March 2025

.webp)

Principal Consultant

Reviewed By

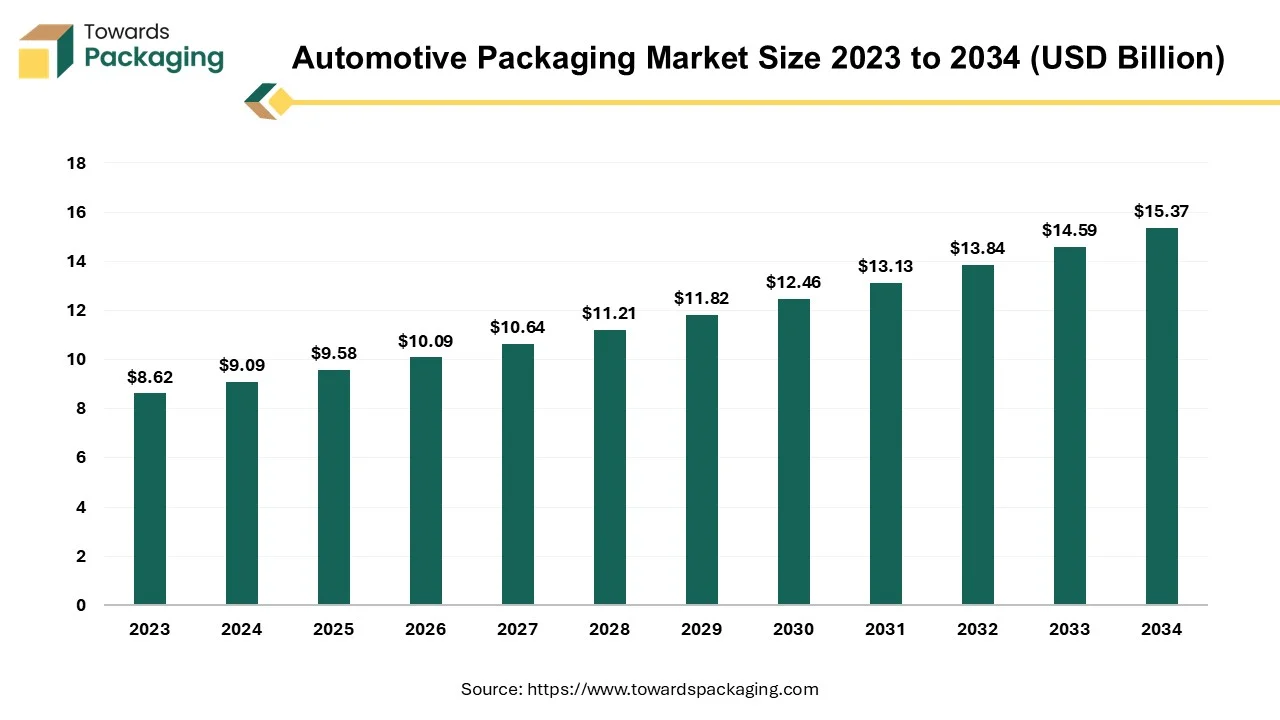

The automotive packaging market is projected to witness significant growth from 2025 to 2034. It will grow from USD 9.58 billion in 2025 to USD 15.37 billion by 2034, expanding at a CAGR of 5.4%, driven by innovations and key market players in the automotive sector.

The automotive sector has witnessed a surge in packaging developments driven by the rising global demand for automobiles and after-sales components. The industry is undergoing a transformation as mechanical systems are being replaced by electronic assemblies, which in turn impacts automotive packaging requirements.

Within this context, two noteworthy trends are emerging in response to the growing demand for spare parts. Firstly, there is a shift toward reducing the volume required for empty packaging and optimizing space utilization. This trend aims to minimize waste and improve efficiency in packaging logistics. Secondly, there is a notable evolution in production technology, leading to the development of low-cost disposable packaging options. This trend aligns with the need for cost-effective solutions in the automotive industry.

