February 2025

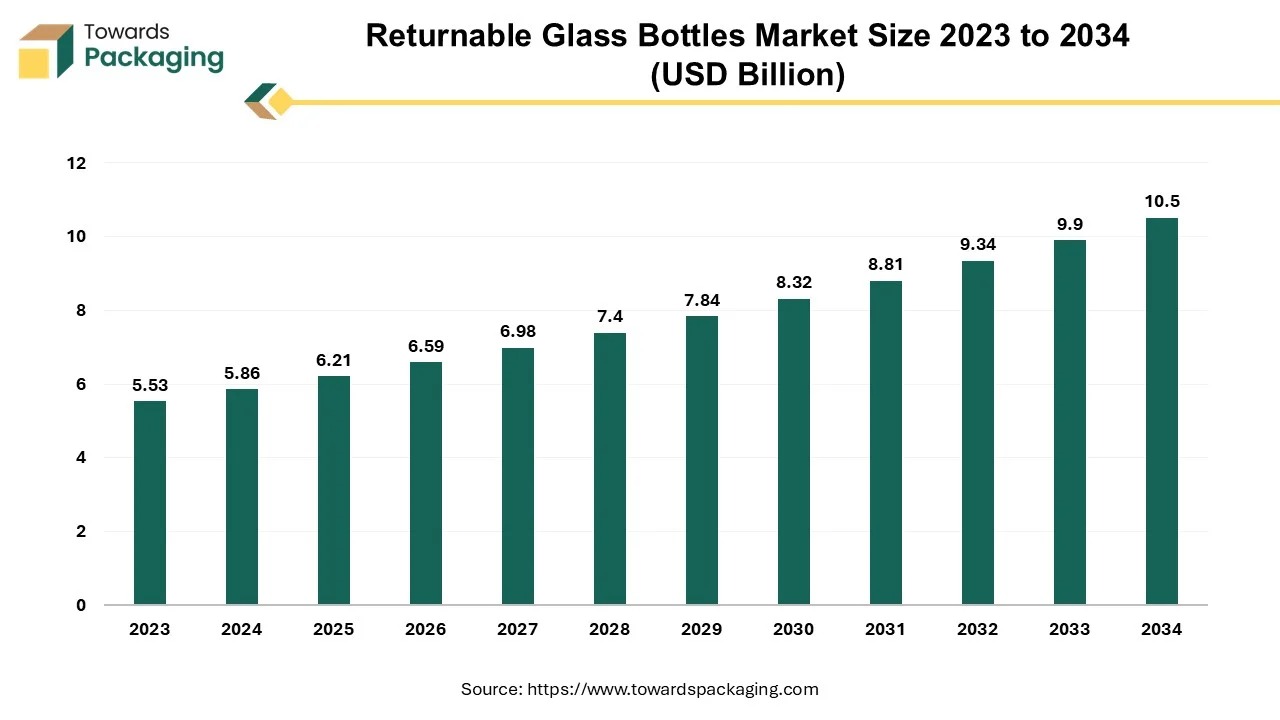

The returnable glass bottle market is expected to grow from USD 6.21 billion in 2025 to USD 10.5 billion by 2034, with a CAGR of 6% throughout the forecast period from 2025 to 2034.

The program of reusable glass packaging reinforces the basic idea that recycling enhances the value in glass containers by proposing a returnable system, in which, 'new' beverages can be produced from returned bottles by avoiding the making of new, virgin ones. This tactic is intended to enlarge the refill and sustain target proposition, which cuts down on carbon footprint and increases the chance of circular economy.

Glass has a very good versatility, easily moved from single-use to multi-use products and returnable glass bottles that can perform more than 40 cycles of use. The debate ongoing about the environmental consequences of packaging is pushing the packagers for such glass bottles towards the growth which is beyond the imagination. Now, a large proportion of the worldwide bottle beer is distributed via returnable bottles, which no other FMCG product can boast of. Nevertheless, the degree of market involvement in returnable beer bottles varies distinctly from a market to market even within the same region.

For Instance,

The customary bottle washing employs glass etching therefore, its components can suffer abrasion damage in the form of scuff rings caused by glass-to-glass friction during filling and transportation. Improvements in protective clean tech, combined with cosmetic cleaning of scuff spots on the bottles, plays a crucial role of preventing such damages and enabling the reuse of these bottles for multiple times. As a corollary, this ensures the highest possible return from the bottles and therefore bottle fleets will be an increasingly attractive proposition for brewers or soft drink companies which may not have previously considered it.

considering returnable bottles, bottling and soft drink companies will be very suitable placed to make a substantial investment, which is expected to bring in great financial profits and a good brand image for the wastewater management, by increasing the usage of their own bottle fleets.

