April 2025

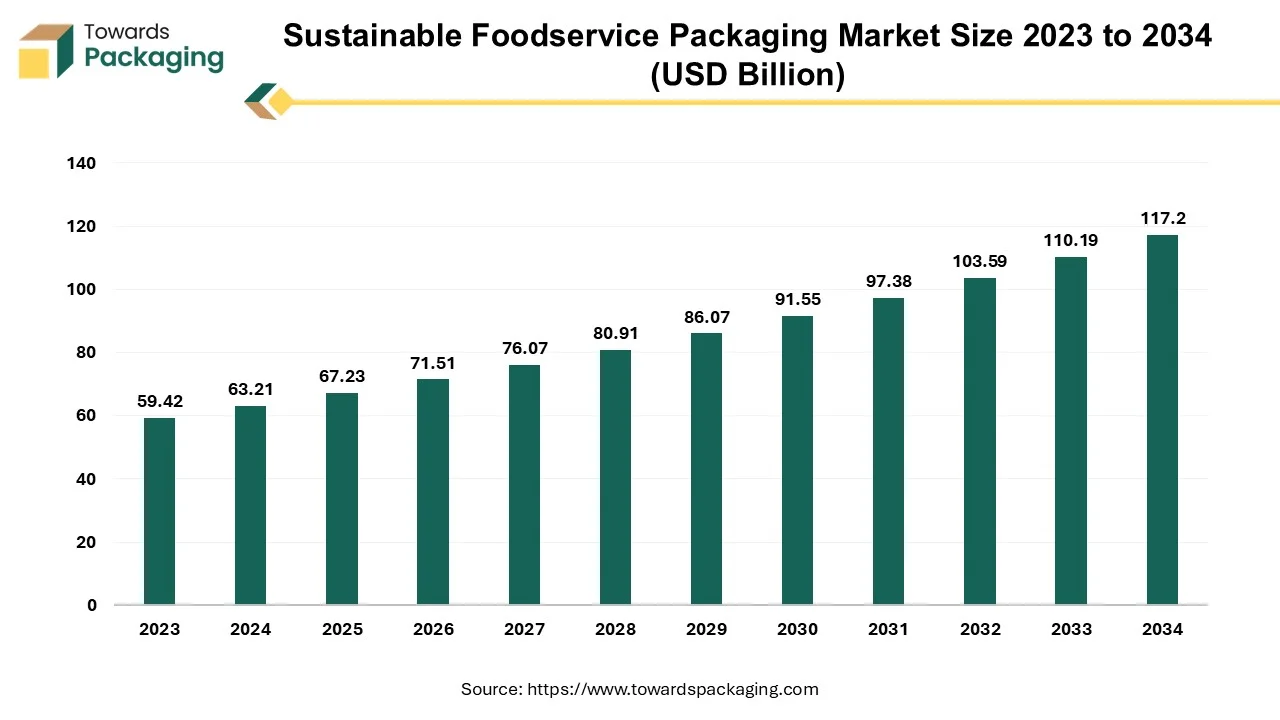

The global sustainable foodservice packaging market size is estimated to reach USD 117.2 billion by 2034, up from USD 63.21 billion in 2024, at a compound annual growth rate (CAGR) of 6.37% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

To significantly reduce the foodservice industry's environmental effect, sustainable foodservice packaging is necessary. Companies can reduce the waste, preserve the natural resources and decrease the carbon emissions by switching to the sustainable materials. Companies in the foodservice industry can gain a lot from using the sustainable packaging. The sustainable packaging industry is growing at a significant rate. The foodservice sector, which holds a majority share of the market for sustainable packaging, is primarily responsible for this enormous growth. Sustainable foodservice packaging has multiple benefits that extend beyond environmental protection to include improved product quality, brand recognition, economic effectiveness through product repurposing and consumer preference.

The increasing environmental awareness among consumers coupled with the stringent government regulations and bans on single-use plastics is anticipated to augment the growth of the sustainable foodservice packaging market within the estimated timeframe. The development of innovative, cost-effective biodegradable, compostable, and recyclable materials along with the rise of the circular economy concept are also expected to support the market growth. Furthermore, the increasing investment in recycling and composting infrastructure as well as the growing demand for sustainability is also likely to contribute to the growth of the market in the years to come. The global packaging market is estimated to grow at a 3.16% CAGR between 2025 and 2034.

With more ecologically conscious consumers than ever, the use of sustainable packaging is growing. According to the 2023 Buying Green Report by Trivium Packaging, global inflation has caused consumer prices to increase significantly, yet customers are willing to pay extra for the products that are packaged sustainably. In general, 82% of the people surveyed said they would be willing to pay extra for the sustainable packaging that is an increase of 4 points from 2022 and 8 points from 2021. This suggests that despite the economy being worse, consumers still prioritize protecting the environment. Consumers that are between the ages of 18 and 24 are even more inclined towards sustainability, they lead at 90%. Today, sustainable packaging is essential for the company growth since environmentally concerned consumers are searching out the firms that adopt eco-friendly practices.

