April 2025

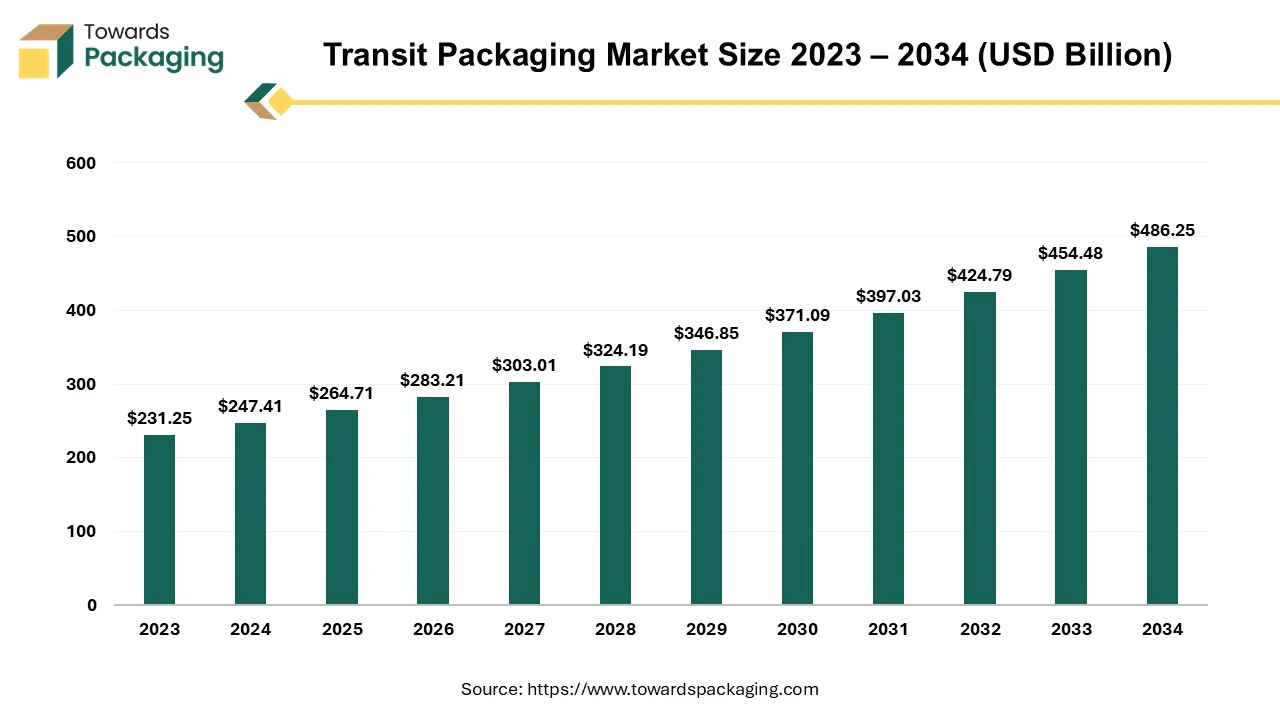

The global transit packaging market was valued at USD 247.41 billion in 2024 and is expected to reach USD 486.25 billion by 2034, growing at a 6.99% CAGR from 2025 to 2034. The rising demand for automobile parts has significantly boosted the need for transit packaging, driving market growth worldwide.

Unlock Infinite Advantages: Subscribe to Annual Membership

Packaging can take many different forms. Depending on the items or materials shipping and the level of protection needed, consumers need different types of transit packing. "Transit Packaging" is something that's frequently disregarded in packaging. Transit packaging is designed to endure several transit stressors including moisture, vibration, compression, etc. and is mostly used for business-to-business transactions. Additionally, transit packaging differs greatly from retail packaging. While transit packaging puts the protection and durability of the goods first, retail packaging places greater emphasis on the presentation and advertising of the products.

