April 2025

.webp)

Principal Consultant

Reviewed By

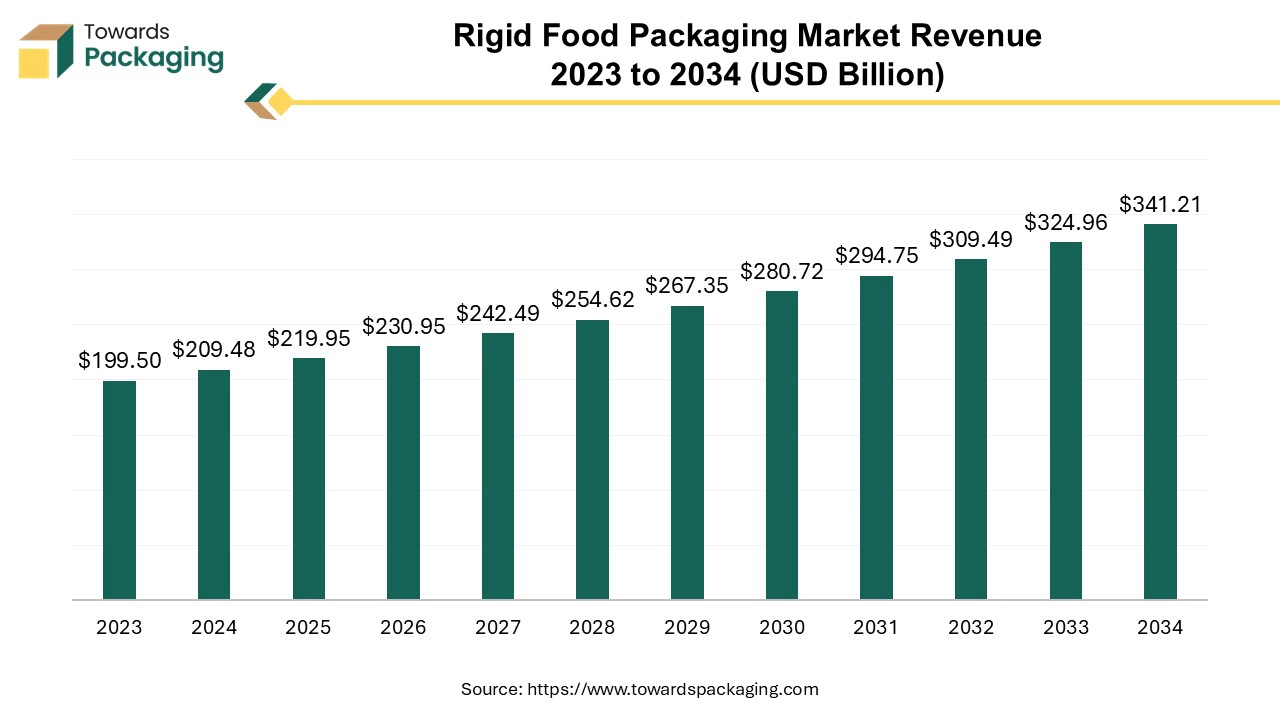

The global rigid food packaging market, valued at US$ 199.50 billion in 2023, is projected to reach approximately US$ 341.21 billion by 2034, growing at a CAGR of 5% from 2024 to 2034. This growth is driven by the increasing demand for ready-to-eat food and evolving consumer food preferences.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing rigid food packaging which is estimated to drive the global rigid food packaging market over the forecast period.

Rigid food packaging is a category of packaging designed to offer a solid, inflexible structure to protect food products. Unlike flexible packaging, which can be bent or folded, rigid packaging maintains its shape and provides a stable barrier to external factors. Rigid packaging maintains its shape and does not collapse or bend. This rigidity assists in safeguarding the food from physical damage and contamination.

The materials utilized for rigid packaging are typically sturdy, strong and resistant to impacts, ensuring that the food inside remains safe during transportation and storage. Rigid packaging offers a solid barrier against external factors such as air, moisture, light, and contaminants. This helps in preserving the freshness and extending the shelf life of the food. Rigid packages frequently feature easy-to-use designs, such as resealable lids or easy-pour spouts, which enhance the consumer experience. Many rigid packaging materials, such as glass and metal, are recyclable or reusable, contributing to environmental sustainability.

