April 2025

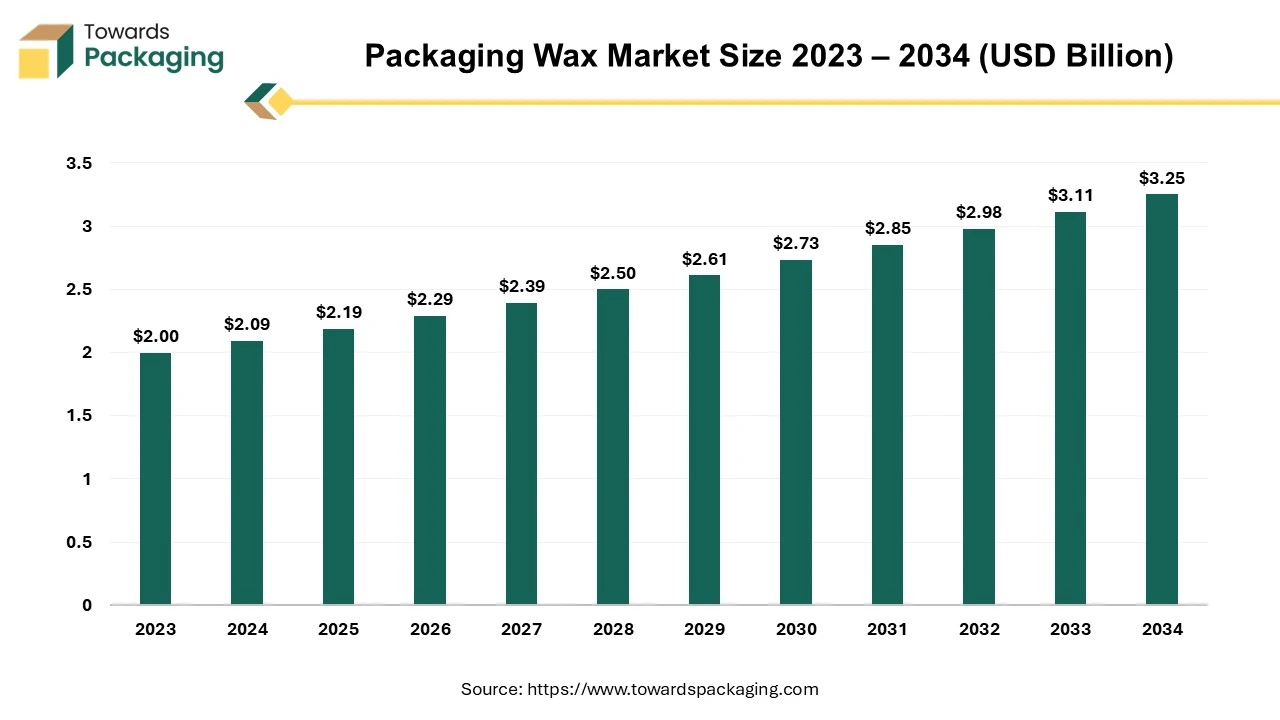

The packaging wax market is projected to reach USD 3.25 billion by 2034, expanding from USD 2.19 billion in 2025, at an annual growth rate of 4.55% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The demand for premium packaging solutions is driving the growth of the packaging wax market. Additionally, the market is driven by the growing concern of sustainability and eco-friendly packaging. Growing urbanization and population will likely enhance market expansion in the forecast period.

The packaging wax market is anticipating growth due to pharmaceuticals, cosmetics, and food & beverage industries. Such industries are majorly promoting products with wax-based packaging solutions. Waxes like beeswax, candelilla wax, and paraffin wax are trending in the manufacturing industries. Additionally, growing demands for sustainable packaging are improving the utilization of mineral and synthetic wax materials in the packaging solution, leading to boosted market growth.

Growth in the utilization of e-commerce and online shopping is driving developments of smart, protective, and customized packaging solutions that highlight the overall packaging wax market transformation. Advancements in packaging technology and innovation of active and intelligent packaging solutions are seeking contributions to market success. Regions like North America, Asia Pacific, and Europe are significantly expanding markets due to expanding industries, adoption of advanced technologies, growing urbanizations, government support, and a growing shift of sustainability in the globe.

