Seafood Packaging Market Outlook Scenario Planning for 2034

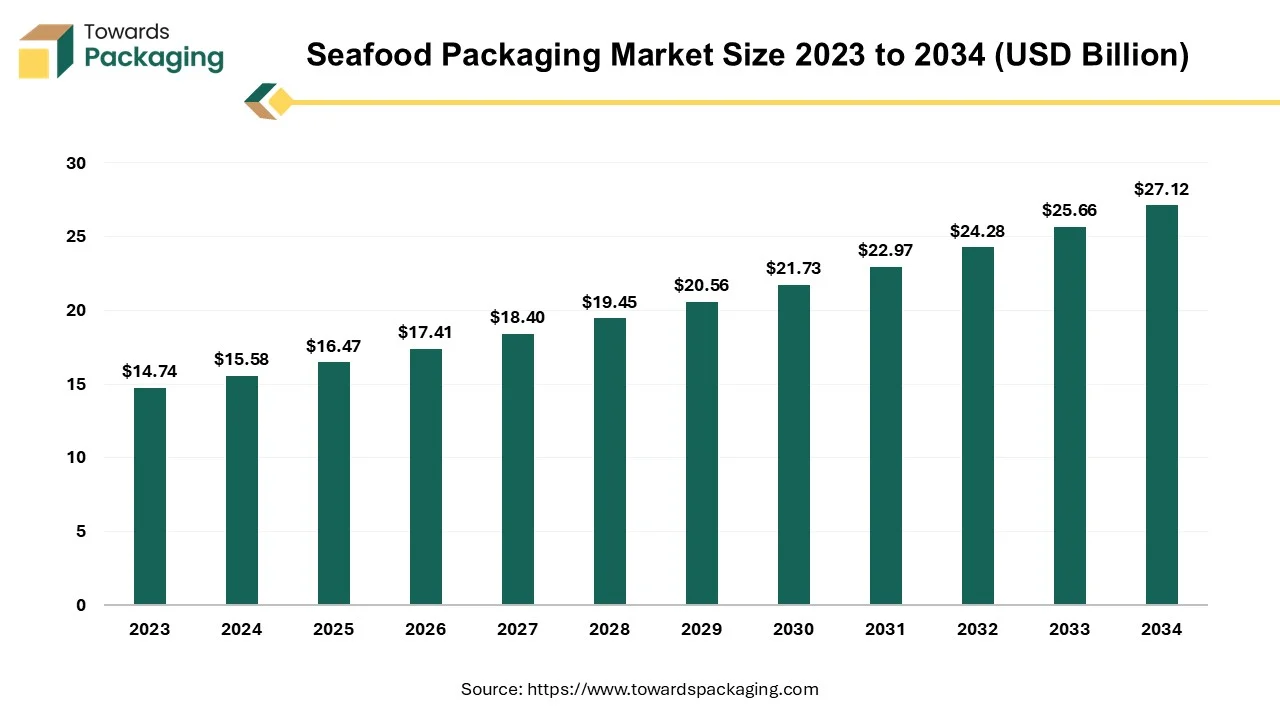

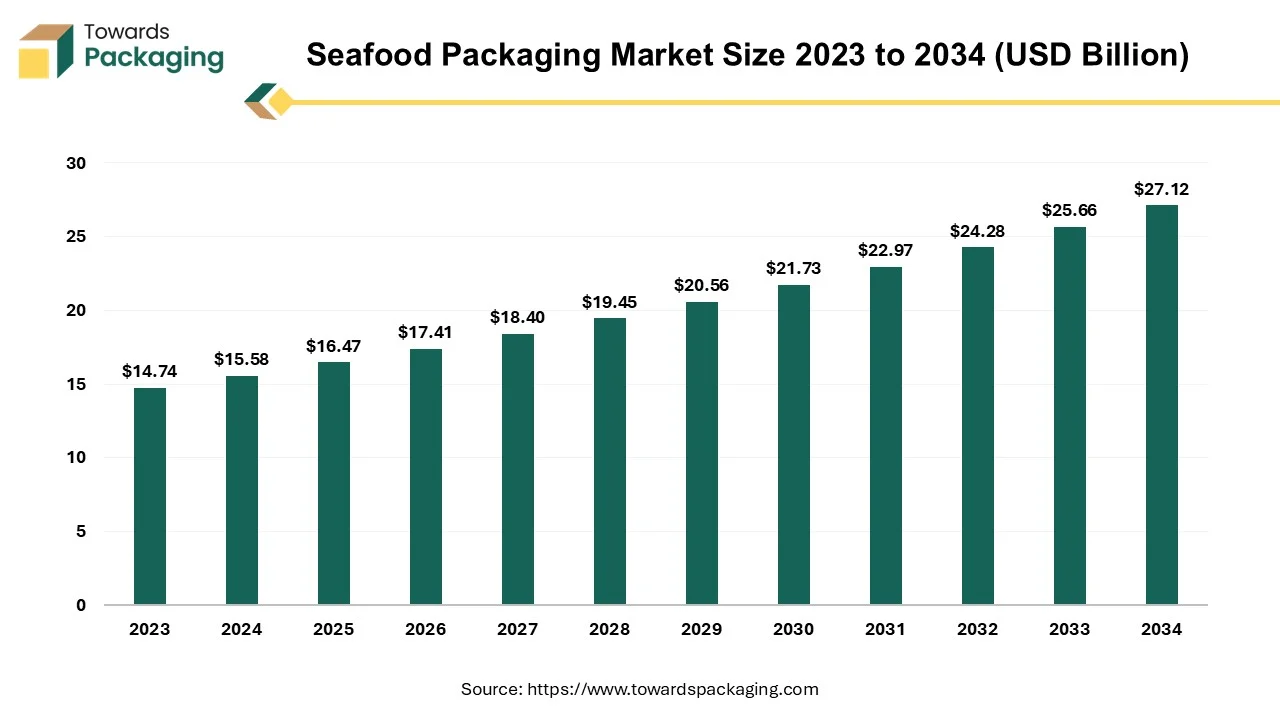

The seafood packaging market is forecasted to expand from USD 17.41 billion in 2026 to USD 28.67 billion by 2035, growing at a CAGR of 5.7% from 2026 to 2035. This report includes comprehensive data on market segments like materials (plastic, paper, metal, others), product types (shrink films, trays, bags & pouches), and packaging technologies (MAP, vacuum skin packaging).