The supply chain of any company must include transit packaging. Reliable packing reduces product damage and advances company. Let's examine the advantages, classifications, and varieties of transportation packaging. The initial or deepest layer of packing is called primary packaging. Transit packaging facilitates the effective transportation of goods from one location to another in a world where prompt delivery and customer satisfaction are critical. It helps with effective logistics and lessens loss in addition to making the loading, unloading, stacking, and moving of goods easier.

From December 31, 2021, to December 31, 2022, various international shipments were made, including carton boxes, gift boxes, and laminating paper. Shipments from China included:

In addition, shipments also included gift boxes from China to the UK, and packaging from Israel and Malaysia to China.

The rise in urbanization and fast rate of increase in industrialization and supply chain, the demand for transit packaging grown consequently. As supply chains become more global and interconnected, there's a greater need for secure and efficient transit packaging to protect goods during transportation. The rise of e-commerce has significantly increased the demand for transit packaging solutions, as goods often need to withstand longer and more varied transportation routes. Innovations in materials science and packaging technologies contribute to the development of lighter, stronger, and more efficient transit packaging solutions. In order to address the rising demand of the packaging solution, the key players operating in the market developed the automated technology packaging solution, which is estimated to drive the growth of the transit packaging market over the forecast period.

For instance,

Increasing regulations and consumer demand for sustainable packaging solutions are pressuring companies to innovate and adopt eco-friendly materials and practices. Fluctuating raw material prices, transportation costs, and competitive pricing pressures can impact profit margins and market competitiveness. Meeting stringent regulations regarding packaging materials, especially in international markets, can pose challenges and require continuous adaptation. Efficiently managing packaging logistics, including storage, transportation, and disposal/recycling, can be complex and costly.

Pharmaceuticals, drugs, and medicines are packaged primarily in transit packing to prevent damage to the products. It helps with easy handling and effective storage, and it is also utilized to maintain the quality of pharmaceutical products. Additionally, product contamination is eliminated by the packing. Also, it offers an extra degree of security to maintain the pharmaceutical product secure within and protects the medication from outside influences like pollutants and temperature changes. This packaging product facilitates the process of product segregation and transportation by clearly displaying information about the products. Therefore, the pharmaceutical industry's increasing need for transit packaging fuels the market's expansion.

The paper & paperboard segment held the largest share of the transit packaging market in the year 2024. Due to its reputation for being environmentally friendly, paper and paperboard-based packaging is among the oldest and most widely used for food products, including beverages, dry powders, confections, milk and milk-based products, and bakery goods. The development process of paper incorporates a variety of hazardous chemicals, such as phthalates, surfactants, bleaching agents, printing inks, and hydrocarbons, which are then released into the water system during paper manufacture, food consumption, and recycling.

Recycling is seen to be the greatest way to restore environmental damage, however paper can only be recycled six or seven times, and the waste produced by the paper industry is very varied in both type and composition. There are numerous ways to dispose of paper, including pyrolysis, composting, landfilling, and incineration; however, process optimization becomes a barrier.

The purpose of this review article is to provide a comprehensive overview of the numerous health and environmental hazards associated with the use of paper and paper-based packaging materials in the food business, as well as to explore in detail the use of these materials for food applications. Focusing on the advantages offered by the paper & paperboard transit packaging, the key players operating in the market are focused on adopting inorganic growth strategies like acquisition for development of sustainable transit packaging which is estimated to drive the growth of the segment over the forecast period.

For instance,

The plastic segment is estimated to grow at fastest rate over the forecast period. Plastic packaging's strength and sealability prolong shelf life by preventing product deterioration. It has been demonstrated that plastics may effectively preserve food, offering advantages such as extended shelf life, reduced resource requirements, and simultaneous protection against UV rays, moisture, odors, etc. Plastics are the most versatile material there is, and they cannot be replaced. The most effective method to ensure the safety of the food in contact with them is to use plastic materials. Given their high level of regulation, plastics are the safest packaging material to employ.