Artificial intelligence (AI) is dramatically transforming the packaging wax market. AI is gaining importance in packaging wax manufacturing companies due to its ability to understand ongoing market dynamics and trends; it helps manufacturers build strategies according to present market situations. Additionally, AI is beneficial in detecting possible market challenges and risks, enabling companies to prevent financial loss.

AI algorithms and machine learning are advantages for optimizing the production process, which helps to reduce overall manufacturing costs and improve companies’ margins. With a growing need for solutions to meet regulatory standards for quality control as well as consumers' specialized demands, industries are significantly adopting AI.

For example, the cosmetic industry has focused on adopting smart packaging solutions like wax-based packaging with advanced technology integration. As there will be constant concerns for safety, quality control, quality assurance, customization, and standards, the door of AI adoption will always be open.

Expanded e-commerce and social media platforms are influencing consumers for premium and luxury cosmetic products. As demands for luxury cosmetic products have increased, the need for premium packaging solutions like wax-coated packaging has been boosted. Cosmetic industries require customized packaging solutions. Increasing demand for skincare and haircare products is emerging for advanced packaging solutions, including wax-based packaging solutions.

Furthermore, the shift of the cosmetic industry towards the adoption of sustainable packaging solutions is enhancing the production of biodegradable wax materials. As consumer preferences have changed toward chemical-free and natural cosmetic products, industries have increased the adoption of natural waxes like beeswax materials for packaging solutions.

As consumer demands for sustainable and premium packaging solutions have increased, the cosmetic industry is further expanding innovations and developments in packaging wax.

For instance, in June 2024, Blur India, an Indian makeup brand, introduced its novel lip and cheek glazes in 10 different vibrant shades. These products are designed by using key ingredients like castor oil, sunflower seed wax, candelilla wax, bran wax, mineral oils, silica, glycerine, avocado oil, ozokerite, hydrogenated vegetable oil, pigments, and vegetable poly glycerine.

Consumer demand for single-serve packaging solutions has increased due to their convenience. The expanded e-commerce platform and online shopping are the crucial reasons for the rising demand for single-service packaging solutions. Due to the convenience and portability of single-service packaging, consumers are attracted to them.

The demand is high among travelers. Several industries, like food & beverages, pharmaceuticals, and personal care, are driving demand for single-serve packaging solutions like snack packaging, unit-dose medicine packaging, and shampoo & conditioner packets.

The world has witnessed great sustainability consciousness in recent years. Consumers highly prefer sustainable and eco-friendly packaging solutions, which encourage manufacturers to innovate and develop biodegradable and recyclable packaging solutions. Manufacturers are focusing on the development of biodegradable wax-like plant-based wax and beeswax packaging solutions.

Additionally, the growing shift toward recyclable wax packaging solutions is improving market competition. With rising environmental regulatory promotions for reducing carbon footprints, the demands for sustainable wax-based packaging solutions are expected to boost in the upcoming period.

Technology advancements are holding great market potential, as due to the pressure of regulatory standards, market competitions, and consumer demands for luxurious packaging solutions, manufacturing companies are investing in developments on cutting-edge technologies. Technology developments like the utilization of nanotechnology in wax-based packaging materials help to enhance the sustainability and performance of the materials.

Utilization of graphene in packaging materials to enhance the strength, sustainability, and durability of the packaging solutions. Additionally, technology developments allow for the production of wax-based packaging with anti-counterfeiting features like RFID tags. Similarly, advanced technology like authentication technology is helping to improve packaging solutions by detecting the authenticity of the products.

Furthermore, with rising awareness of the reduction of carbon footprints, the reduction of plastic use is expected to boost sustainable packaging demands; as a result, production companies are frequently investing in the development of biodegradable, recyclable, and bioplastic materials, leading to improved market competition and brand reputations.

The raw material cost is restraining the packaging wax market. Crude oil is a crucial raw material used in packaging wax production. The high cost of crude oil challenges the manufacturers. Additionally, growth in the cost of petroleum-based waxes and natural waxes is causing an impact on manufacturing companies' economies.

Raw material costs lead to high production costs, which lead to less profit margin; the high cost of packaging wax impacts market competition. Additionally, increased raw material costs hamper the supply chain. The high cost of raw materials creates difficulties in material availability among companies, which is likely to drive a shift toward alternative materials like plant-based or bioplastic waxes.

