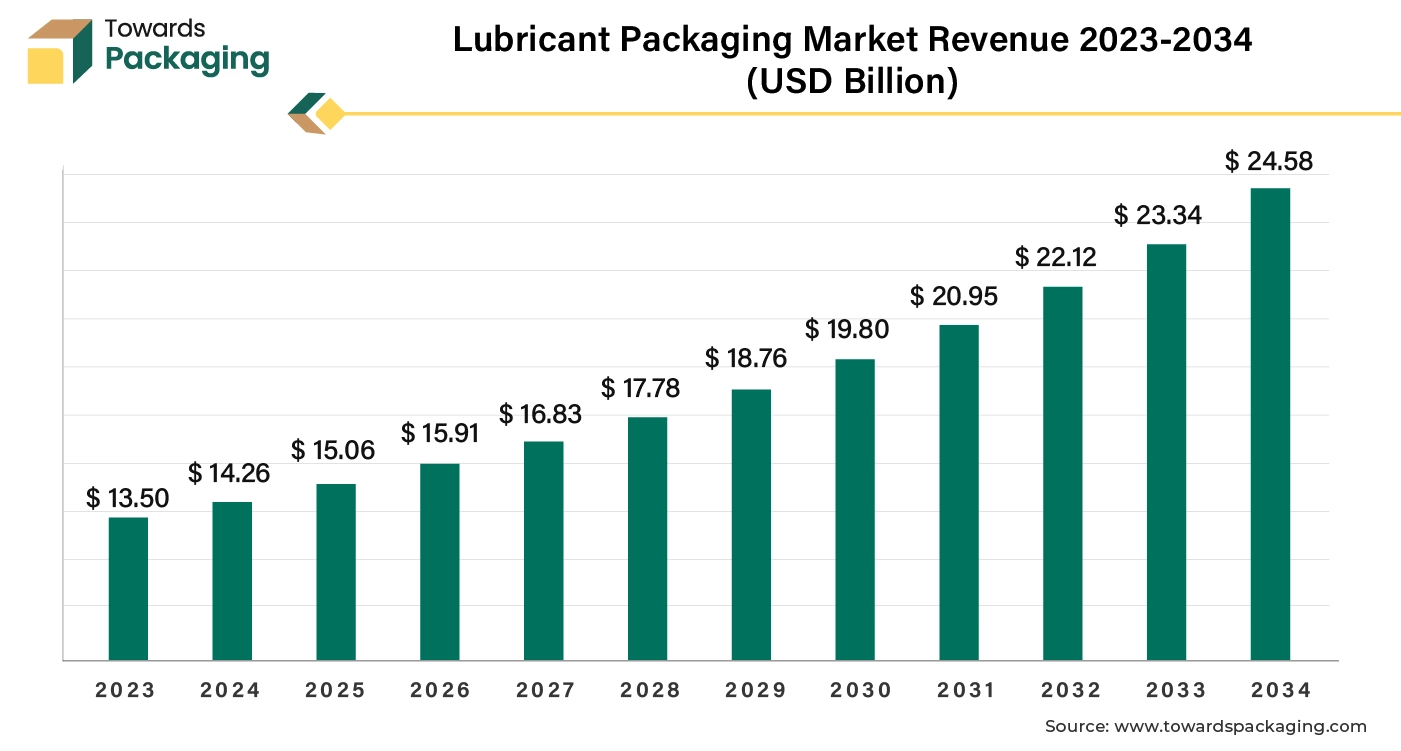

The lubricant packaging market is anticipated to grow from USD 15.06billion in 2025 to USD 24.58 billion by 2034, with a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2025 to 2034.

Growing awareness of product quality and brand image encourages companies to invest in premium packaging. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing lubricant packaging which is estimated to drive the global lubricant packaging market over the forecast period.