The carbon footprint of glass bottles is really high, only 1.2 ton of CO2 average being consumed for every 1 ton of new glass bottles. Having trucks that can be returned allows diminishing of the impact and enhance sustainability of the product. The Heineken company has been ahead on this issue by introducing FOBO – the "forwardable" bottle that has around a 70% lower carbon footprint than a one-way bottle. which is achieved by refilling the glass bottles that can be utilized again.

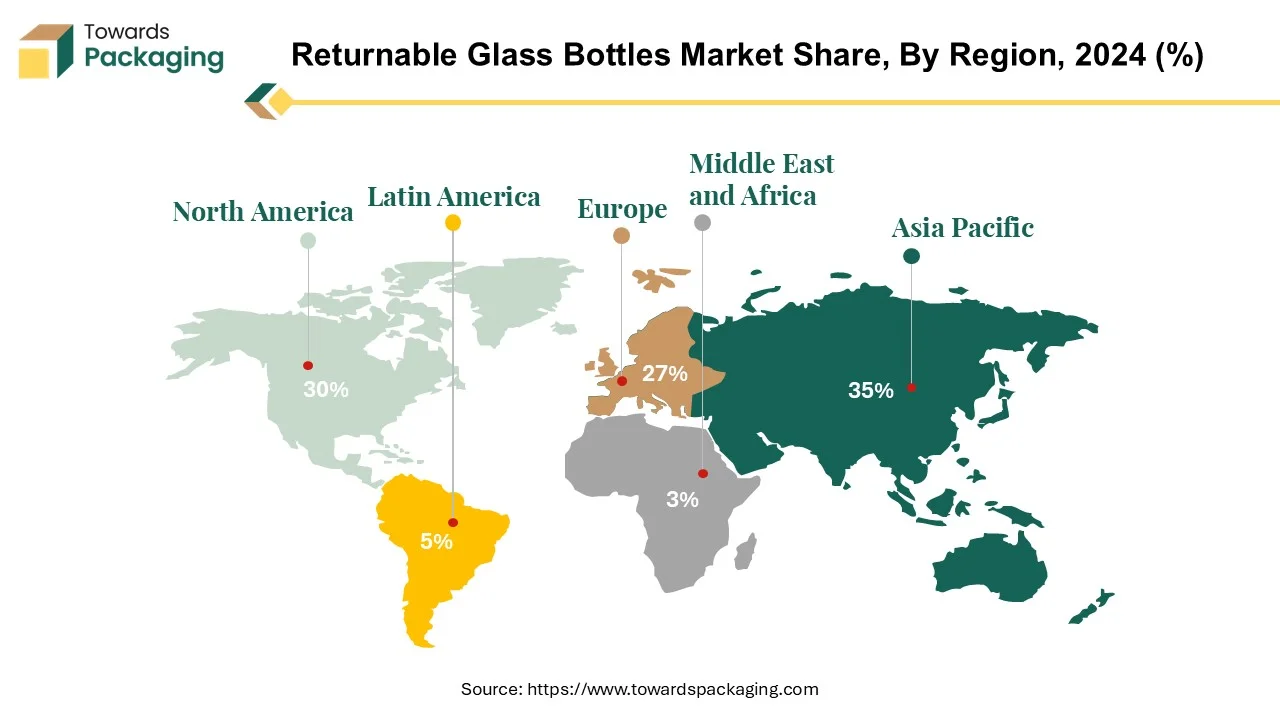

The Asia Pacific region have been the primary producers of glass bottles and has a dominant share in the global container glass industry with the usage of lightweight glass bottles has taken over the scene during the last two decades. The growing concern about lightweight glass bottles as an attractive packaging solution has been particularly pronounced after several glass makers in the region started manufacturing such products recently.

From these producers, Asian glass manufacturers have the seen the quick use of lightweight container glass production techniques. Alcoholic drinks ranked ahead in the Asia Pacific region, where regional glass volume dedicated to this beverage made up the largest share than the other beverages. These driving forces are attributed to the pressures of high production demand and the overall increasing of the feedstock prices. In this context, collecting and reusing returnable glass bottles positions itself as a key competitive advantage compared to other options, especially in the area of cost-efficiency.

China and Japan in Asia are the top exporting countries of glass. Japan, which is known for the innovative technology, is neck to neck with China, which has a big manufacturing sector, in glass exports. Together, they bring about a significant rate of the region's development and prosperity of the industry. Japan, which is an important producing region of container glasses in Asian countries, is a spotlight in lightweight glass making across the Asian range.