AI-driven tools can analyze consumer preferences and market trends to create more effective packaging designs. Machine learning algorithms can optimize packaging shapes, sizes, and materials for improved functionality and appeal. AI-powered vision systems can detect defects and inconsistencies in packaging during production, ensuring high-quality standards and reducing waste. AI-powered vision systems can detect defects and inconsistencies in packaging during production, ensuring high-quality standards and reducing waste.

AI can optimize supply chain logistics by predicting demand, managing inventory, and streamlining distribution processes, which can reduce costs and improve delivery times. AI can optimize supply chain logistics by predicting demand, managing inventory, and streamlining distribution processes, which can reduce costs and improve delivery times. AI can optimize supply chain logistics by predicting demand, managing inventory, and streamlining distribution processes, which can reduce costs and improve delivery times. AI can monitor equipment performance and predict potential failures or maintenance needs, minimizing downtime and improving operational efficiency.

AI analytics can provide insights into consumer behaviour and preferences, allowing companies to tailor their packaging strategies and marketing efforts more effectively. AI can help in developing and implementing more sustainable packaging materials and processes by analyzing environmental impact and optimizing resource use.

AI can enable more efficient and cost-effective customization of packaging for different markets or products, enhancing brand differentiation and consumer engagement. Overall, AI integration can drive innovation, improve efficiency, and enhance the overall quality and sustainability of rigid food packaging.

