March 2025

.webp)

Principal Consultant

Reviewed By

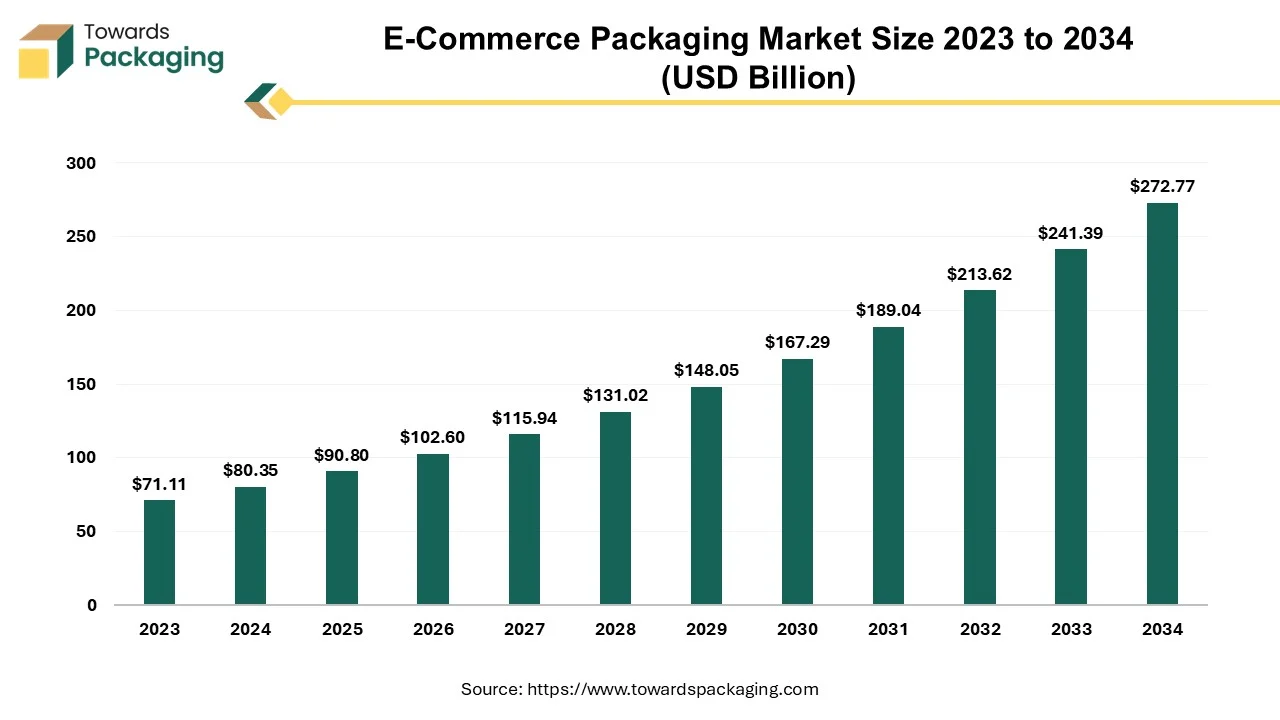

The e-commerce packaging market is set to expand significantly from 2025 to 2034. The market is projected to grow from USD 90.8 billion in 2025 to USD 272.77 billion by 2034, at a CAGR of 13%, driven by the continued boom in online shopping and the need for efficient packaging solutions.

E-commerce packaging involves meticulously preparing merchandise and items to ensure secure transportation to a specified destination. As online commerce continues flourishing, various services catering to this domain have emerged as significant markets. Shipping boxes have garnered substantial attention in conjunction with the e-commerce industry. The primary objective of e-commerce packaging is to safeguard products against potential damage from physical or environmental factors, spanning the period from packaging to final delivery. Moreover, good packaging is a hallmark of establishing a formidable presence in any industry.