For Instance, April 2024, Sapporo Brewery, the centrepiece of Japanese brewing industry, has been a frontrunner in the country's container glass cooperatives and the Japan Institute of Packing Innovation to aid in the production of light glass bottles. Over the years, by the effort’s persistence, Kirin Brewery has been able to decrease the reusable beer glass bottles' weight.

These bottles are not only lighter but also offer the user the functionality to operate more effectively. With eye-catching opening caps and nice-to-tight sealing features, these products can be counted as recognized evidence of the advancement of Japan's technology. These advancements may sound improbable but the fact is Japan has lighter returnable bottles which include all sizes of large, medium and small bottles for beer. Being driven by technology improvements and customer's environmental consciousness about packaging solutions, the Asia's container glass industry has a chance to experience constant growth and implementation of advanced technologies.

For Instance,

North America is rapidly embracing the use of returnable glass bottles in line with the wider trend of sustainable packaging choices. The situation in the region is similar, and both consumers and businesses value environmental factors. Hence, the demand for refillable glass bottles is increasing annually. On the other hand, supply shortages and disruptions are facing the sector in a way that is partly influenced by the high demand and reallocation of raw materials to produce vaccine vials. It is true that there are difficulties in increasing the number of bottles that are recycled which is just 31% in the USA. Considering the fact that glass is completely recyclable, there exists an undeniable scope to advance and intensify recycling techniques, and thereby to reduce dependence on first-use materials by up to 95%.

The United States is one of the countries importing the largest quantities of glass, and the manufacture of various products including drinks, cosmetics, and medicines drives this demand. It connects with a huge variety of glass outfits, providing not only national but also international packaging products. Factors contributing to the growth of returnable glass bottles are many. As sustainable alternatives to single-use plastics become increasingly popular, returnable glass bottles become a choice, owing to recyclability and possibility of reuse. The credibility and aesthetic appeal of glass defined it as the most preferred packaging option for high-end consumers. In North America, the beverage market is getting more receptive to refillable and reusable packaging as consumers are made more responsible, which results in more companies paying attention to their sustainability. Firms promote the renewable glass bottles as an environmental-friendly package, while at the same time, through this proposition, corporations seek to establish an image of eco-friendly and brand loyalty among the customers.

Bottle washing and logistics innovations are also having an important effect to improve returnable glass bottle systems’ economical and environmentally friendly characteristics for consumers. This means that overloading the break-even point is necessary in order to cut the fixed costs of these innovations and encourage more companies to try returnable packaging methods. The market for the returnable glass bottles in the USA and Canada is close to the growing stage of the life cycle; which is mainly due to the existing environment and consumer focus, moreover it is an outcome of the technology intensification in the industry. Making these glass bottles of returnable process fuses sound environmental solution for beverages packaging region.

For Instance,

Modern returnable glass bottle production involves the use of the automated glass-making machine, which has a built-in function of pressing to shape the mouth of the bottle and blowing moulding to form the hollow part of the container. It employs a raw material rich in quartz sand, soda ash, and limestone, thereby making it a glass container that can be recycled and reused an infinite number of times. They will be recycled on average 30 times, thus achieving a high level of sustainability.

The blowing process under pressure is mainly used in bottle making, especially, for production of wide-mouthed jars. This technique takes into account a specialized (Individual Section) IS machine, which breaks an entire production process into different sections as well as produces glass bottles of same size in batches. In the Blow-and-Blow technique, bottles with varying neck thicknesses are produced. Here, the molten glass drop is descended into the moll, and then it is shaped into neck and chest region using compressed air. Then, the container is flipped, heated again, and forced back into shape with the remaining burst of compressed air.

Traditionally, beer bottles were originally made from thick, dark glass with similar long necks as wine bottles. With the development of brewing skills, the size and shape of beer bottles changed too to illustrate changing tastes and the innovation in the market.

These manufacturing methods showcase the fact that glass bottle production is capable of tackling diverse market needs and hurdles. Both wide-mouth jars for food preserving and sleek beer bottles for the packaging of the beverage are the blown manufacturing process which remains a critical part in the development of the dynamic returnable glass bottle market.

For Instance,

The returnable glass bottles in the alcoholic beverages industry have a straightforward strategy. Consumers buy an alcoholic beverage in a returnable glass bottle at retailers, their product of choice. After emptying the contents, they return the empty bottle either to the retailer or the designated collection point. Once collected, the bottles are washed and disinfected to ensure up to the hygiene standards for reuse. These containers are filled with either the same or another alcoholic beverage, after which they are ready for redistribution to retailers to be resold.

