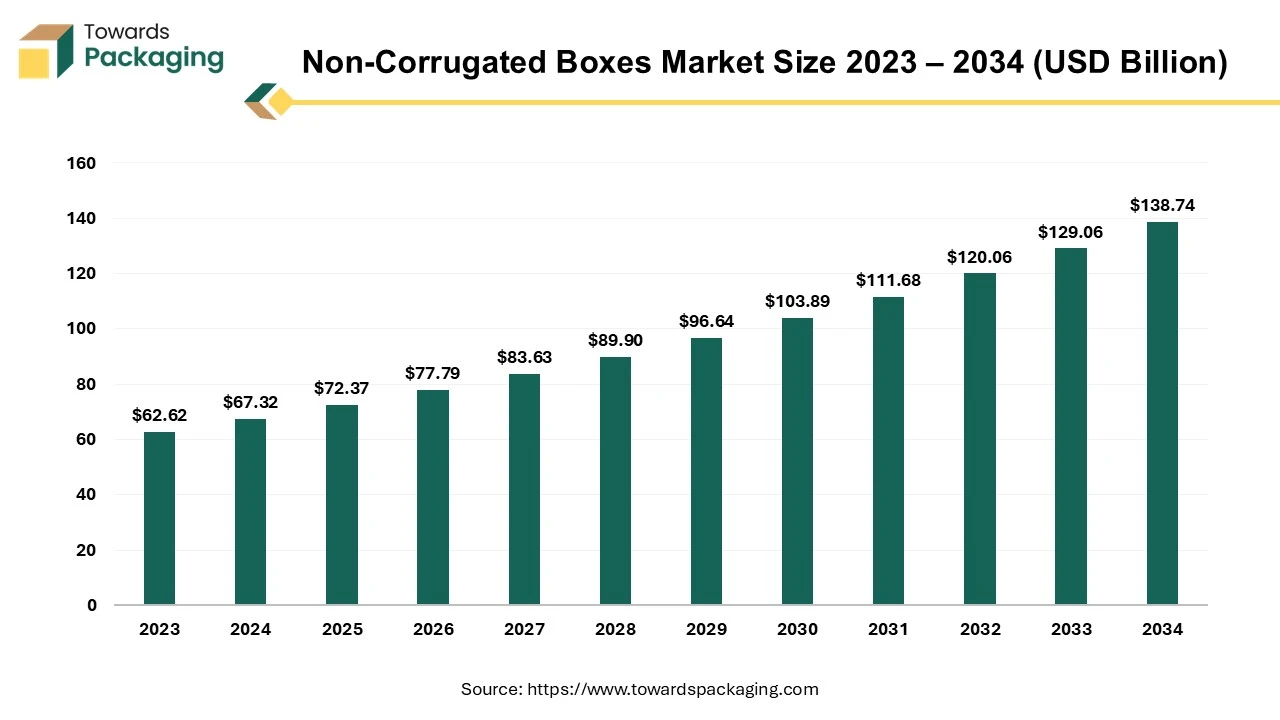

The non-corrugated boxes market is forecasted to expand from USD 77.80 billion in 2026 to USD 149.15 billion by 2035, growing at a CAGR of 7.5% from 2026 to 2035. The market is driven by the increasing demand for aesthetic packaging in the consumer electronics, fashion, and food industries. In 2024, the Asia Pacific region led the market with a 35% share, followed by North America at 30%. The market is highly competitive with key players such as Graphic Packaging International, WestRock, and Mayr-Melnhof. The leading product types are telescopic boxes (20%) and collapsible boxes (30%), while the thickness segment between 1.5mm to 2.5mm holds 35% market share.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

Non-corrugated boxes are often used for consumer goods, such as food products, electronics, or cosmetics, where the packaging is more about presentation than protection. Non-corrugated boxes are suitable for storing items that do not require heavy-duty protection. Non-corrugated boxes are used in promotional or gift packaging where aesthetics are more important than the durability. The non-corrugated boxes are generally cheaper to produce than corrugated boxes due to simpler manufacturing processes. Non corrugated box are easier to print and customize for branding and marketing purposes. Overall, non-corrugated boxes are best suited for applications where high durability is not a critical factor and where the focus is on appearance and cost efficiency.