Rapid urbanization and industrialization are boosting the packaging wax market in the Asia Pacific. Asia Pacific has a large consumer base that is rapidly demanding packaging solutions for food & beverages and pharmaceutical products. Growing disposable income among the middle-class population is driving demand for premium packaging solutions, encouraging industries to pursue cutting-edge innovations.

China is leading the market with a growing middle-class population, leading to encouraging companies to invest in research & developments for the development of cutting-edge wax production with advanced performance and sustainability. The Chinese government is focusing on the promotion of sustainability, which is raising demand for environmentally friendly packaging solutions. On the other hand, India is expected to lead the market in the upcoming period due to the country's growing industrialization.

The availability of crude oil helps lower the cost of formulation, which is paid in favor of the manufacturing companies. Additionally, growing sustainability concerns are leading to investments and developments in the country in petroleum wax. The growth of e-commerce and social media influence plays a crucial role in the market. With rising demand for natural and organic cosmetic products, the market is expected to boost in the forecast period.

The packaging market is witnessing significant growth in North America due to the region's growing demand for sustainable packaging solutions. North America is well known for the establishment of the key industries. Straight regulatory standards are encouraging this competitive packaging industry to innovate cutting-edge sustainable packaging solutions.

The United States is the leading market in North America due to growing consumer demand for premium packaging solutions in the country. Manufacturers are investing in research & developments to meet with consumer demands for the high-quality packaging. Polyethylene wax is crucial to packaging solutions driving growth of the market in North America. Strict regulatory frameworks for food & beverage packaging are contributing to the region's market.

By product, the mineral wax segment dominated the market due to its cost-effectiveness, which drove manufacturers' preference toward them. Mineral waxes are petroleum and microcrystalline waxes, which are less costly compared to other plant-based waxes. The high melting of the mineral wax drives its importance in packaging applications for a high level of thermal stability.

The cosmetic industry is driving the growth of the segment by highly adopting mineral wax packaging solutions due to their properties of thickness, chemical resistance, and texture. The segment is further witnessing growth due to its increasing adoption for transportation packaging, as the mineral wax has high durability. Easy availability is key to end users' adoption of mineral wax packaging materials.

Additionally, as some mineral wax contains biodegradable and non-toxic properties, the demand for mineral wax packaging solutions is expected to enhance among sustainable-conscious consumers. The synthetic wax segment is expected to grow fastest in the coming years. Supply chain issues in naturally sourced wax are pushing businesses to switch to synthetic waxes.

By packaging, the rigid segment held the biggest share of the packaging wax market. The segment is driven by the growing utilization of rigid packaging wax among industries like food & beverages, cosmetics, and pharmaceuticals. The need for barrier properties packaging solutions is fueling the adoption of rigid packaging wax in the food & beverage industry, such as containers, trays, and cups. The chemical resistance property of rigid packaging encourages its utilization in the pharmaceutical industries for capsules and ampoules.

Additionally, the cosmetic industry is significantly driving segment growth by utilizing rigid packaging wax applications like product containers and mascara tubes. Rigid packaging wax solutions have great durability, making them preferred by various industries. The flexible segment is set to see notable growth in the forecast period due to demands for low-cost packaging. Flexible packaging wax takes up less storage space, making it a more cost-effective alternative.

By application, the pharmaceutical segment is leading the market due to the increased demand for high-quality packaging materials. The need for packaging solutions with moisture, oxygen, and any contamination resistance properties is the reason driving the growth of the segment. Additionally, expanding healthcare infrastructure, rising prevalence of disease, and an aging population are driving demand for pharmaceutical products, leading to enhanced production capacity of pharmaceutical companies.

Regulatory compliance for packaging materials to meet regulatory standards and demands for customized packaging solutions are continuously contributing to segment expansion. The personal care segment is set to see substantial growth in the coming years.

“The company's lower carbon product range is allowing consumers to enhance their sustainability performance along with meeting the high industry standards, with a 35% reduction in carbon footprint without compromising on quality.”

By Product

By Packaging

By Application

By Region

April 2025

April 2025

April 2025

April 2025