Such system has multiple advantages. On the one hand, it largely eliminates waste through the promotion of reuse of packaging instead of one-time use. On the other hand, returnable glass bottles are environmentally friendly because glass can be reused or recycled indefinitely, thus reducing the demand for fresh raw materials. Similarly, it saves carbon emissions which result from the production and transportation of new bottles. From a business point of view, the use of returnable glass bottles as the packaging material can be quite cost-effective in the long run. The expenses on bottle collection and cleaning infrastructure would be more in the beginning compared to reducing packaging costs and increasing brand loyalty over time. Hence, the latter is always higher than the former.

Returnable glass bottles present an environmentally friendly and economically beneficial packaging solution for the alcoholic beverage market, offering advantages to both nature and business. While in breweries 26% of the packaging space is returned bottles, which makes it one of the significant packaging strategies. That demonstrates the industry's seriousness when it comes to sustainability by reusing glass containers is minimizing environmental impact and the establishment of a circular economy. Globally, more than 45% of beer is consumed in returnable glass bottles. In 2022, the company invested in a water reclamation facility and in a 6.5 MW solar power plant, with more than 14 000 panels, at its Sedibeng brewery. This has led to a reduction of about 30% of carbon emissions from the brewery. Heineken has joined many global sustainability and net-zero initiatives such as The Climate Group’s RE100 program, the We Mean Business Coalition, the Race to Zero movement, the Business Ambition for 1.5°C and the Climate Pledge.

For Instance,

The beverage packaging market is characterized by this annual growth, with trade across the world introducing new international products to consumers' home and their shifting in lifestyle fashion like veganism, dairy-free and low alcohol drinks. Along with, several brands' sustainability plans such as reuse programs become essential part of their businesses. While EU regulation recently took a critical step forward, it introduced the reuse targets. It is the most used kind of glass reusable bottles in new manufacturing nations. Some of countries are using them for more than 80% of their beverage’s consumption.

In seeking for sustainable packaging solutions, glass, which is a traditional package material, distinguishes itself by being able to be reused and recycled. The glass industry is an active player of the supply chains and it finds different solutions such as returnable ones to save materials. Notable industry players, for instance Coca-Cola HBC and PepsiCo, are setting new goals, which is a signal of the movement toward sustainability. Accordingly, the food and cosmetics markets are paving the way to reuse which is in line with this notion.

For many consumers, a glass bottles are regarded as symbol of high quality and classy beverages. Sometimes reusable glass bottles serve as a symbol of the fact where they also provide additional benefits of cost-effectiveness and environmental protection for both consumers and producers. Nevertheless, punctual cleaning and refilling reduces the integrity of the glass leading to ugly scratches on the bottles.

For Instance,

The competitive landscape of the returnable glass bottle market is dominated by established industry giants such as Coca- Cola, Revino, Sidel, Vetropack, Markem-Image, Goya, Green Giant, Cento, Del Monte Foods Inc., Nature's Greatest Foods, Linx Printing Technologies, Whole Foods Market, Rosarita, Old El Paso, Reese, Farmer’s Market Foods, Domino Printing Sciences, Great Value, Native Forest, 365 by WFM, Rotel, Paul Leibinger GmbH & Co. KG, Libby's, Good & Gather. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Coca-Cola probably applies a demand and supply driven approach in terms of reusable bottle market. This strategy may manifest itself through funding of sustainable packaging solutions like glass bottle returns, which are aligned with their environmental pledges. Furthermore, cooperation with suppliers and technology investments into the recycling facilities are some of the ways how Coca-Cola can implement reusing system of returnable glass bottles.

For Instance,

Revino simply make returnable glass bottles that meet the needs of the wine and liqueur manufacturers in terms of quality. They can give marketing for the introduction of innovative bottles, manufacturing technologies as well as customer service to be able to stay their competitiveness in the market.

For Instance,

Sidel may prefer to develop packaging or equipment which can be reused repeatedly from glass bottles to reduce the carbon foot print. In the beverage industry, they can target the market where bottle making and processing technologies would be improved to increase efficiency and cut down the production costs of their customers in this area.

For Instance,

Vetropack is perhaps a glass package specialist, offering returnable bottles made from borosilicate and soda lime glass to various markets. The strategy may include offering many different types of bottles with diverse customization options that may enable them to portray the right brands and brand packaging of their clients. Furthermore, the company could promote its sustainability efforts by expanding the use of recycled glass in the manufacturing chain, taking advantage of environmental consumer knowledge.

For Instance,

By Manufacturing Process

By Application

By End Use

By Region

February 2025

February 2025

February 2025

February 2025