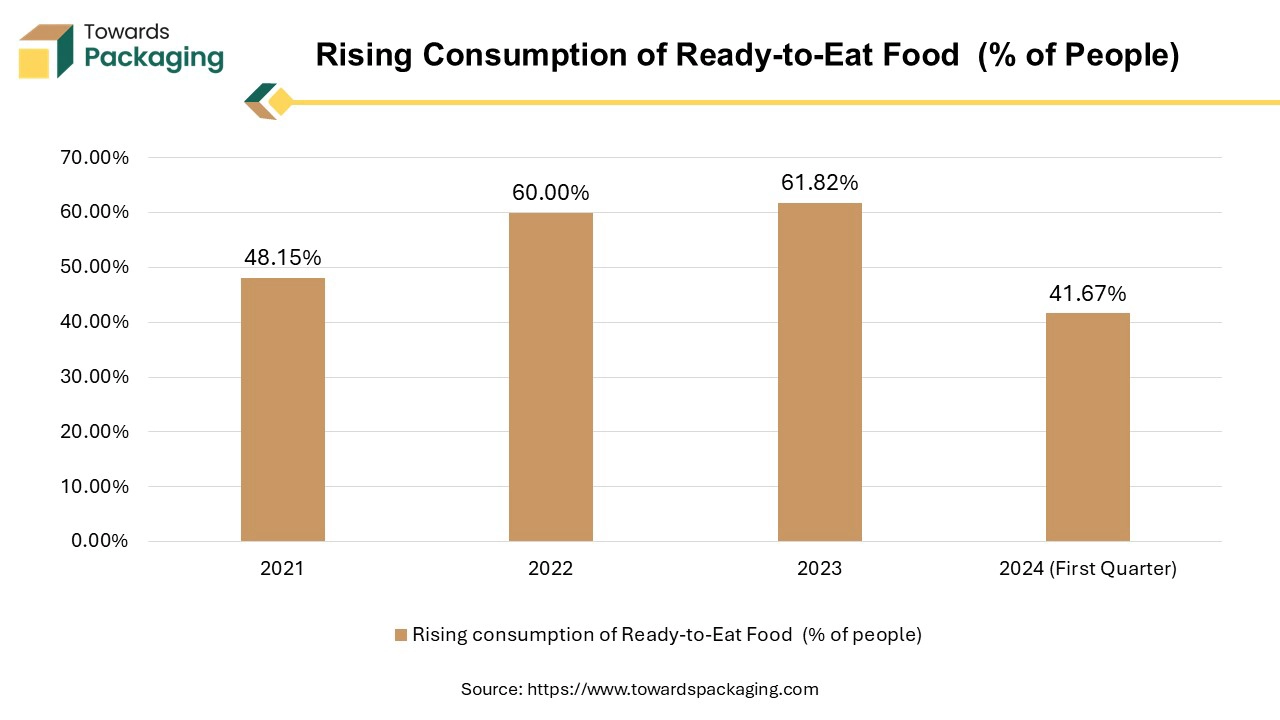

The rising consumer preference for ready-to-eat and on-the-go food products drives the need for convenient and durable packaging solutions. Busy life-style and modern consumers, particularly in urban areas, lead fast-paced lives with limited time for meal preparation, boosting the demand for convenient food options. As more people work long hours and commute, there's a greater demand for quick, easy meal solutions that fit into a busy schedule. Growing urban populations often have higher disposable incomes and are more likely to seek convenient food options available at their fingertips. There is a growing demand for healthier options in the ready-to-eat category, driving innovation in this segment and making it more attractive to health-conscious consumers.

The key players operating in the market are facing competition from flexible packaging solutions as well as high cost of technology for manufacturing rigid food packaging is restrict the growth of the rigid food packaging market. The production and material costs for rigid packaging can be higher compared to flexible packaging, impacting affordability and overall market growth. While there are advancements in sustainable packaging, traditional rigid packaging materials can contribute to environmental pollution and waste, leading to regulatory pressures and consumer demand for eco-friendlier solutions.

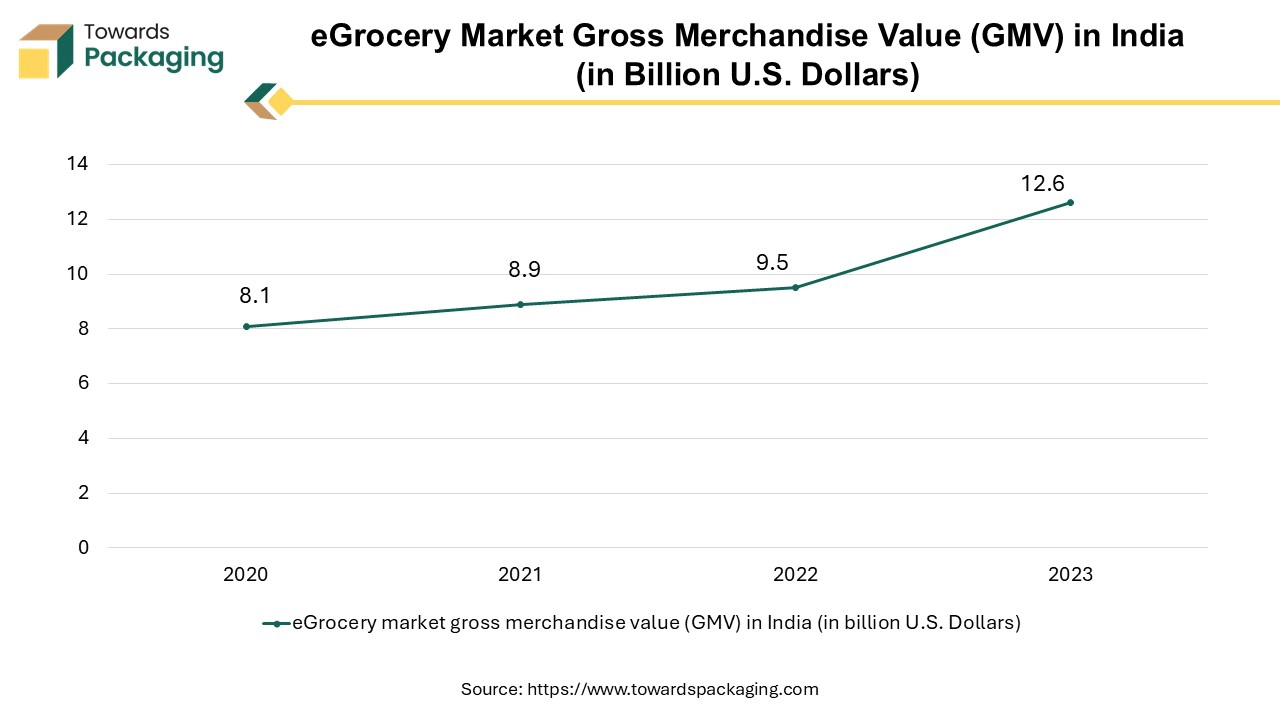

As grocery shopping and online food ordering trend is growing, there is increased demand for protective and packaging solutions suitable for shipping. As the e-commerce industry expands, the demand for ready-to-eat food products is observed to rise. E-commerce involves shipping food products over long distances, often requiring multiple handling points. Rigid packaging provides the necessary protection to prevent damage, ensuring that food items reach consumers in optimal condition. This demand for protective packaging drives the need for more rigid packaging solutions.