Lubricant packaging refers to the containers and materials used to store, transport, and dispense lubricants, which are substances designed to reduce friction between surfaces in mutual contact. This packaging is crucial for maintaining the quality and effectiveness of lubricants, ensuring safe handling and compliance with regulations. The lubricant packaging is mainly done in bottles and jars, drums, barrels, pails, containers, and flexible packaging among others. Bottles and jars are common for consumer lubricants like motor oils or household products. Drums and barrels are used for bulk industrial lubricants. Pails and containers are suitable for medium-sized quantities. Flexible packaging is Lightweight options that are cost-effective for certain applications.

Lubricant packaging functions as shield for the lubricants from contamination, environmental and moisture factors. Ensures safe transport and storage, often incorporating features like child-resistant caps. Increasing focus on eco-friendly packaging materials, including recyclable and biodegradable options, to reduce environmental impact. The labelling on the lubricant packaging provides essential information about the product, including usage instructions, safety warnings, and regulatory compliance.

AI integration can significantly enhance the lubricant packaging market in several ways by supply chain optimization, enhancing quality control, helping in carrying out smart packaging. AI can analyze historical data and market trends to predict demand for various lubricant products, allowing manufacturers to optimize inventory levels and reduce waste. AI algorithms can streamline transportation routes and schedules, reducing costs and improving delivery times.

Machine learning models can be used to identify defects in packaging materials or finished products during the production process, ensuring higher quality standards. AI can predict equipment failures in packaging lines, minimizing downtime and ensuring consistent production. AI can analyze customer preferences and market trends to develop customized packaging designs that enhance brand identity and meet specific consumer needs.

Smart packaging solutions can incorporate AI to provide real-time updates and product information through QR codes or augmented reality. AI can assist in identifying and selecting sustainable materials for packaging, reducing environmental impact while maintaining product integrity. AI tools can evaluate the environmental impact of packaging options, helping companies make informed decisions about their packaging strategies. AI can enable interactive packaging that engages consumers through personalized experiences, such as usage tips or loyalty programs accessed via mobile apps. AI can process consumer feedback and reviews to identify areas for improvement in both product and packaging, enhancing customer satisfaction.

By optimizing various aspects of production and logistics, AI can help reduce overall packaging costs, leading to more competitive pricing in the market. Integrating AI into the lubricant packaging market can lead to enhanced efficiency, improved quality, greater customization, and better sustainability practices. These advancements can not only streamline operations but also create a more engaging experience for consumers, ultimately driving growth in the industry.