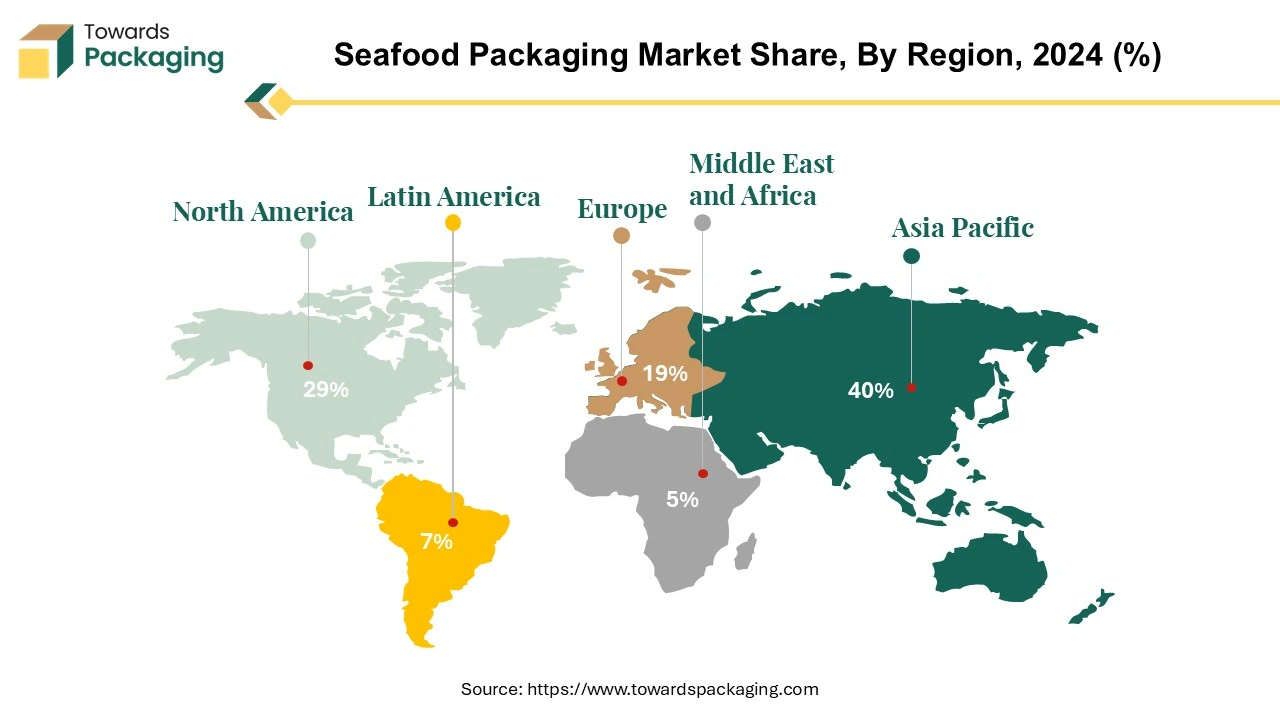

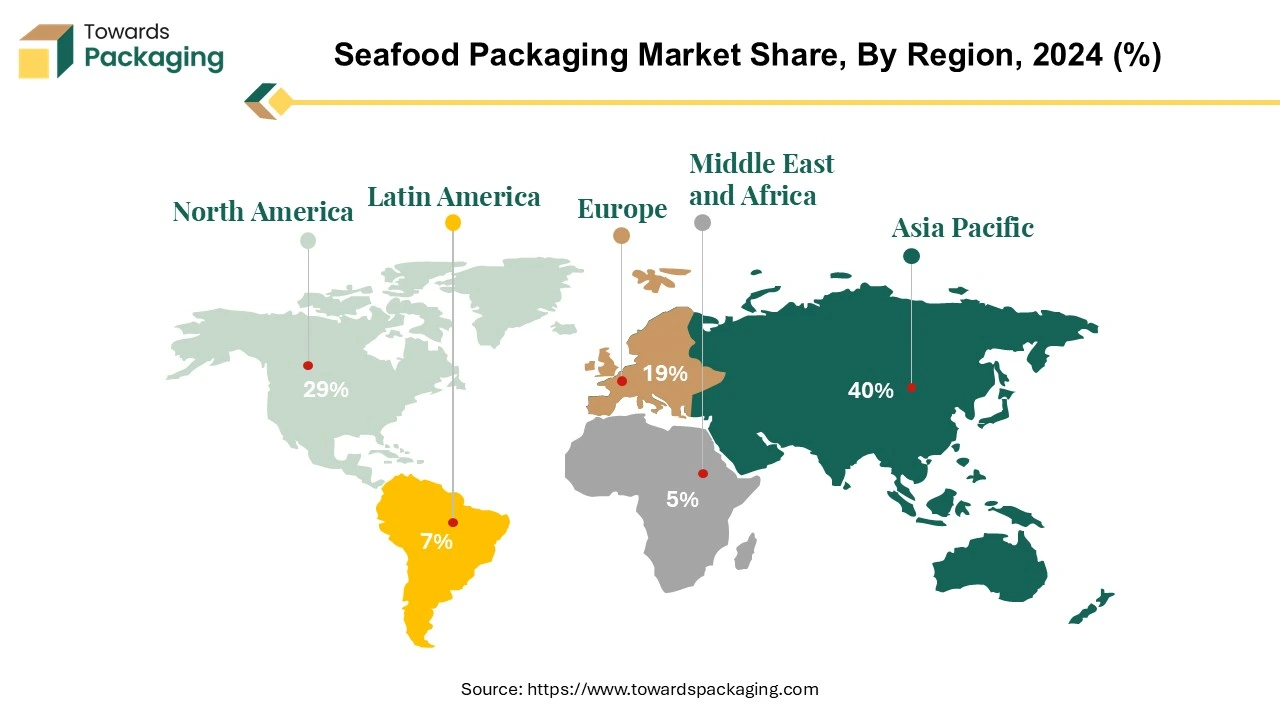

The analysis covers regional insights for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, along with the key companies such as Sealed Air, Amcor, and DS Smith. It also includes competitive landscape, value chain analysis, trade data, and manufacturers & suppliers' information to provide a complete market view.

Major Key Insights of the Seafood Packaging Market

- Asia Pacific dominated the seafood packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By material, the plastic segment dominated the market with the largest share in 2024.

- By product type, the shrink films segment registered its dominance over the global seafood packaging market in 2024.

- By packaging technology, MAP segment is expected to grow at significant rate during the forecast period.