Furthermore, the automotive sector is increasingly adopting reusable packaging for heavy components like underbody components, engine components, and cooling systems. This transition toward reusable packaging will contribute to market growth in the coming years. The industry is actively replacing disposable packaging with reusable alternatives, driven by advancements in material science. Developing economically viable and biodegradable plastics has expanded the options for manufacturing disposable packaging for automotive parts.

These trends and advancements in automotive packaging underscore the industry's commitment to sustainable practices and cost optimization. Incorporating reusable packaging and the availability of environmentally friendly materials for disposable packaging contribute to the overall growth and development of the automotive packaging market.

Protective packaging plays a significant role in the global automotive packaging market, accounting for more than one-third of the market share. This is primarily attributed to the extensive use of fragile electrical and electronic components in automobiles, which require adequate protection during packaging and transportation. However, the nature of protective packaging is used only once and then discarded contributes to a substantial volume of waste generation.

In response to consumer demand for eco-friendly packaging solutions and the high cost associated with bio-degradable plastic packaging, corrugated packaging products have gained widespread adoption in the automotive sector. Corrugated packaging offers a sustainable alternative while still providing the necessary protection for automotive parts. The use of corrugated packaging is expected to continue to rise significantly within the automotive industry.

Another packaging segment experiencing rapid growth in the automotive sector is flexible packaging, particularly bags, and pouches. This growth can be attributed to the need for lightweight and durable packaging for many small-sized automotive components. Flexible packaging offers the versatility and efficiency required for packaging these components securely. The bags and pouches segment is anticipated to witness the fastest growth rate among all packaging products in the automotive packaging market.

The increasing adoption of eco-friendly packaging solutions and the demand for lightweight and durable packaging options highlight the evolving trends and preferences within the automotive sector. Manufacturers and suppliers in the industry are increasingly focusing on sustainable packaging practices and exploring innovative packaging solutions to address environmental concerns and meet the diverse packaging needs of the automotive market.

The integrated circuit (IC) packaging industry is experiencing substantial growth in the current automotive market, driven by the increasing demand for automation and enhanced vehicle performance. These market changes are poised to make automobiles more reliable and intelligent. To address the increasingly complex requirements of the automotive industry, the semiconductor packaging sector strategically focuses on developing advanced packaging solutions that cater to the next generation of automotive applications.

Traditionally, automotive ICs have been packaged using wire-bond technology. However, with the growing intricacy and higher performance expectations of automotive applications, the packaging industry is transitioning towards high-performance flip chip and advanced fan-out packages. These packaging technologies are being embraced for GPS, automotive infotainment, and radar applications.

This study provides a comprehensive overview of the evolving packaging landscape within the automotive industry, encompassing the shift from conventional wire-bond to flip chip interconnect and advanced fan-out wafer-level packages. It meticulously examines the advantages and disadvantages of each packaging technology, considering crucial factors such as package and board-level reliability, cost analysis, assembly processes, and the selection of optimal bill of materials (BOM).