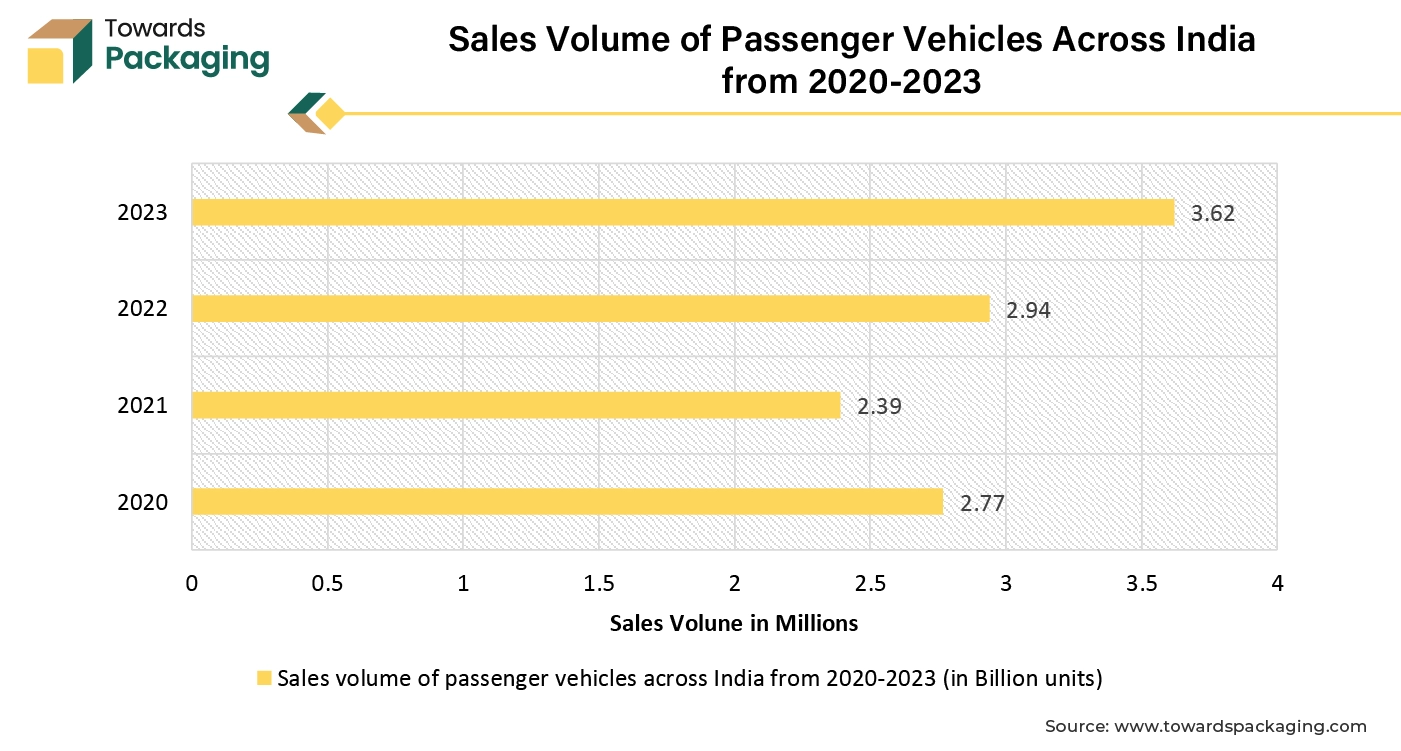

The rise in vehicle production and ownership worldwide directly correlates to an increased demand for automotive lubricants. As vehicles require regular oil changes and maintenance, the packaging of these lubricants becomes essential. Increasing demand and sales of passenger as well commercial vehicles has risen the demand for the automobile lubricants, which is estimated to drive the growth of the lubricant packaging industry over the forecast period.