For retail packaging, non-corrugated boxes are frequently utilized where aesthetics are important. The product's visual attractiveness and branding can be improved with ease by adding high-quality printing, embossing, and other design components. The cost of producing non-corrugated boxes, like those composed of paperboard or thin cardboard, is typically lower than that of corrugated boxes. Their cost-effectiveness may make them a more desirable option for companies trying to reduce their packaging costs. The global packaging market size is growing at a 3.16% CAGR.

Retail packaging for a lot of consumer goods, including food, cosmetics, and electronics, uses non-corrugated boxes. These boxes offer an excellent mix of display and protection. Many non-corrugated boxes are made from recyclable materials, which aligns with sustainability goals. Consumers and companies increasingly prioritize environmentally friendly packaging solutions. Overall, combination of lower costs, aesthetic and appealing presentation, and practicality contributes to the higher sales of non-corrugated, particularly for retail and consumer goods.

Scope & method: “Non-corrugated boxes” are primarily folding cartons & set-up (rigid) boxes. Exact global company shares are not publicly reported, so the figures below are reasonable estimates derived by mapping each company’s 2024 net sales that are predominantly folding-carton packaging to the 2024 global folding-cartons market size.

| Rank | Manufacturer (global) | 2024 share (%) |

| 1 | Graphic Packaging International (GPI) | 5.00% |

| 2 | WestRock – Consumer Packaging | 2.40% |

| 3 | Mayr-Melnhof (MM) – Packaging divisions | 1.40% |

| - | All other manufacturers (highly fragmented long tail) | 91.20% |

AI algorithms can help optimize non-corrugated box designs for strength, durability, and material efficiency, reducing waste and improving performance. Machine learning can predict equipment failures and maintenance needs, minimizing downtime and extending the lifespan of manufacturing machinery. AI can improve inventory management and forecasting, ensuring optimal stock levels and reducing lead times.

Computer vision systems powered by AI can inspect non-corrugated boxes for defects and inconsistencies more accurately than human inspectors. AI-driven analytics can provide insights into customer preferences and trends, allowing companies to tailor their products and services more effectively. AI can drive automation in manufacturing processes, including cutting, folding, and assembling boxes, increasing production speed and reducing labor costs.

Companies that packages goods ought to investigate how artificial intelligence (Al) functions in intelligent packaging systems. Al is a multi-benefit game changer. Examine smart packaging and Al in more detail to see why they are so advantageous for any business that packages goods.

Modern consumers value the overall experience of purchasing and unboxing products. Premium packaging enhances this experience, making it more memorable and satisfying, which can lead to increased brand loyalty. In a competitive market, businesses use aesthetic and premium packaging to stand out from competitors. High-quality packaging can help a product attract attention on shelves and online, thereby boosting sales and brand recognition. The rise of social media platforms encourages consumers to share their experiences, including unboxing videos and photos. Attractive packaging can enhance social media presence and create organic marketing opportunities. Premium packaging often conveys a higher perceived value of the product inside. Consumers are willing to pay more for products that come in high-quality, well-designed packaging, as it suggests better quality and exclusivity.

Non-corrugated boxes, such as those made from rigid or paperboard materials, are often used for premium and luxury packaging due to their superior appearance and durability. As consumer preference shifts towards aesthetically pleasing packaging, the demand for non-corrugated boxes increases. The key players operating in the beauty and cosmetics field are adopting inorganic growth strategies like partnership to launch brand in exclusive packaging which is estimated to fuel the growth of the non-corrugated boxes market over the forecast period. Increasing launch of new cosmetic and beauty brands are rising the demand of the non-corrugated boxes market, which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

For instance,

The non-corrugated boxes often face competition from the other alternative packaging options and which are lower in cost as compared to it which is major restraining factor for the non-corrugated boxes market. Non-corrugated boxes, such as those made from rigid paperboard or specialty materials, are often more expensive to produce compared to corrugated alternatives. This higher cost can be a barrier, especially for budget-conscious businesses. Non-corrugated boxes generally offer less protection against impacts and rough handling compared to corrugated boxes, which may limit their use for shipping or handling products that require robust protection. Although many non-corrugated boxes are recyclable, some types may not be as easily recyclable as corrugated boxes.