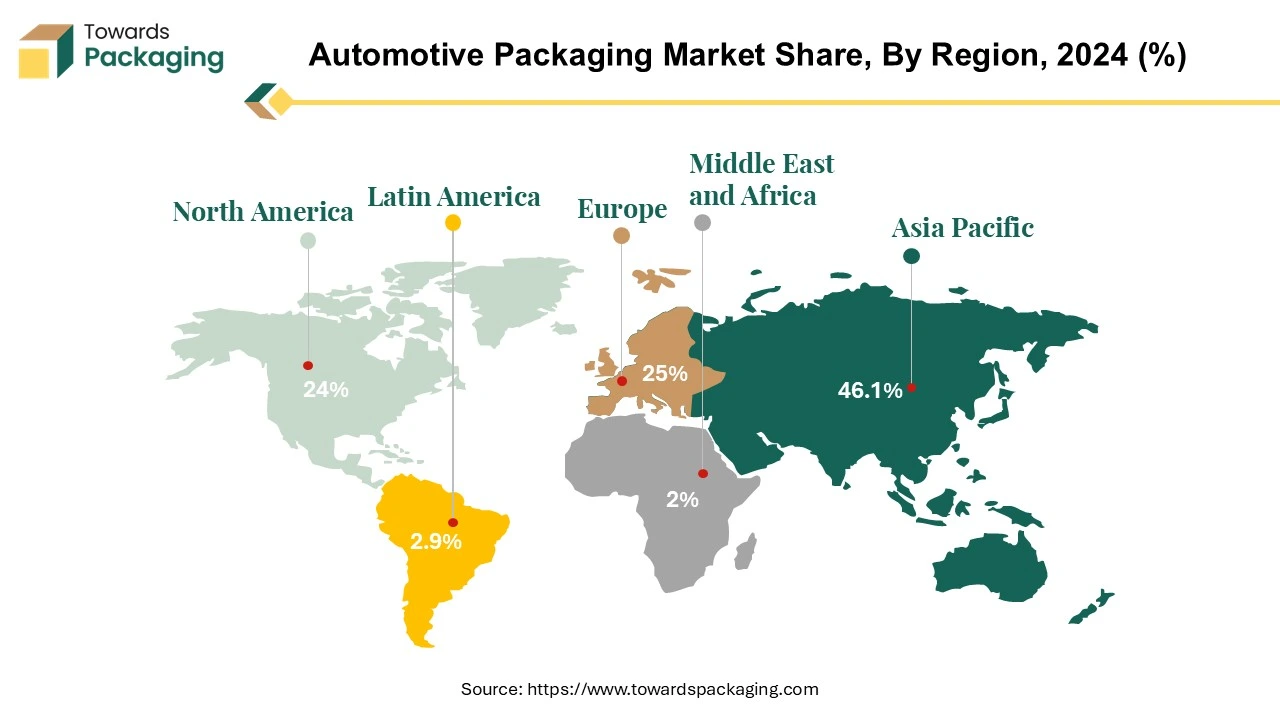

During the projected period, it is estimated that around 46.10% of the automotive packaging market's growth will stem from the Asia-Pacific (APAC) region. The primary drivers of this growth in APAC are China, Japan, and India, considered key markets. However, it is important to acknowledge that the pace of market expansion in APAC is expected to be comparatively slower than that of Europe.

The APAC region is currently experiencing rapid industrialization and urbanization, leading to significant economic transformation. These factors will facilitate the expansion of the automotive packaging market in APAC throughout the forecast period. The increasing industrial and urban landscape is generating demand for automotive packaging, primarily due to its crucial support for the growing automotive industry in the region. Although the growth rate in APAC may be slower when compared to Europe, the region's substantial size and ongoing economic advancements present considerable opportunities for the automotive packaging industry.

The automotive industry is currently driven by four main trends fueling innovation: electrification, autonomous driving, connectivity, and comfort. These trends are shaping the future of automobiles and influencing the direction of technological advancements in the industry.

One of the key drivers behind these trends is the increasing focus on environmental considerations. Governments worldwide aim to reduce carbon dioxide (CO2) emissions and promote cleaner energy consumption. This has led to a strong emphasis on electric vehicles (EVs) and the development of sustainable energy sources within the automotive sector. In addition to environmental concerns, safety has always been a crucial aspect of modern vehicles. With the rapid expansion of autonomous vehicles, significant investments are being made to further enhance safety features. Advanced driver assistance systems (ADAS) and robotic vehicles are being developed to improve overall vehicle safety and minimize accidents.

Furthermore, the automotive industry is witnessing a shift towards increased connectivity. Vehicles are becoming more interconnected, allowing seamless communication with external networks, infrastructure, and other vehicles. This connectivity enables enhanced functionalities such as real-time navigation, remote diagnostics, and vehicle-to-vehicle communication, ultimately improving the driving experience. There is a growing emphasis on passenger comfort and entertainment. With the integration of advanced technologies, in-cabin options are evolving to provide passengers with a more comfortable and enjoyable experience. Features such as personalized climate control, infotainment systems, and other in-car entertainment options are becoming increasingly important in modern vehicles.