- By application, fresh & frozen segment is expected to grow at significant rate during the forecast period.

- By seafood type, the fish segment dominated the seafood packaging market in 2024.

Seafood packaging refers to the specialized materials and techniques used to store, transport, and preserve seafood products while maintaining freshness, safety, and quality. Since seafood is highly perishable, packaging solutions must provide temperature control, moisture resistance, and protection from contamination. Fresh & frozen seafood packaging removes oxygen to slow bacterial growth and extend shelf life. Seafood packaging prevents spoilage by maintaining optimal temperature, humidity, and oxygen levels.

Market Trends

Sustainable Packaging Solutions

- Consumers and regulators are increasingly prioritizing environmental sustainability, leading to a shift towards eco-friendly packaging options.

- Biodegradable and Recyclable Materials: There's a growing adoption of packaging made from biodegradable and recyclable materials, reducing plastic waste and environmental impact.

- Reusable Packaging: Some companies are introducing reusable packaging systems to minimize single-use plastics.

Emphasis on Traceability and Transparency

Ensuring the authenticity and safety of seafood products is becoming increasingly important.

RFID/NFC Technology: Embedding RFID or NFC chips in packaging allows for real-time tracking of seafood products, enhancing supply chain transparency and consumer trust. Growth in Flexible Packaging: Flexible packaging solutions are gaining popularity due to their practicality and cost-effectiveness. Pouches and Vacuum-Sealed Bags: These formats are expected to account for a significant share of the market, offering benefits like extended shelf life and reduced storage space.

Regulatory Changes Impacting Packaging

Governments are implementing policies that influence packaging practices: Extended Producer Responsibility (EPR) Schemes: In regions like the UK, new levies on packaging aim to offset recycling costs, prompting companies to adopt more sustainable packaging solutions to mitigate financial impacts.

How Can AI Improve the Seafood Packaging Industry?

Artificial Intelligence (AI) is transforming the seafood packaging industry by enhancing efficiency, improving product safety, optimizing sustainability, and reducing waste. The integration of AI-driven technologies ensures smarter supply chains, better quality control, and improved customer experiences. AI-powered computer vision and machine learning can detect defects, contamination, and freshness in seafood packaging. AI systems can scan packaging for tears, leaks, incorrect seals, or spoilage in real-time. AI sensors analyze color, texture, and gas levels inside packaging to determine freshness. AI-based biosensors detect harmful bacteria (e.g., Salmonella, Listeria, E. coli) in packaged seafood.

AI enhances smart packaging by integrating real-time monitoring systems for freshness, temperature, and supply chain tracking. AI algorithms analyze data from IoT sensors to ensure seafood remains in ideal conditions.AI adjusts expiration dates based on real-time storage conditions instead of fixed shelf-life estimates. AI models use historical data, temperature fluctuations, and packaging material properties to predict spoilage risk.

Driver

Expansion of the Seafood Industry

Growth in aquaculture production and sustainable fishing practices. Rising demand for frozen, processed, and ready-to-eat seafood. As aquaculture and wild-caught seafood production grow, more packaging materials are required for processing, storage, and distribution. Increased seafood variety (fresh, frozen, canned, processed) creates demand for specialized packaging solutions. Expanding seafood exports require durable packaging to maintain quality and freshness over long-distance shipping. Compliance with international packaging and labeling standards boosts demand for innovative packaging solutions. Expansion of supermarkets, hypermarkets, and seafood specialty stores increases the need for well-branded, attractive, and functional seafood packaging. Consumer demand for clear labeling, resealable packs, and portion-sized packaging boosts market innovation.

- In January 2025, according to the data published by the Seafood Exporters Association of India, by 2025, India wants to increase its seafood exports by US$ 4 billion (EUR 3.7 billion), with an annual export value target of US$ 12 billion (EUR 11.1 billion). India exported USD 8 billion (EUR 7.4 billion) worth of seafood during its April 2022–March 2023 fiscal year. Of that amount, US$ 5.6 billion (EUR 5.2 billion) came from frozen shrimp, of which US$ 2.6 billion (EUR 2.4 billion) were sent to the U.S.