This can be a concern for companies and consumers focused on sustainability. The production processes for non-corrugated boxes can be more complex and time-consuming, which might limit scalability and increase lead times. In some regions, the market for non-corrugated boxes may be saturated, making it challenging for new entrants to gain a foothold or for existing companies to expand. If consumer preferences shift back toward more practical and cost-effective packaging solutions, the demand for non-corrugated boxes may decrease. The availability and adoption of alternative packaging materials, such as flexible packaging or biodegradable options, can also limit the growth of non-corrugated boxes.

Businesses are increasingly seeking customized packaging that reflects their brand identity. Non-corrugated boxes offer excellent opportunities for unique and branded packaging designs. The demand for unique and high-quality gift packaging provides an opportunity for non-corrugated boxes, which are often used for special occasions and premium gifts. The expanding e-commerce industry creates a demand for high-quality packaging that enhances the customer experience. Non-corrugated boxes, often used for premium and luxury items, are well-suited for this purpose. As unboxing becomes a significant part of the consumer experience, brands are investing in packaging that provides a premium and memorable unboxing experience, leveraging non-corrugated boxes. The key players operating in the market are booming their business by offering customized gift packaging using non-corrugated boxes, which estimated to create lucrative opportunity for the growth of the non-corrugated boxes market over the forecast period.

For instance,

Government Initiatives to Reduce Packaging Cost

The telescopic box held the dominating share of the non-corrugated boxes market in 2024. Telescopic boxes offer adjustable sizes and configurations, which makes them versatile for various applications. This adaptability attracts a wide range of industries, from logistics to retail. Their ability to extend and retract allows for efficient use of storage space, reducing shipping and warehousing costs. This efficiency appeals to businesses seeking cost-effective solutions. Telescopic boxes provide better protection for goods during transit due to their customizable fit, leading to fewer damages and returns, which is a key consideration for manufacturers and retailers. Manufacturers continuously innovate with new materials and designs, enhancing performance and appealing to customers looking for specialized packaging solutions.

Many telescopic boxes are designed with recyclable or eco-friendly materials, aligning with the growing demand for sustainable packaging solutions. Hence, the telescopic boxes offer flexibility, alignment and efficiency with current non-corrugated boxes market trends and contribute to their significant growth in the packaging industry. The key players operating in the market are focused on developing the new product to expand its product portfolio, which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

For instance,

The thickness between 1.5mm to 2.5mm segment held the largest share of the non-corrugated boxes market in 2024. The thickness of a product, such as a box, can impact sales growth in various ways. If a box is designed with a thickness between 1.5 mm and 2.5 mm, it can handle the goods inside it very well. A thicker box generally offers better protection for the contents, which can reduce damage during shipping and handling. This added durability can appeal to consumers and businesses concerned with quality and safety. Thickness of packaging between 1.5 mm to 2.5 mm often feels more premium and sturdy, which can enhance the perceived value of the product inside. Consumers might be willing to pay more for products that are well-protected and come in high-quality packaging. Offering boxes with a specific thickness can help a brand differentiate itself from competitors. A well-designed, durable box can be a key selling point and a factor in a consumer’s purchasing decision.

For instance,

The consumer electronics segment held the dominating share of the non-corrugated boxes market in 2024. In the consumer electronics sector, packaging plays vital roles. It safeguards the product from physical damage during shipping and handling, ensuring that the electronics arrive in good condition and function properly. Non-Corrugated boxes assists to serves as a key marketing tool, communicating the brand's identity and values. As non-corrugated boxes are printable and gives large space for printing even includes logos, colors, and designs that appeal to consumers and differentiate the product from competitors. Non-corrugated materials allow for advanced printing and finishing techniques, which can showcase the brand and product features more prominently.

This can be crucial for attracting consumers and conveying high value. It provides essential information about the product, such as features, specifications, and instructions for use. This helps consumers make informed purchasing decisions and facilitates ease of use. Non-corrugated materials like moulded plastic, high-quality paperboard, and foam offer a more polished and visually appealing presentation. They enhance the overall look and feel of the product, aligning with the premium image of many electronics.