These four trends—electrification, autonomous driving, connectivity, and comfort—drive innovation within the automotive industry. Manufacturers, suppliers, and other industry stakeholders are investing in research and development to capitalize on these trends and meet the evolving demands of consumers seeking environmentally friendly, safe, connected, and comfortable vehicles.

While relatively resistant to change compared to the consumer market, the automotive market is increasingly recognizing the significance of advanced packaging technology. Consequently, the packaging market is expected to grow substantially, reaching nearly US$8 billion in 2023. This growth can be attributed to several factors, including the industry's evolving regulations and specific qualification requirements.

To meet the increasing demand and mitigate production costs, original equipment manufacturers (OEMs) and Tier 1 suppliers increasingly subcontract their semiconductor assembly and test operations to outsourced semiconductor assembly and test (OSATS) companies. This strategic move allows them to leverage the expertise and capabilities of specialized external partners, enabling more efficient and cost-effective production processes. In addition to cost considerations, OEMs and Tier 1 suppliers also seek to benefit from the specialized knowledge and resources of OSATS companies in meeting the industry's stringent regulations and qualification requirements. As regulations become more specific and demanding, partnering with OSATS companies provides access to the necessary expertise and infrastructure to ensure compliance.

By subcontracting to OSATS companies, automotive industry players can effectively navigate the evolving landscape, capitalize on advanced packaging technologies, and meet the increasing market demands. This strategic outsourcing approach allows them to optimize their supply chain, enhance operational efficiency, and ultimately deliver high-quality automotive products to meet customer expectations. In the automotive industry, packaging requirements encompass the need for simplicity, reliability, and affordability. However, as certain modules incorporate more chips with increased integration and higher added value, the complexity of packaging solutions also rises. Outsourced semiconductor assembly and test (OSATS) companies have emerged as key players in addressing these diverse packaging needs.

The evolving manufacturing technologies of OSATS companies have become more sophisticated, enabling them to handle higher levels of complexity in automotive packaging. This advancement has created an opportunity for OSATS to play a significant role in meeting the industry's demands. OSATS' expertise and capabilities allow them to provide tailored solutions that align with the specific requirements of automotive modules, encompassing simplicity and reliability while ensuring cost-effectiveness.

Over a relatively short period, OSATS have experienced substantial growth in their market share within the automotive packaging sector. This can be attributed to their ability to adapt to the increasing complexity of packaging solutions and effectively meet the evolving needs of the industry. Their expanding role underscores their value as trusted partners for automotive manufacturers, enabling them to enhance their packaging capabilities and deliver high-quality products with improved integration and added value.

By leveraging the sophisticated manufacturing technologies of OSATS, the automotive industry can effectively address the dual challenge of simplicity and complexity in packaging. This partnership allows automotive manufacturers to streamline operations, enhance product performance, and ultimately provide reliable and affordable solutions to meet the market's demands.

When manufacturing vehicles for the market, automakers extensively source parts from various global suppliers to meet the industry's and consumers' stringent demands for high-quality automobiles.

Given the multitude of parts required to assemble an engine, frame, exterior decorative items, and numerous other automotive components, auto engineers heavily depend on efficient custom automotive packaging to ensure the safe delivery of these parts.

When evaluating automotive packaging options, selecting the optimal solution that ensures the preservation of your product's integrity is essential.

Custom automotive packaging plays a crucial role in transporting essential components required for automobile assembly. Pioneer Packaging understands this significance and provides a diverse range of solutions to guarantee the secure and efficient delivery of your products into the hands of auto engineers. By leveraging Pioneer Packaging's expertise, you can trust that your automotive components will be safely transported, ensuring a smooth manufacturing process.

Compared to traditional methods such as ordering over the phone, the convenience of purchasing automotive components online has significantly increased due to the widespread availability of e-commerce platforms and modern shop management systems. This shift has been driven by the ease and accessibility offered by online shopping, allowing consumers to browse and compare products, access detailed information, and benefit from transparent pricing.

One of the reasons consumers prefer online purchasing is the perceived lack of transparency in pricing and procedures at local garages. Online platforms provide detailed product descriptions, allowing consumers to make informed decisions and better understand the pricing structure. This transparency enhances the shopping experience and builds trust between consumers and online retailers.