In the expanding e-commerce landscape, efficient packaging solutions play a vital role in guaranteeing customer satisfaction and fostering brand loyalty. The meticulous wrapping of goods protects them from external hazards during transit and enhances their presentation, contributing to a positive unboxing experience. Consequently, businesses must recognize the pivotal role of e-commerce packaging in safeguarding the integrity of their products and ensuring their arrival in pristine condition. Additionally, the significance of superior packaging extends beyond mere protection and aesthetics. It is a powerful marketing tool, enabling businesses to make a lasting impression on their target audience. Well-designed packaging with visually appealing elements can capture consumers' attention and elevate the perceived value of the enclosed products.

By leveraging packaging as a strategic brand touchpoint, companies can establish a distinct identity, reinforce their brand message, and differentiate themselves from competitors in a highly competitive e-commerce landscape. To capitalize on the potential of e-commerce packaging, organizations should invest in innovative and sustainable packaging materials. This aligns with growing consumer preferences for eco-friendly practices and showcases the brand's commitment to environmental responsibility. By adopting sustainable packaging solutions, businesses can enhance their reputation, attract environmentally-conscious consumers, and contribute to a greener future.

The emergence of the e-commerce industry and the expanding population with access to fast and reliable internet has unlocked significant market potential in e-commerce packaging. Additionally, due to growing environmental concerns surrounding the biodegradation of plastic materials, more companies are now prioritizing the development of 100% organic and reusable packaging solutions. The excitement and convenience of online shopping, where products can be delivered quickly and at competitive prices, further fuels the growth of the e-commerce packaging market. Furthermore, the growing demand for packaged food and beverages creates new opportunities within the sector. Other contributing factors include:

However, government regulations regarding corrugated packaging services and concerns over plastic-based packaging solutions pose certain obstacles to the market's growth.