Using the more than 800 tonnes of recycled (polyethylene terephthalate) PET waste gathered by this program, KP made new packaging in 2023. It highlights Klöckner Pentaplast Group 's mission to promote environmental stewardship and sustainably designed packaging solutions. It is the equivalent of repurposing 14 million polyethylene terephthalate (PET) bottles. With the use of Oracle technology and Keep Sea Blue's Blockchain platform, the kp team is able to do thorough quality checks and confirm the origin, date, and location of plastic collection. The recycling procedure complies with RecyClass, ISO 9001, and BRC certifications.

The plastic segment held the dominating share of the rigid food packaging market in 2024. Plastic rigid packaging is perfect for ready-to-eat food goods and is very durable and user-friendly. Packing expenses can be kept down by using plastic since it is often less expensive to make and carry than some other materials. Food goods can have their shelf life extended and their freshness preserved with the help of plastic packaging's efficient barrier qualities. Because plastic packaging is lightweight, handling and transportation expenses are lowered.

Since plastic can be molded into a wide range of sizes and shapes, it may be used to develop custom designs and packaging that can accommodate a variety of food products and consumer preferences. Features that improve food safety are frequently included in plastic packaging design, such as airtight closures and tamper-evident seals. The key players operating in the market are focused on developing and launching plastic rigid food packaging solution to meet the rising demand by the consumers.

The boxes & cartons segment accounted for a considerable share of the rigid food packaging market in 2024. Cartons and boxes provide a convenient and safe way to store and transport food. They offer protection against contamination, spoilage, and physical damage. The increase of online food delivery and grocery shopping has significantly increased the need for robust and reliable packaging solutions to ensure food reaches consumers in good condition. Many food companies are shifting towards eco-friendly packaging options.

Cartons and boxes, especially those made from recycled materials, are often seen as more sustainable compared to plastic alternatives. Packaging plays a crucial role in branding and marketing. Boxes and cartons offer ample space for branding and information, helping companies stand out in a competitive market. The key players operating in the market are focused on adopting inorganic growth strategies like partnership to launch rigid box packaging, which is estimated to drive the growth of the segment over the forecast period.

The meat, poultry & seafood segment held the dominating share of the rigid food packaging market in 2024. As incomes increase, particularly in developing countries, people can afford to purchase more meat and fish, which are often seen as premium food items. Many cultures and diets place a high value on meat and fish as primary sources of protein and essential nutrients. This cultural preference drives consumption patterns. Urban areas tend to have better access to diverse food products, including meat and fish.

Urban lifestyles also often lead to higher consumption of convenience foods, which frequently include meat and fish. Increased global trade and food availability have made meat and fish more accessible worldwide. Global supply chains make it easier for consumers to access a variety of meat and fish products. Proper packaging is crucial for maintaining the freshness and safety of meat and fish products. Effective packaging helps prevent contamination, spoilage, and extends shelf life, which is increasingly important to consumers and retailers. The key players operating in the market are focused on developing biobased compostable rigid packaging for meat, poultry & seafood.