Restraint

Supply Chain Disruptions & Consumer Shift Toward Fresh & Unpackaged Seafood

The key players operating in the market are facing issue due to consumer shift towards fresh & unpackaged seafood and supply chain disruptions which has estimated to restrict the growth of the seafood packaging market in the near future. Governments worldwide are enforcing strict rules on plastic usage and waste disposal, increasing compliance costs. Bans on single-use plastics and requirements for biodegradable or recyclable materials can limit traditional packaging solutions. Eco-friendly alternatives (e.g., bioplastics, compostable trays) are more expensive than conventional plastic, affecting affordability for small and mid-sized seafood businesses.

Fluctuations in raw material availability (e.g., petroleum-based plastics, recycled materials) can impact production. - Global supply chain issues (e.g., shipping delays, labor shortages) may hinder market growth. Many consumers prefer buying fresh, unpackaged seafood from local markets, reducing demand for pre-packaged seafood.

Market Opportunity

Stringent Food Safety Regulations

Compliance with U.S. Food and Drug Administration, EU, and other food safety standards encouraging innovation in packaging materials. Adoption of tamper-proof and traceable packaging. For instance, in February, 2025, according to the data published by the European Union, the Packaging and Packaging Waste Regulation (PPWR Regulation (EU) 2025/40), which was adopted by the EU on December 19, 2024, is to promote the advancement of packaging and related waste into a circular and competitive economy. By reducing the use of primary raw materials, making recycling all packaging on the EU market economically feasible by 2030, incorporating recycled plastic into packaging in a safe manner, and putting the packaging industry on track to become climate neutral by 2050, the PPWR went into effect in February 2025. In an effort to further harmonize national manufacturing, recycling, and reuse policies, the new law addresses the full packaging life-cycle. With the rules in place, the EU anticipates a significant reduction in water use, greenhouse gas emissions, and packaging's detrimental consequences.

Segmental Analysis

Plastic Segment Led the Market in 2024

The plastic segment held a dominant presence in the seafood packaging market in 2024. Plastic provides a strong barrier against moisture, oxygen, and contaminants, keeping seafood fresh and preventing spoilage. Compared to alternatives like glass or metal, plastic is cheaper to produce, transport, and store. Plastic packaging is lightweight, reducing shipping costs and making handling easier.

Shrink Films Segment to Sustain as a Leader

The shrink films segment accounted for a considerable share of the seafood packaging market in 2024. Shrink films conform tightly around seafood products, creating an airtight seal that helps retain freshness. Shrink films are more affordable compared to rigid packaging materials. The shrink films prevent contamination from external elements like dust, bacteria, and moisture.

MAP Led the Market in 2024

The MAP segment dominated the seafood packaging market globally. The modified atmosphere packaging replaces oxygen with a controlled gas mix (e.g., CO₂ and N₂) to slow microbial growth and oxidation. MAP preserves the texture, color, and taste of seafood without the need for chemical preservatives. MAP packaging helps retain natural moisture, preventing dehydration and freezer burn in frozen seafood. Modified Atmosphere Packaging extends the viability of seafood for export and online delivery, reducing food waste in transit.

Large Consumer Base for Fresh & Frozen Segment to Support Dominance

The fresh & frozen segment registered its dominance over the global seafood packaging market in 2024. Seafood is a rich source of high-quality protein, omega-3 fatty acids, vitamins, and minerals. Frozen seafood offers year-round availability, allowing consumers to enjoy fish regardless of the season. More consumers are choosing seafood due to sustainable fishing and responsible aquaculture initiatives.

Growing Demand for Fish to Promote Dominance

The fish segment led the global seafood packaging market in 2024. Fish is the most widely consumed seafood due to its affordability, availability, and nutritional benefits. Fish benefits from Modified Atmosphere Packaging (MAP), vacuum sealing, and freezing to extend shelf life. Fish is available in multiple formats: fresh, frozen, canned, smoked, and processed (fillets, portions, or whole fish). Fish is heavily traded worldwide, requiring high-quality vacuum-packed, frozen, and insulated packaging to maintain quality during long-distance transport. Countries like China, Chile, Norway, and India dominate global fish exports, increasing demand for secure packaging solutions.

Segmental Insights

By Material

The paper segment is expected to grow at the fastest CAGR in the coming years due to the growing need for recyclable and environmentally friendly packaging options. Adoption is accelerating due to growing environmental regulations and consumer preference for packaging free of plastic. Paper-based seafood packaging offers enhanced moisture resistance while retaining an environmentally friendly appearance, particularly when paired with barrier coatings.