Foodservice brands are gradually shifting to using more environment friendly packaging for their goods due to the growing local restrictions, consumer demand along with the increasing need for the companies to be recognized as an ecologically conscious brand. Just by looking at or feeling the packaging, consumers are likely to be able to distinguish between the unsustainable and sustainable packaging. Sustainable packaging, which is typically used in place of most plastics, is more aesthetically acceptable to the consumers and is comprised of natural materials like bagasse, wood pulp, cornstarch and even seaweed. Since2022, especially the younger ones and those with higher incomes, have expressed an interest in buying the products that are packed sustainably. Thus, with the customers demand for more sustainable solutions and governments regulations, companies of the packaging goods and brands are progressively embracing the trend.

The higher cost of sustainable packaging materials is likely to hinder the growth of the sustainable foodservice packaging market within the estimated timeframe. Demand for more ecological packaging options is undoubtedly increasing. However, even though people want their packing materials to be eco-friendly, they additionally desire the same amazing package experience as before, in terms of the safety and quality, which can be difficult for packaging makers to achieve. However, preserving quality isn't the only challenge that producers face. Almost 40% of the brands have identified cost as one of the most significant hurdles in transitioning to sustainable packaging.

Furthermore, despite the use of the recycled materials is growing in popularity, especially since the passing of the Plastic Tax bill, using the recycled materials is still generally more expensive than utilizing virgin materials. This is due to the fact that the majority of the environmentally friendly packaging materials are quiet new and has a smaller production scale. Therefore, in order to alter the machinery line, more expenditure for research and development is required, which accounts for the increased costs. Furthermore, the majority of sustainable products are now produced at a higher cost due to the use of renewable energy in their manufacturing process. The eco certification is an additional factor that might frequently increase the pricing. These certifications are vital as they demonstrate to the customers that a business or product is truly eco-friendly and that false green marketing is not being used. However, quality checks and inspections, administrative charges, certification fees as well as the marketing expenses must all be covered in order to obtain an eco-certification.

The increasing investments in the sustainable packaging and composting infrastructure are likely to create opportunities for the growth of the sustainable foodservice packaging market in the years to come. In a circular economy, efficient sustainable packaging is intended for the recovery either by recycling or composting rather than for disposal in landfills or for burning. Companies have a significant chance to invest in their supply chains and the future of the world by adopting the circular economy. Organizations that focus on the environmentally friendly packaging should also make sure that the infrastructure for product-package sorting and reprocessing such as composting and recycling centers, is supported by the expansion of these facilities.

Some of the recent investments and funding made include

These strategic investments in sustainable packaging and related infrastructure are important for the sustained growth and development of the sustainable foodservice packaging market.

The paper & paperboard segment captured largest market share of 41.21% in 2024. Since long ago, paper and paperboard have been valuable materials for a variety of applications including printing, packaging, and arts. Cellulose fibers are woven into a network to form sheets of paper and paperboard. Both flexible and rigid packaging can be made using these materials. From freezing food storage to boiling water and heating in microwaves and traditional radiant heat ovens, paper and paperboard packaging can withstand a broad range of temperatures. The fact that paper and paperboard are made from renewable resource that is trees, is one of their main advantages. Also, to minimize their negative effects on the natural ecosystems and to assist the local communities that rely on the forestry for their livelihoods, many suppliers of paper and paperboard are dedicated to procuring their products from the certified sustainable forests. Paper and paperboard are a wise choice for customers and organizations trying to minimize their environmental effect as they provide a number of ecological benefits.

The quick service restaurants (QSR) segment held largest market share of 44.23% in 2024. Offering eco-friendly packaging and disposal bins that separate the recyclable, compostable, and biodegradable materials helps QSRs gain more popularity with environmentally conscious clients and draw in additional revenue. The fast food and quick-service restaurant (QSR) meal consumption of the millennials is fueled by their busy lifestyles. Growth in this segment is also being driven by operators' desire to be responsive to the customers' dining tastes and experience expectations. Unique QSR packaging trends are also being driven by independent QSRs, or the ones with no more than four locations with the same name. These eateries are anticipated to expand at the fastest rate per year, which will enable them to provide distinctive in-restaurant as well as delivery experiences. One characteristic that sets them apart is their tendency to provide quick cuisine that can be customized to the tastes of the local population.