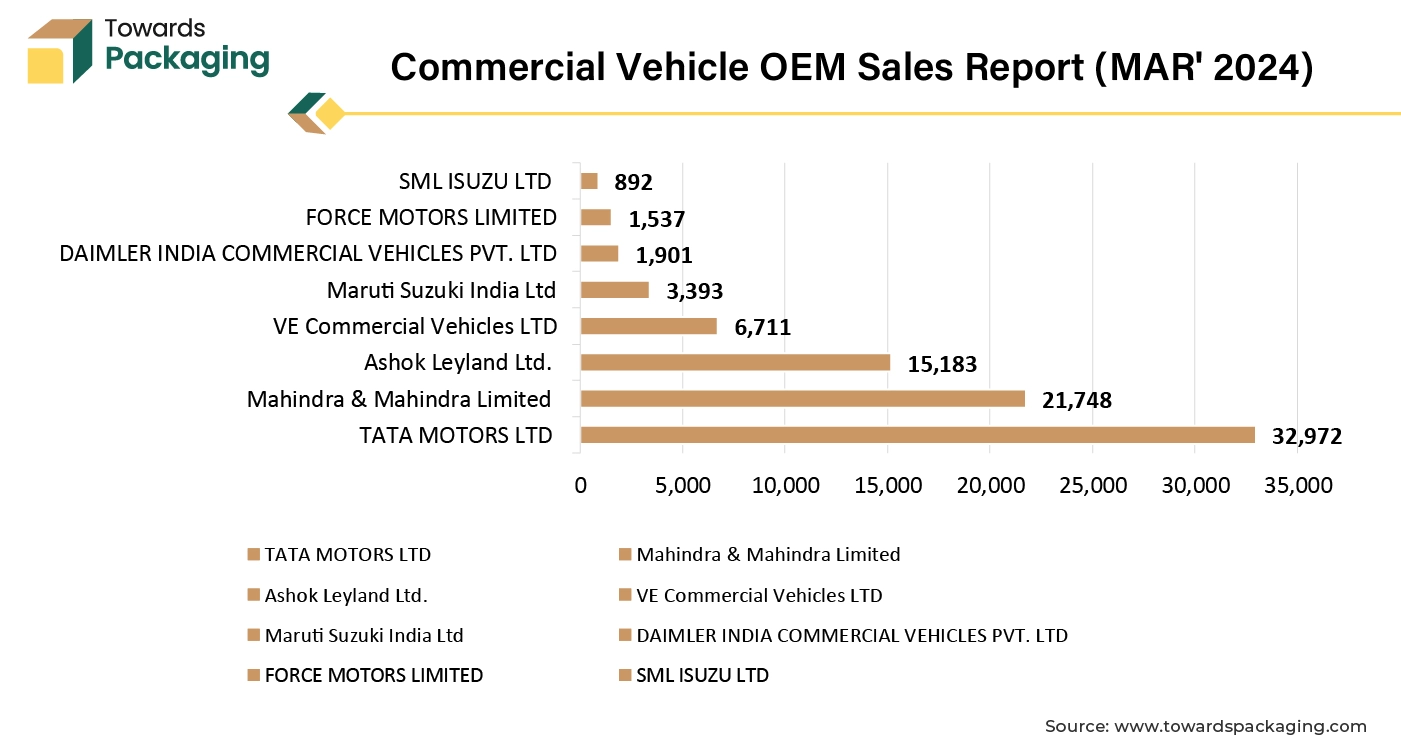

All-India retail data for commercial vehicles shows that sales of 80,057 units were made in July 2024, increasing 5.93 percent year over year from 75,573 units in July 2023. With improved model availability and positive market sentiment, especially during holidays like Navratri and Gudi Padwa, the PV category saw double-digit year over year increase. More vehicles on the road lead to higher demand for maintenance products, including lubricants. Regular oil changes and lubrication services become essential for vehicle performance and longevity.

Different types of vehicles require various lubricants (engine oils, transmission fluids, etc.), which expands the market for specialized products tailored to specific vehicle types and performance needs. An increase in commercial vehicles, such as trucks and buses, elevates lubricant consumption due to the higher mileage and more rigorous operating conditions they face, necessitating frequent lubricant changes. As developing regions see growth in vehicle sales, the lubricant market expands, as these areas often have rising standards for vehicle maintenance and fuel efficiency.

The key players in the market are facing challenges in obtaining the sustainable materials at the lower cost which is observed to restrict the growth of the lubricant packaging market. While there is a strong push for sustainable packaging, the higher costs associated with eco-friendly materials can be a barrier for some manufacturers. Meeting stringent regulations regarding packaging safety and environmental impact requires continuous investment and innovation, which can strain smaller companies. The lubricant packaging market is competitive, with numerous players vying for market share. Differentiating products and maintaining brand loyalty can be challenging.

Rapid industrialization, particularly in emerging markets, has led to increased machinery usage, thereby boosting the need for industrial lubricants and their packaging. A growing consumer preference for eco-friendly packaging solutions is influencing manufacturers to adopt recyclable and biodegradable materials. This shift is driven by regulatory pressures and corporate responsibility goals. The key players operating in the market are focused on launching new lubricant products in sustainable package which has observed to grow the demand for lubricant packaging and is estimated to create lucrative opportunity for the growth of the lubricant packaging market in the near future.

For instance,

The engine oil segment held a dominant presence in the lubricant packaging market in 2024. The rise in the need for engine oils can be attributed to growth of the segment. A growing global demand for automobiles has led to higher production rates, necessitating more engine oil. Modern engines are more complex and require specialized oils to ensure optimal performance and efficiency. Increased awareness of vehicle maintenance and performance has driven consumers to use high-quality engine oils.