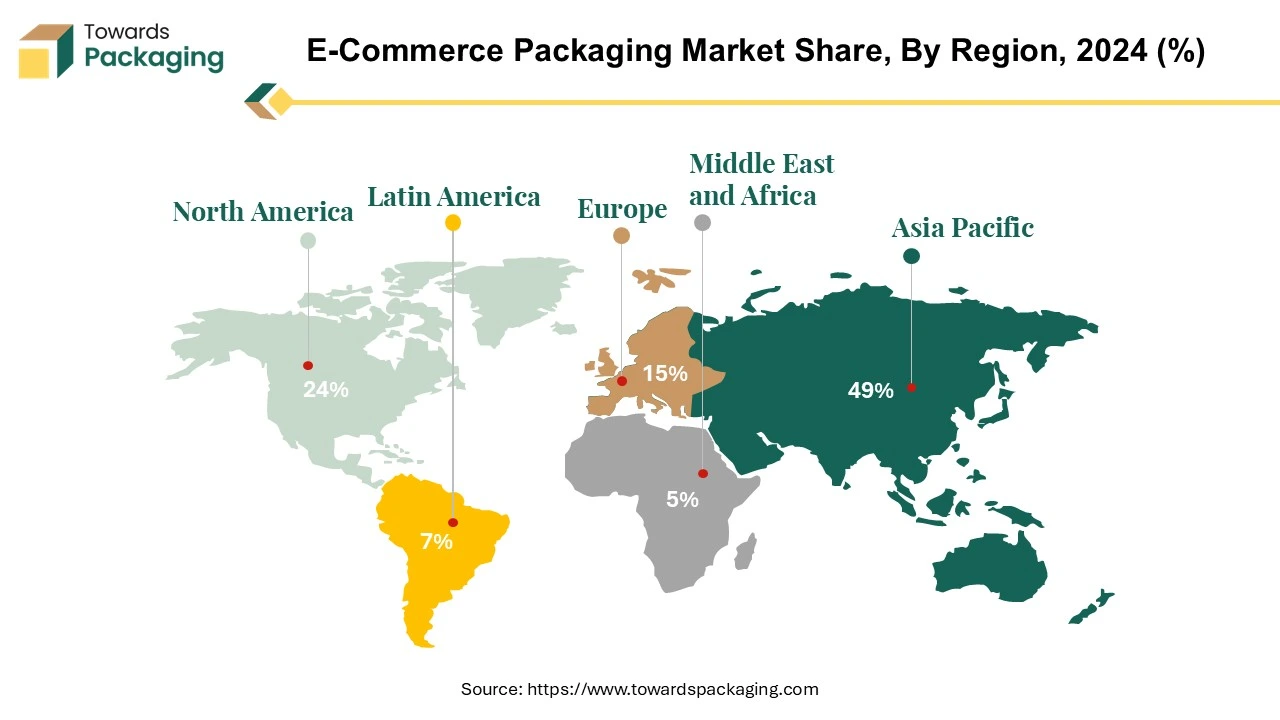

The Asia-Pacific region emerged as a dominant force in the global e-commerce packaging market in 2020, accounting for over half (approximately 52%) of the market value. This share represents a significant increase from the previous five years, highlighting the remarkable strides made in e-commerce within major Asian markets like China, Japan, and South Korea. These countries, known for their robust economies and technological advancements, have established themselves as some of the world's largest and most developed markets for e-commerce packaging. Online shopping has become deeply ingrained in the culture, contributing to the region's dominance.

Moreover, the influence of e-commerce is expanding beyond the markets above. Countries in Southeast Asia, including Indonesia, Thailand, and Vietnam, are experiencing a surge in e-commerce adoption, with significant growth potential. Additionally, the Indian market, with its massive population and increasing internet penetration, is poised for substantial e-commerce growth in the next decade. This shift towards e-commerce is unique in these countries, as it bypasses a stage of retail development that typically involves the prevalence of supermarkets and hypermarkets. Instead, consumers have transitioned directly from traditional channels like street markets and small independent stores to online platforms.

The rise of the Asia-Pacific region as a powerhouse in e-commerce packaging signifies the region's economic strength, technological advancement, and evolving consumer behaviour. It presents lucrative opportunities for businesses in the sector and underlines the importance of adapting to the dynamic e-commerce landscape in this vibrant market.

China is the world's largest individual market for e-commerce packaging, capturing nearly 38% of the global market value in 2020. Within the Asia-Pacific region, China's share accounted for almost 73%, although this percentage slightly declined from nearly 77% five years ago. Meanwhile, other countries in the region, such as South Korea, have experienced growth in their e-commerce markets. The Chinese e-commerce market has witnessed rapid expansion over the past decade, despite internet penetration in the country being just under 60%.

This growth can be attributed to the emergence of a prosperous urban consumer base and the increasing popularity of online purchases of luxury goods from overseas. These factors have propelled the e-commerce sector in China, contributing to its dominant position in the global market for e-commerce packaging. As China's consumer base becomes more affluent and urbanized, the demand for e-commerce packaging solutions is expected to continue its upward trajectory. The country presents significant opportunities for businesses operating in the e-commerce packaging industry, especially as online shopping and cross-border transactions gain popularity among Chinese consumers.

The transition to online retail will continue to substantially influence packaging requirements and reshape the traditional converting value-chain landscape. The realm of e-commerce packaging necessitates meeting new and distinct demands, such as enhanced strength while reducing the emphasis on elaborate "on-the-shelf" printing. Rather than focusing on in-store appeal, there is a heightened focus on optimizing packaging for last-mile shipments, enhancing the consumer's unboxing experience, and facilitating convenient and efficient product returns. With the rise of e-commerce, packaging plays a vital role in ensuring that products reach customers intact during the final leg of delivery. This calls for robust packaging solutions that can withstand the rigors of transportation and handling. The packaging design should also prioritize the consumer's unboxing experience, creating an engaging and memorable moment when the product is unveiled. This can include creative box structures, personalized messages, or surprise elements.

Moreover, the ease and efficiency of product returns have become critical considerations in the e-commerce ecosystem. Packaging must facilitate hassle-free returns, providing convenient ways for customers to send back items while ensuring the protection and integrity of the package throughout the return process. To thrive in the evolving e-commerce landscape, packaging companies, and converters must adapt to these changing needs. This may involve developing specialized packaging materials and designs tailored for last-mile delivery, investing in innovative unboxing experiences, and implementing efficient return packaging systems. By aligning with the unique requirements of e-commerce, packaging providers can better serve online retailers and contribute to a seamless and satisfying customer journey.