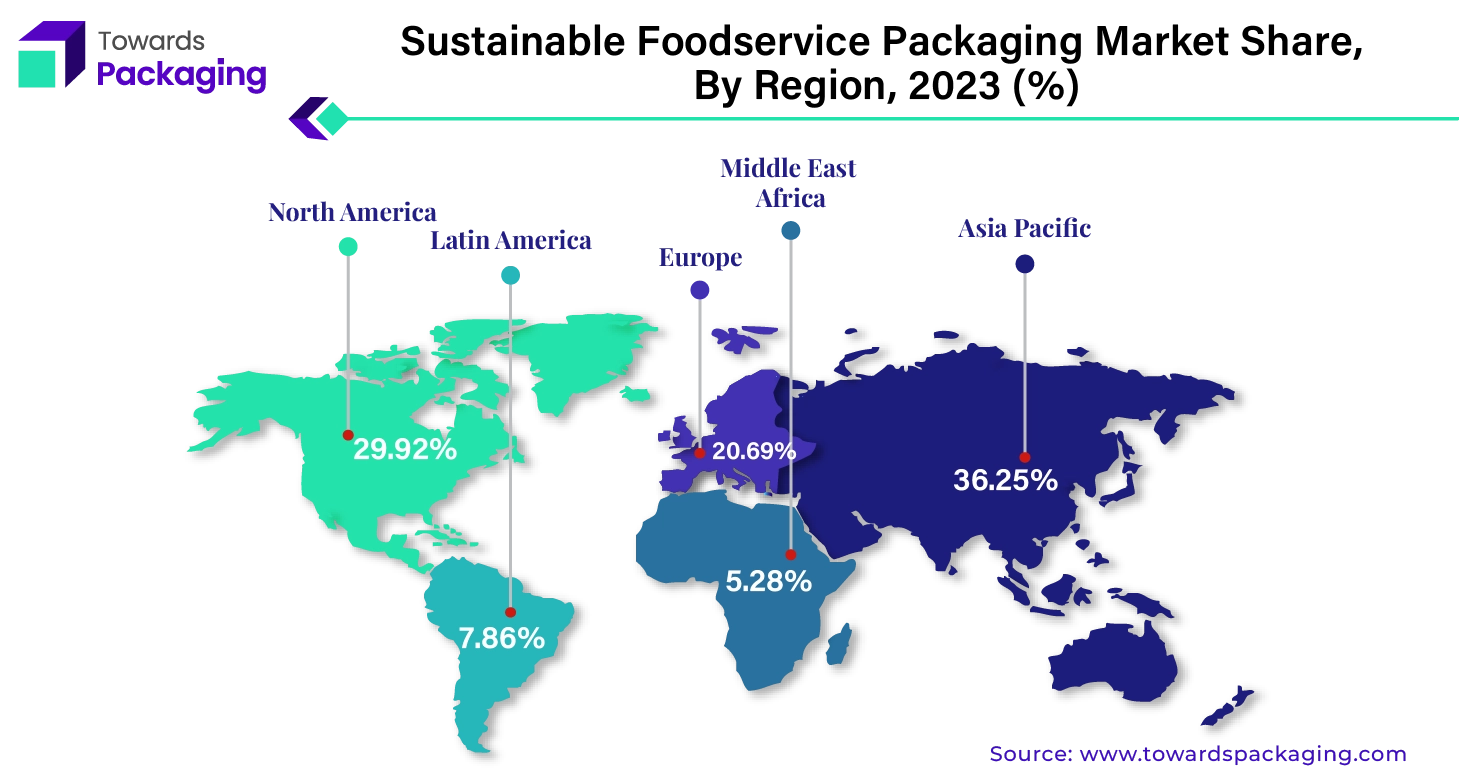

Asia Pacific held largest market share of 36.25% in 2024 and is expected to grow at a fastest CAGR of 8.60% during the forecast period. This is owing to the rapid urbanization which is leading to an increased demand for foodservice outlets, including quick service restaurants, cafes, and kiosks. Furthermore, the growing population in economies like China, India, and Indonesia with higher consumption rates is also likely to support the regional growth of the market. Additionally, the rapid economic growth as well as the increasing disposable incomes and higher consumer spending on foodservice are also anticipated to contribute to the regional growth of the market within the forecast period.

North America is expected to grow at a substantial CAGR of 4.96% in 2024. This is due stringent regulations aimed at reducing plastic waste and promoting sustainability across the region. Also, the consumer preferences towards products that are perceived to be healthier and more environmentally friendly along with the rise in food delivery services is further expected to support regional growth of the market in the years to come. Furthermore, the growing investment in the sustainability-focused startups and technologies as well as in the recycling and composting infrastructure is also expected to support the regional growth of the market in the near future.

By Material

By Product

By End User

By Region

April 2025

April 2025

April 2025

April 2025