The aftermarket car parts market offers various products, including fenders, headlights, and replacement windscreens. To ensure the safe delivery of these products, unique packaging solutions are essential to prevent damage during shipping. The selection of the most suitable packaging materials and methods depends on the specific application and destination of the product.

Manufacturers and sellers must carefully consider the packaging requirements for each automotive component, considering factors such as size, fragility, and protection needed during transit. Various packaging materials, such as foam, cardboard, bubble wrap, and protective films, can provide adequate cushioning and secure the components in transit. Furthermore, the choice of packaging methods, such as individual packaging or bulk packaging, should be determined based on efficiency and cost-effectiveness. Each component should be packaged to ensure its integrity and prevent any potential damage, meeting customer expectations upon delivery.

By leveraging suitable packaging materials and methods, the automotive aftermarket industry can ensure the safe transportation of products and uphold customer satisfaction. Effective packaging solutions play a crucial role in maintaining product quality and reducing the risk of damage, ultimately contributing to a positive buying experience for consumers. The automotive packaging market has witnessed significant growth due to the increasing demand for direct sales through e-commerce platforms in manufacturing automobile components. This expansion of e-commerce platforms globally, coupled with the automotive industry's emphasis on establishing a strong online presence, presents many opportunities for the global automotive packaging market.

Various packaging solutions have been developed to ensure the safe transportation of automobile components purchased online. These solutions include heat-sealed bubble pouches, plastic corrugated divisions lined with foam, and films that protect against marring, scratching, and abrasion. These packaging materials and methods are designed to safeguard the components during transit and maintain their integrity upon delivery. The growth of e-commerce platforms in the automotive industry has opened up new avenues for the automotive packaging market. As consumers increasingly turn to online platforms to purchase automobile components, the demand for effective packaging solutions has risen. Manufacturers and suppliers in the automotive industry recognize the importance of securely packaging their products and ensuring they arrive in optimal condition to meet customer expectations.

The global expansion of e-commerce platforms and the automotive industry's focus on online sales present ample opportunities for the automotive packaging market. Packaging companies that can provide innovative, protective, and visually appealing packaging solutions tailored to the needs of the automotive sector stand to benefit from this growing market. By meeting the packaging requirements of the automotive industry, these companies can contribute to enhancing the customer experience and facilitating the efficient and safe delivery of automobile components purchased online.

The comparative landscape of the automotive packaging market is characterized by intense competition and rapid innovation, driven by the evolving needs of the automotive industry. This market serves the packaging requirements of automotive manufacturers and suppliers, catering to the safe transportation and storage of automotive components. The landscape's key factors include market size, packaging types, material innovation, customization and branding, safety and quality standards, sustainability, and environmental impact.

The market's size and growth vary across regions, influenced by vehicle production volumes, export/import activities, and industry trends. Various packaging types, including crates, pallets, containers, and protective packaging solutions, are offered to address the diverse needs of automotive components. Manufacturers continuously strive to develop innovative packaging materials that combine strength, lightweight characteristics, and environmental sustainability. Customization and branding are crucial, as companies provide tailored packaging solutions that align with their client's specific requirements, incorporating branding elements and handling instructions.

Safety and quality standards are of paramount importance in the automotive packaging market. Manufacturers adhere to rigorous regulations and certifications to ensure that packaging effectively safeguards the components during transportation, handling, and storage. With growing environmental concerns, sustainability has become a key consideration. Automotive packaging companies are adopting eco-friendly materials and implementing recycling initiatives to minimize environmental impact.

The competitive landscape is marked by fierce rivalry, with companies differentiating themselves through product innovation, cost-effectiveness, customer service, and supply chain efficiency. Strategic partnerships with automotive manufacturers and suppliers are often forged to gain a competitive edge. Additionally, geographic presence plays a significant role as companies expand into new markets to serve the global automotive industry.

By Product

By Packaging

By Automotive Parts

By Component

By Geography

March 2025

March 2025

March 2025

March 2025