By Product Type

The trays segment is expected to grow at the fastest CAGR in the coming years since trays enhance product visibility in retail displays and offer robust structural support because of their ease of handling and the convenience, they are frequently used for both fresh and processed seafood. Their demand in supermarkets and hypermarkets is further reinforced by their compatibility with vacuum packaging and modified atmosphere technologies.

By Packaging Technology

The vacuum skin packaging segment is expected to grow at the fastest CAGR in the coming years because it can prolong the shelf life and keep the product fresh. By securing the seafood product tightly, this technology lowers oxygen exposure and prevents spoiling. Its adoption is primarily driven by improved product presentation, leak prevention, and decreased food waste.

By Application

Processed segment is expected to grow at the fastest CAGR in the coming years because of the growing demand from consumers for seafood products that are ready to cook and eat. This growth is supported by urban lifestyles and a growing desire for convenient protein sources. During storage and transit, flavor, texture, and nutritional value are preserved with the aid of advanced packaging solutions.

By Seafood Type

The molluscs segment is expected to grow at the fastest CAGR in the coming years as the amounts of oysters, clams, mussels, and scallops consumed worldwide rise. Packaging needs are rising as a result of export demand for molluscs premium positioning in global markets. For safe long-distance transportation, contamination avoidance, and freshness preservation, specialized packaging solutions are necessary.

Asia’s Largest Seafood Market to Support Dominance

Asia Pacific region held the largest share of the seafood packaging market in 2024. Asia Pacific leads global seafood production, with countries like China, India, Indonesia, Vietnam, and Japan being major contributors. High seafood consumption in coastal and inland areas due to cultural preferences and affordability. Over 90% of the world's aquaculture production comes from Asia Pacific, ensuring a continuous seafood supply. The growth of fish farming (e.g., shrimp, tilapia, salmon, and carp) increases demand for advanced packaging solutions.

Growing middle-class population and busy lifestyles fuel demand for ready-to-eat and frozen seafood. Many Asia Pacific countries are enforcing plastic waste reduction policies, driving innovation in biodegradable and recyclable packaging.

North America Advancement in Cold Chain Logistics to Promote Growth

North America region is anticipated to grow at the fastest rate in the seafood packaging market during the forecast period. Improved refrigeration and insulated packaging in North America ensure seafood maintains freshness during transport. Growth in direct-to-consumer seafood delivery services is fueling demand for innovative packaging solutions. Supermarkets like Walmart, Costco, and Whole Foods emphasize premium seafood packaging to attract health-conscious buyers.

U.S. Seafood Packaging Market Trends

The U.S. is expanding sustainable fish and shrimp farming, increasing demand for packaging solutions that support freshness and branding. U.S. Food and Drug Administration and U.S. Department of Agriculture regulations require advanced packaging solutions to maintain freshness, prevent contamination, and extend shelf life.

Europe Environmental Regulations to Project Notable Growth

Europe is seen to grow at a notable rate in the foreseeable future. EU bans on single-use plastics (e.g., the European Green Deal) are driving the adoption of biodegradable, compostable, and recyclable packaging. Increasing focus on carbon footprint reduction pushes companies to use eco-friendly materials like bioplastics, paper-based packaging, and recyclable trays. European consumers prioritize sustainably sourced seafood, increasing demand for packaging with eco-certifications (e.g., MSC, ASC, and EU organic labels). Europe is a major seafood importer, sourcing from Norway, Iceland, Asia, and North America. Strict EU food safety standards drive demand for high-quality, tamper-proof, and traceable seafood packaging.

Value Chain Analysis

Raw Materials Sourcing

Seafood packaging uses materials like EPS foam, PET trays, corrugated boxes, and vacuum-sealed films to maintain freshness. Increasing focus is placed on recyclable and marine-safe materials.

Key players: Amcor Plc, Sealed Air Corporation, Berry Global, DS Smith, Sonoco Products.

Logistics and Distribution

Cold-chain logistics are critical for seafood transportation to maintain temperature integrity and prevent spoilage. Insulated containers and temperature-monitoring systems are widely used.

Key players: Lineage Logistics, Americold Realty Trust, Maersk (reefer containers), Sealed Air (protective packaging solutions).

Retail Sales and Financing

Seafood packaging demand is driven by supermarkets, hypermarkets, and export markets. Financing includes supply contracts with seafood processors and sustainability-linked investment programs.