While there is a pessimistic view that e-commerce will significantly diminish the traditional role of primary packaging designed to attract consumer interest in retail stores, it is essential to consider the evolving dynamics between online and offline channels. While the part of primary packaging in retail stores may change, it is unlikely to become a relic of the past in the foreseeable future. It is true that customers are becoming increasingly digitally savvy and can seamlessly navigate between online and offline channels. However, the purchase decision process is complex and influenced by various factors. While some customers may have already made up their minds before ordering or buying an item, there are still opportunities for primary packaging to capture attention and create a positive brand impression.

Primary packaging continues to serve functions beyond attracting consumer interest. It protects the product, conveys essential information, and showcases the brand identity. These functions remain relevant regardless of the sales channel. While utilitarian protective packaging may have a more significant role in e-commerce due to the emphasis on safe transit, the visual appeal and branding aspects of primary packaging are still essential for overall customer experience and differentiation.

Moreover, it is essential to note that consumer behaviour and preferences are diverse. While tools for easy replenishment and reordering may reduce impulse purchases in physical stores, there will still be consumers who enjoy the tactile experience of shopping in-store and are influenced by the packaging aesthetics and messaging. Rather than seeing a complete decline, it is likely that the role of primary packaging will evolve and adapt to the changing retail landscape. Packaging design and marketing strategies may need to be adjusted to cater to digital-savvy consumers' unique needs and preferences. However, the importance of packaging in capturing attention, conveying information, and reinforcing brand identity will persist.

In the wake of the global COVID-19 pandemic, there has been an unprecedented surge in demand for online delivery services, particularly in groceries and household items. This sudden shift in consumer behaviour has created a tremendous opportunity for e-commerce companies to capitalize on the increased need for contactless shopping experiences. Recognizing the critical role that e-commerce plays in maintaining social distancing measures, governments worldwide have actively encouraged these companies to take the lead in mitigating the impact of the pandemic.

As a result, the e-commerce sector is poised for substantial growth in the packaging industry. With more consumers relying on online platforms to fulfil their shopping needs, the volume of dispatched packages is expected to skyrocket. E-commerce companies, therefore, must prepare to meet this surge in demand by implementing efficient packaging and logistics strategies. This entails streamlining warehouse operations, optimizing order fulfilment processes, and partnering with reliable shipping providers to ensure timely and reliable deliveries.

During the height of the pandemic, e-commerce companies witnessed unprecedented two-fold growth, especially between April and June 2020. The lockdown measures implemented in various countries compelled consumers to turn to online shopping as a safer alternative to traditional retail. This surge in demand highlighted the importance of a robust e-commerce infrastructure that can handle increased order volumes without compromising delivery speed or customer satisfaction. To sustain this growth and capitalize on the momentum gained during the pandemic, e-commerce companies must adapt their strategies to the evolving market dynamics. Investing in cutting-edge technology and automation solutions can significantly enhance operational efficiency. Implementing advanced inventory management systems, utilizing artificial intelligence algorithms for demand forecasting, and optimizing last-mile delivery logistics are crucial to meeting ever-increasing customer expectations.

Moreover, e-commerce companies should prioritize the development of a seamless and intuitive user interface to enhance the online shopping experience. User-friendly websites and mobile applications, personalized recommendations, and easy-to-navigate product catalogues can foster customer loyalty and drive repeat purchases. By leveraging data analytics and customer insights, e-commerce companies can tailor their offerings and marketing campaigns to suit individual preferences, thereby establishing a competitive edge in the market.

Given the surge in demand for e-commerce packaging, sustainability, and eco-friendliness are paramount considerations. Consumers are becoming increasingly conscious of the environmental impact of excessive packaging waste. E-commerce companies must, therefore, adopt sustainable packaging practices by using recyclable materials, optimizing package sizes, and minimizing unnecessary fillers. Embracing green packaging solutions aligns with consumer expectations and helps reduce costs associated with packaging materials and waste management.