The development and popularity of synthetic oils have broadened consumer options, increasing overall demand. Improvements in oil formulation and additives have enhanced oil performance, driving up usage in various applications. These factors collectively contribute to the growing demand for engine oils in the automotive and industrial sectors. Increasing launch of the new engine oil product in the market to meet the rising demand of the consumers is estimated to drive the growth of the segment over the forecast period.

For instance,

The drums segment accounted for a considerable share of the lubricant packaging market in 2024. Drums are widely used due to its large space and strength to ship the lubricants safely. Drums are robust and protect the contents from damage during transport and storage. They can hold large volumes, making them efficient for bulk distribution and reducing the frequency of refills. They can be used for various types of lubricants, making them suitable for different applications.

Drums provide secure sealing, preventing leaks and contamination, which is critical for maintaining oil quality. Packaging in drums is often more economical for manufacturers and distributors compared to smaller containers. Many drums are recyclable, aligning with sustainability practices in the industry. These factors contribute to the widespread use of drums in the packaging of engine oils and lubricants.

The plastic segment accounted for a significant share of the lubricant packaging market in 2024. Plastic containers are significantly lighter than metal or glass, reducing shipping costs and making handling easier. Plastic packaging is generally less expensive to produce and purchase compared to alternatives, making it an economical choice. Plastics are resistant to impact and can withstand various environmental conditions, providing better protection for the lubricant. Plastic containers often feature user-friendly designs, such as spouts or handles, which improve pouring and dispensing. The key players operating in the market are focused on introduction of the new lubricants in the plastic containers due to the advantages offered by it, which is estimated to drive the segment growth over the forecast period.

The automotive segment registered its dominance over the global lubricant packaging market in 2024. Lubricants are needed for various automotive components beyond engines, including transmissions and differentials, expanding the market for lubricant companies. New technology and advanced motors of luxury vehicles require specialized lubricants to meet higher performance standards, creating opportunities for lubricant companies to innovate and offer advanced products.

The introduction of new regulations and performance specifications encourages the development of high-quality lubricants, driving growth in premium product lines. The shift toward eco-friendly and synthetic oils align with automotive industry trends, providing lubricant companies with opportunities to innovate and capture market share. Collaborations with original equipment manufacturers (OEMs) help lubricant companies secure approvals and recommendations, enhancing brand credibility and increasing sales.

Asia Pacific region held a significant share of the lubricant packaging market in 2024. This region is witnessing rapid industrial growth and increasing vehicle ownership, making it the fastest-growing market for lubricant packaging. Countries like China and India are key contributors. The major automotive players are present in the Asia Pacific region. The key players operating in the automotive sector are focused on launching new vehicles with advanced motors which requires lubrication. Increasing launch of the new motor vehicles in the Asia Pacific region is supporting the growth of the lubricant packaging market in the region.

For instance,

North America is projected to host the fastest-growing lubricant packaging market in the coming years. The region is characterized by a mature automotive market, driving demand for high-quality lubricant packaging. Regulatory compliance regarding packaging materials is also significant. The key players operating in the North America market are focused on carrying out research and development activity for introducing high quality lubricants packaging and is estimated drive the growth of the lubricant packaging market in the region.

For instance,

Leading distributor of specialty chemicals and additives, IMCD Group ("IMCD"), today unveiled the upgraded IMCD Lubricants & Energy Laboratory, which will serve clients across North America. The laboratory is situated in the heart of one of the major energy sector hubs and one of the biggest petrochemical production regions in the country, in Greater Houston, Texas. In order to offer clients in the lubricants and energy markets extensive technical support, the IMCD Lubricants & Energy Laboratory has expanded and now includes a variety of new testing equipment for metalworking fluids and industrial and automotive lubricant applications.

By Product

By Packaging Type

By Material

By End-Use Industry

By Region

April 2025

April 2025

April 2025

April 2025