Key players: Walmart (retail distribution), Carrefour, Amcor Plc, Berry Global, Thai Union Group (processor partnerships).

Global Seafood Packaging Market Players

- Sealed Air

- DS Smith

- Amcor

- Berry Global

- Constantia Flexibles

- Clondalkin Group

- Cascades

- DOW

- Smurfit Kappa

- Victory Packaging

- AEP Industries Inc.

- Amcor plc

- Crown

- Silgan Holdings Inc.

- SIRANE GROUP

- Printpack

- FFP Packaging Ltd

- ULMA Packaging

Latest Announcements by Seafood Packaging Industry Leaders

- IN August 2024, Michael Stephens, CEO of Bama Sea Products, stated that the home delivery services collaborate with constantly listen to customer feedback and make package modifications to enhance user experiences and foster client loyalty. In the home delivery industry, shrimp in particular frequently result in customer complaints because of their tendency to leak, handle clumsily, and cross-contaminate with other proteins. Working with Aptar to create a suitable SeaWell packaging solution for this market and see it through to commercialization was the goal. In order to preserve freshness, quality, and appearance, Aptar Food Protection, a division of Aptar, created the Sea Well active packaging solution for seafood, which is presently being used by merchants all over the United States.

New Advancements in Seafood Packaging Industry

- In 2025, International Paper purchased DS Smith, a prominent producer of fiber-based packaging, which is assisting seafood processors in cutting expenses and carbon dioxide emissions with its DryPack seafood box. In cold chain operations, fresh fish can be kept below 40 degrees Fahrenheit for more than 40 hours when packed in a DryPack, a 100% water-resistant box. Shipped to the processers' flat, the high-performance product reduces fuel emissions and inbound freight expenses. DryPack has 100% recycling and FBA approval.

- In January 2025, Royal Greenland, the massive European seafood company introduced a completely recyclable packaging option for its 15-pound boxes of cod and halibut. With the help of packaging solutions company Schur, the innovative packaging uses a water-based coating specifically designed for frozen seafood in place of conventional cardboard coated in polyethylene.

Seafood Packaging Market Segments Covered

By Material

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Other plastics (e.g., PET, PLA)

- Paper

- Kraft Paper

- Coated Paper

- Cardboard

- Other Paper Types

- Metal

- Aluminum

- Tinplate

- Steel

- Others

- Biodegradable Materials

- Plant-based Materials (e.g., cellulose)

By Product Type

- Shrink Films

- Polyethylene (PE) Shrink Films

- Polyvinyl Chloride (PVC) Shrink Films

- Polyolefin (PO) Shrink Films

- Other Shrink Films

- Trays

- Plastic Trays

- Paper Trays

- Foam Trays

- Aluminum Trays

- Other Types of Trays

- Bags & Pouches

- Stand-up Pouches

- Flat Bags

- Vacuum Bags

- Pillow Pouches

- Other Types of Bags & Pouches

- Cans

- Aluminum Cans

- Tinplate Cans

- Steel Cans

- Other Types of Cans

- Boxes

- Cardboard Boxes

- Paperboard Boxes

- Rigid Boxes

- Other Types of Boxes

- Others

- Films

- Flexible Packaging

By Packaging Technology

- MAP (Modified Atmosphere Packaging)

- Modified Atmosphere for Fresh Seafood

- Modified Atmosphere for Processed Seafood

- Vacuum Skin Packaging (VSP)

- Vacuum Packaging for Fresh Seafood

- Vacuum Packaging for Processed Seafood

- High-Barrier Vacuum Packaging

- Others

- Active Packaging

- Intelligent Packaging

- Freshness Indicator Packaging

- Biodegradable Packaging

By Application

- Fresh & Frozen

- Fresh Seafood (Fish, Molluscs, Crustaceans, etc.)

- Frozen Seafood (Fish, Molluscs, Crustaceans, etc.)

- Processed

- Canned Seafood

- Smoked Seafood

- Dried Seafood

- Cooked Seafood

- Other Processed Seafood Types

By Seafood Type

- Fish

- Finfish (e.g., Salmon, Tuna, Cod)

- Shellfish (e.g., Clams, Oysters)

- Molluscs

- Mussels

- Squid

- Octopus

- Crustaceans

- Shrimp/Prawns

- Lobsters

- Crabs

- Others

- Caviar

- Seaweed

- Fish Roe

- Other Types of Seafood

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (3)