In conclusion, the COVID-19 pandemic has transformed the e-commerce landscape, catapulting online shopping to new heights. E-commerce companies have a unique opportunity to lead the way in meeting the surge in demand for online deliveries. By embracing efficient packaging and logistics strategies, leveraging technology and automation, and prioritizing customer experience, these companies can position themselves for sustained growth and success in the evolving business environment. Furthermore, adopting sustainable packaging practices will align with consumer values and contribute to a greener and more environmentally responsible future.

The efficiency and speed of the packing process are crucial for success. Online retailers often face the challenge of packing items of various sizes, requiring specialized packaging solutions that can be ordered in specific quantities and stored accordingly. Fanfold corrugated board offers an efficient and flexible solution by providing one type of packaging that can accommodate different products. Fanfold corrugated board is pre-scored, making it easy to manually fold and pack around items. It is also compatible with packaging machines and conveyor belts, allowing for streamlined and automated packing processes. The board is stored in a zigzag fold on a pallet, enabling packers to take only the required amount of board for each packaging case.

This approach offers several advantages for e-commerce retailers:

Using fanfold corrugated board allows e-commerce retailers to optimize their packing processes, reduce packaging waste, and improve overall operational efficiency. The flexibility, ease of use, and adaptability of fanfold corrugated boards make it a practical solution for accommodating the diverse packaging requirements inherent in e-commerce. Indeed, the fanfold corrugated board has traditionally found utility in the furniture industry and for packaging large, bulky goods. However, its popularity is also on the rise in the e-commerce sector. One of the advantages of using the fanfold corrugated board in e-commerce is the ability to create custom packaging that matches specific requirements and sizes. Unlike standard-sized cartons, which often result in oversized packaging for specific items, the fanfold corrugated board allows for creating of packaging tailored to the individual product dimensions. This customization makes the packaging more convenient and provides better protection for the goods inside. By eliminating excess space within the packaging, the need for excessive padding is reduced. This, in turn, saves on material costs and optimizes storage space during shipping and warehousing.

Creating customized packaging with fanfold corrugated boards offers several benefits for e-commerce businesses. It improves the overall efficiency of the packing process, ensures better product protection during transit, and minimizes the amount of padding required. Moreover, it helps optimize space use and reduces costs associated with excess packaging material. By adopting fanfold corrugated boards for custom packaging, e-commerce businesses can enhance the customer experience by delivering goods securely and efficiently. The use of tailored packaging not only provides better protection but also helps in cost savings and optimization of storage space throughout the supply chain.

The competitive landscape analysis of the e-commerce packaging market comprehensively assesses each competitor's strategic position. The analysis includes in-depth information on various aspects of the company, such as its background, financial performance, revenue generation, research and development investments, market potential, and global presence. Additionally, details about the company's production sites and facilities, production capacities, and strengths and weaknesses are highlighted. The analysis also covers insights into the company's product portfolio, including product width and breadth, application dominance, and recent product launches. It is important to emphasize that the provided information focuses explicitly on the companies' activities and strategies within the e-commerce packaging market, enabling businesses to thoroughly understand their competitors' positioning and capabilities.

A recent survey of 1,000 consumers across France, Germany, Poland, Sweden, and Turkey highlights the top incentives for online shoppers of all generations: lower prices, time efficiency, and direct delivery. Fashion products lead as the most frequently purchased items, followed by homeware, consumer electronics, and beauty products.

“As customers have seen the growing availability of easy-close packaging, they have also realized how well it fits their needs. This convenience allows them to easily reseal without searching for packing tape and also supports the sustainability aspect by reusing packaging,” the report notes.

This survey underscores the evolving priorities of online shoppers, with a strong focus on product protection, sustainability, and the convenience of packaging solutions.

By Packaging Type

By End User

By Types and Materials

By Region

March 2025

March 2025

March 2025

March 2025