Developing advanced packaging solutions that offer better protection for fragile electronics can improve product safety and reduce returns, leading to increased use of high-quality packaging materials. Offering customizable non-corrugated box packaging options that cater to individual preferences or limited editions can create a sense of exclusivity and boost consumer interest, thereby driving growth in the non-corrugated boxes market. As the consumer electronics market expands, increased competition among brands can lead to more investment in packaging to differentiate products, thus driving growth in the packaging sector. Moreover, increasing launch of the new consumer electronics goods has risen the demand for the non-corrugated boxes which is estimated to drive the growth of the segment over the forecast period.

For instance,

The Asia Pacific region is estimated to grow at the fastest rate over the forecast period. Rapid urbanization and the development of modern retail formats are increasing the demand for sophisticated packaging solutions that can attract consumers and enhance the shopping experience. The boom in e-commerce in Asia Pacific region has led to a rise in demand for packaging that enhances product presentation and provides a better unboxing experience. Non-corrugated boxes are often used for premium packaging in online retail. A growing middle class with higher disposable incomes in Asia Pacific is driving demand for higher-quality and aesthetically pleasing packaging.

Non-corrugated boxes, such as those made from rigid paperboard, are often perceived as more luxurious. Companies in Asia Pacific are increasingly focusing on brand differentiation through unique and high-quality packaging. Non-corrugated boxes offer better customization options and a premium feel, helping brands stand out. There's a growing emphasis on sustainability and eco-friendly packaging. Non-corrugated options often use recyclable or biodegradable materials, aligning with consumer preferences for environmentally responsible products. Increasing development in Pharma and medical device industry in Asia Pacific is also key factor responsible for rise in demand for the non-corrugated packaging in Asia Pacific region.

North America is observed to grow at the fastest rate in the non-corrugated boxes market during the forecast period. The surge in online shopping in North America has driven demand for non-corrugated boxes of packaging, including non-corrugated boxes, which are often used for premium and specialized packaging needs. There is a growing preference for aesthetically appealing and high-quality packaging. Non-corrugated boxes, such as those made from rigid paperboard, are often chosen for their superior appearance and durability.

There is a growing preference for aesthetically appealing and high-quality packaging. Non-corrugated boxes, such as those made from rigid paperboard, are often chosen for their superior appearance and durability. There's a growing preference for convenience foods, healthier options, and premium products due to busy lifestyle in North America. This shift in consumer behaviour is driving innovation and expansion in the food sector in North America. Increasing launch of the new food center has risen the demand of the non-corrugated boxes in North America is estimated to drive the growth of the non-corrugated boxes market in the North America region.

According to the data published by the Food & Beverage Association, non-profit organization, based in U.S. reported 22.3% growth in the food and beverages industry in 2023 in U.S. in comparison to pervious year that is 2022.