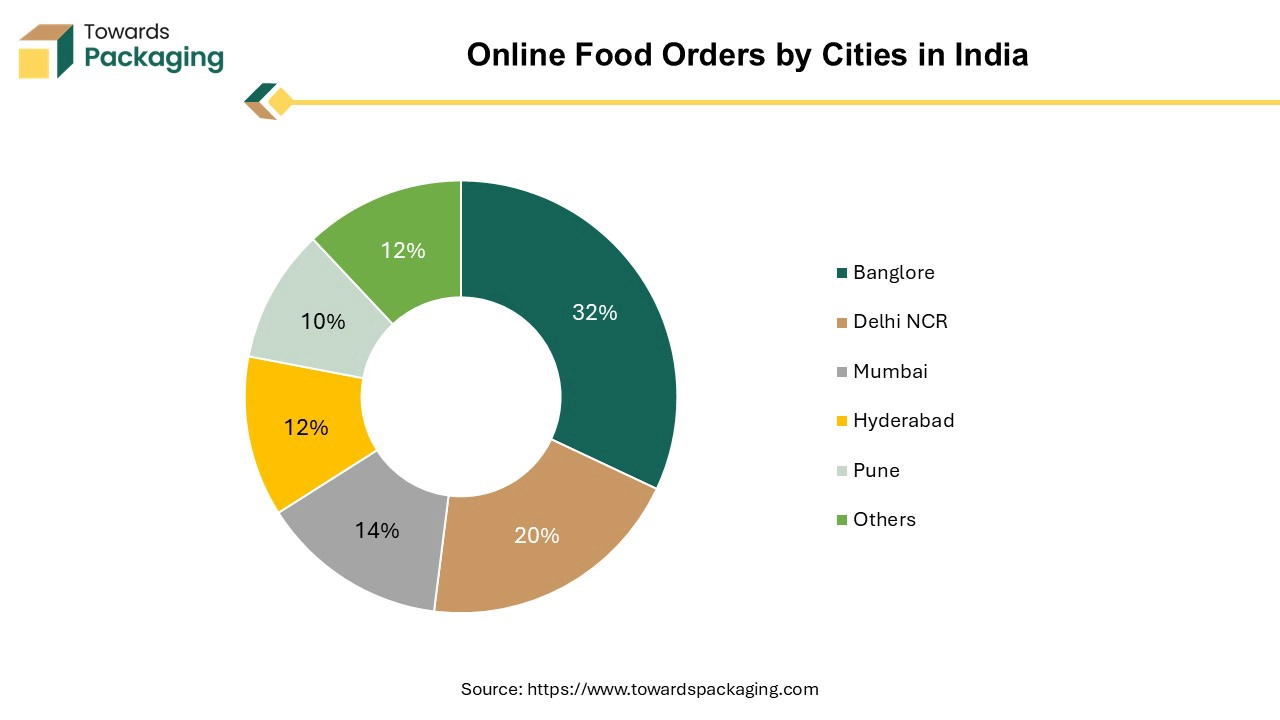

Asia Pacific held the largest share of the rigid food packaging market. Rapid economic development in countries like China, India, and Southeast Asian nations has increased disposable incomes, leading to higher spending on packaged foods. Accelerated urbanization in the region is driving demand for convenient and packaged food options. Urban consumers often prefer the convenience and extended shelf life provided by rigid packaging. The expanding middle class in Asia-Pacific is adopting Western eating habits and increasing their consumption of packaged foods, which boosts demand for rigid packaging solutions. Increased consumption of processed and ready-to-eat foods drives the need for effective rigid packaging that preserves freshness and extends shelf life.

Moreover, the key players operating in the market are focused on launching rigid food packaging for meat and fishes, which is estimated to drive the rigid food packaging market in Asia Pacific region.

North America region is estimated to grow at fastest rate over the forecast period. Continuous innovation in food products, including new flavours, formulations, and packaging, attracts consumers and drives market growth. North America’s diverse population has led to a wide variety of food preferences and increased demand for specialty and international food products. The growth of various retail formats, including discount stores, specialty shops, and convenience stores, provides more options for consumers and drives market growth. The key players operating in the market are focused on launching food in rigid packaging for retail sales, which is estimated to drive the growth of the rigid food packaging market in North America over the forecast period.

In North American region, U.S. is expected to show a steady growth for the rigid food packaging market. The rise in demand for plant-based food products in the country is expected to drive market growth in the forecast period. This demand creates new opportunities for rigid food packaging solutions. The rigid packaging is also more sustainable like metal can or bottles that can be reused or even recycled, offering consumers the complete package.

By Material

By Packaging Type

By Application

By Region

April 2025

March 2025

March 2025

March 2025