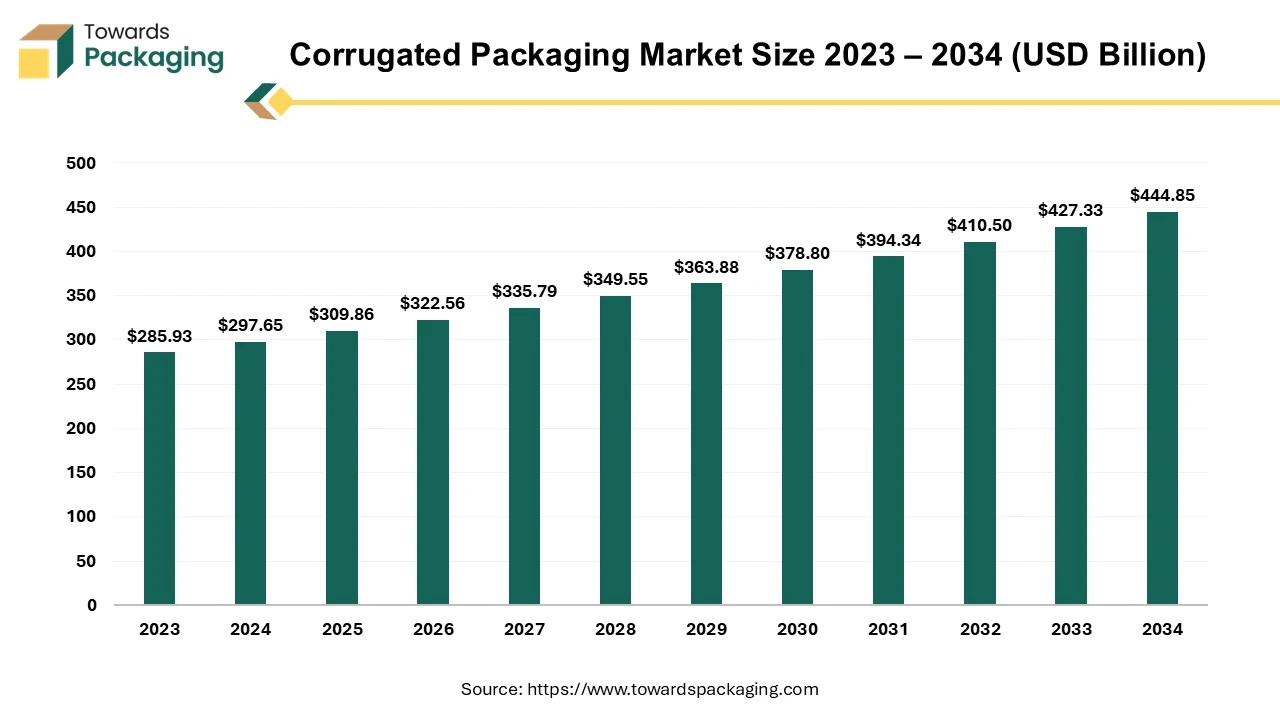

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

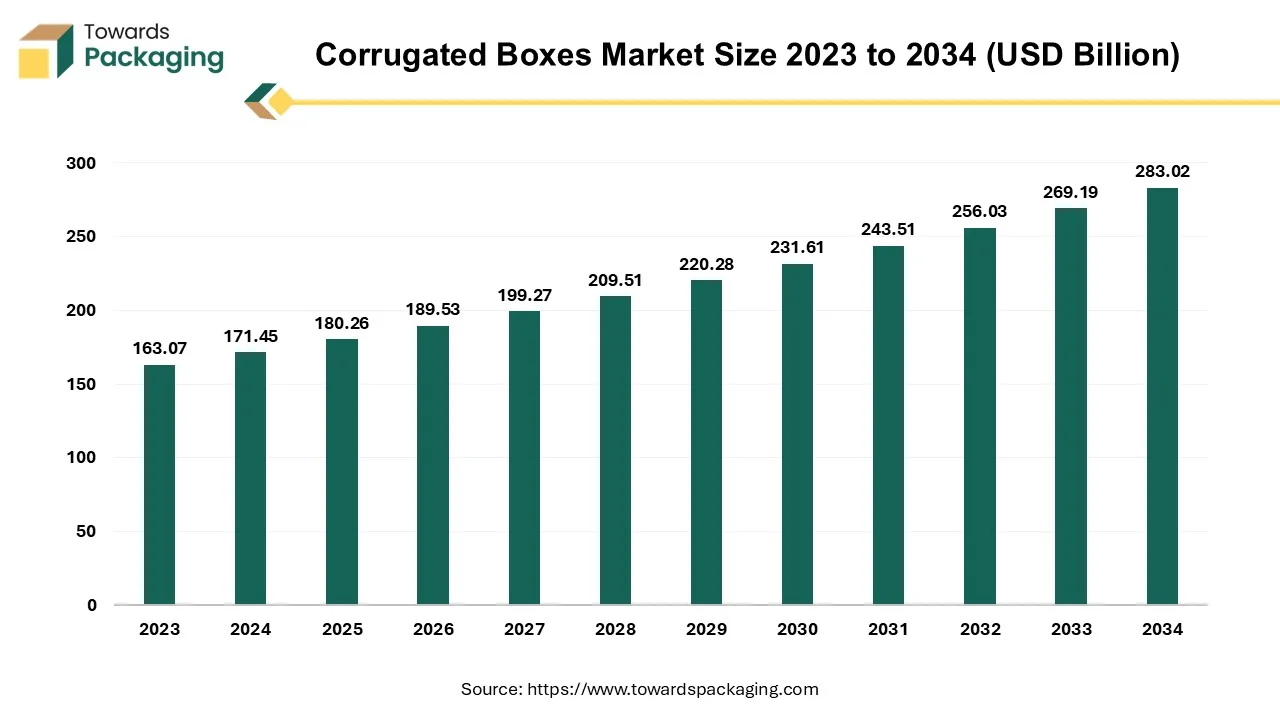

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

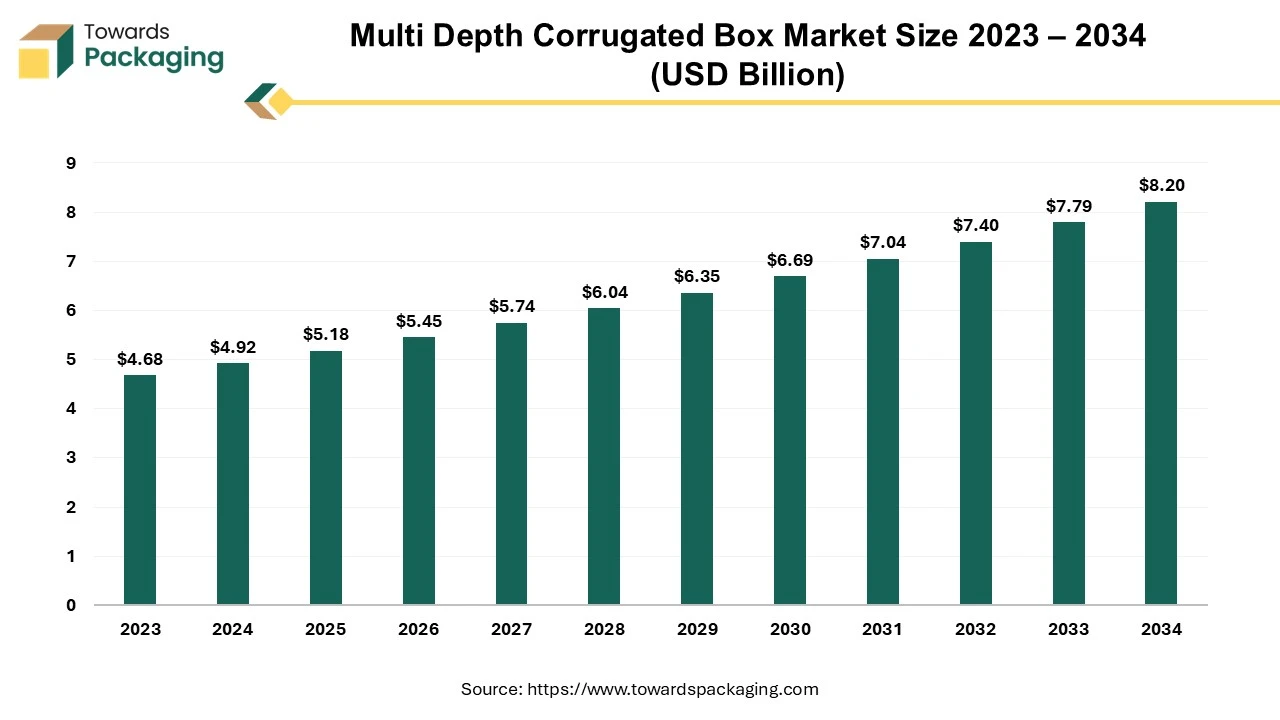

The multi depth corrugated box market is forecast to grow from USD 5.18 billion in 2025 to USD 8.20 billion by 2034, driven by a CAGR of 5.23% from 2025 to 2034.

A multi-depth corrugated box is a type of packaging designed with multiple score lines that allow the box to be adjusted to different heights. This feature makes the box versatile for packaging items of various sizes. By cutting along the score lines, consumers can customize the box’s depth to fit the product securely, minimizing wasted space and reducing shipping costs. This adaptability is particularly useful for e-commerce and shipping industries where flexibility in packaging can be crucial.

The corrugated boxes for transit packaging market is projected to reach USD 511.79 billion by 2034, expanding from USD 328.78 billion in 2025, at an annual growth rate of 5.04% during the forecast period from 2025 to 2034. The rising e-commerce activities and requirement for sustainable packaging resolution.

The rising food delivery facility boosts the production of high-quality corrugated boxes for safe transportation of food products. Continuous advancement in the technology has also fuelled the expansion of the market. This market is dominating in Asia Pacific region due to rising ecological awareness and increasing export business.

Product Type

By Thickness

By End Use

By Region

January 2026

January 2026

January 2026

January 2026