For instance,

The rigid segment has shown the significant growth over the forecast period. Since rigid packaging offers superior protection for the products it contains through its structure and support, it is the most popular packaging type and is predicted to grow significantly in the years to come. Manufacturers heavily rely on rigid packaging products because they are highly impact-resistant and make handling bulk products and shipping fragile goods possible. The second dominant segment is protective packaging, which offers cushioning and product protection and is also expected to grow significantly. Focusing on the advantages and comfort offered by the key players operating in the market launched new rigid packaging in the market, which is estimated to drive the growth of the segment over the forecast period.

The flexible segment is expected to grow at fastest rate over the forecast period. Flexible packaging one of the packaging industry's fastest-growing segments, enhances the value and marketability of both food and non-food products by fusing the best aspects of paper, film, plastic, and aluminium foil to provide a wide range of protective properties with the least amount of material. The industry is still developing at a never-before-seen pace. Lighter weight packaging has been developed as a result of technological innovation and developments, improving the shelf appeal, strength, product protection, and sealing capabilities of flexible packaging.

The boxes & cartons segment dominated the market and accounted large revenue share in 202. The leading segment, boxes and cartons, is predicted to increase quickly throughout the forecast period. The boxes and cartons provide a steady cushion for the goods, ensuring their safety throughout handling, shipment, and travel. Due to their ability to endure the rigors of many transportation operations, modify, and offer comprehensive product protection, they are in high demand from key sectors like food and beverage, automotive, healthcare, and others, which further propels the segment's expansion. The key market players are focused to launch new box manufacturing plant to meet the rising demand of the rising of the box and cartons for shipping purpose, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The pallet segment is estimated to grow at fastest rate over the forecast period. Pallets play a critical role in contemporary logistics. Additionally, a wide variety of pallet types are available on the market, including multi-layer, hardwood, bamboo, plastic, steel, paper, presswood, and so on. Pallets offer significant protection to consumer goods and guarantee that they are secured in one place. The key players operating in the market are focused on developing and introducing the most advance technology for monitoring pallet to ensure safety which is estimated to drive the growth of the segment over the forecast period.

For instance,

Moreover, the key players operating in the market are focused on launching the new manufacturing for pallet to meet the rising demand of the transit packaging, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The food & beverages segment dominated the market in 2024. In current scenario due to the busy lifestyle and rapid urbanization the public is highly dependent on ordering food online which has risen the demand for the carton and paper-based box transit packaging for food delivery. Food safety rules must be followed, freshness must be maintained, and products including food and beverages must be packaged with the utmost care. Food packaging cannot function without corrugated boxes because they provide exceptional protection for perishable items throughout storage, transit, and display.

Corrugated boxes play a crucial role in the marketing and sales strategies of food and beverage firms, as they are extensively utilized in retail environments for both primary and secondary packaging of commodities. The quick-service restaurant business is expected to have significant global expansion over the projected period. Expanding workforce numbers and changing customer tastes are the two primary drivers of sector growth. Not for shopping, but for the meals, more than one-third of patrons attend malls. Quick-service restaurants typically use throwaway paper cups for both hot and cold beverages.

Because of this, there is a rapid global increase in the demand for cups. Major fast-food companies, including McDonald's, KFC, Domino, Starbucks, and Pizza Hut, have opened new sites worldwide in response to the huge demand for prepared food and quick meals. The key players operating in the market are focused on launching new sustainable products for packaging food, which is estimated to drive the segment growth over the forecast period.

For instance,

The healthcare segment is expected to grow at fastest rate and found to be the second dominating segment over the forecast period. Increasing launch of the new drugs and medical devices is estimated to drive the growth of the segment over the forecast period. The key players operating in the market are focused to launch the safest mailer transit packaging technology for the development of packaging solution of the medical device product as well as medicinal drugs, which is estimated to drive the segment over the forecast period.

For instance,

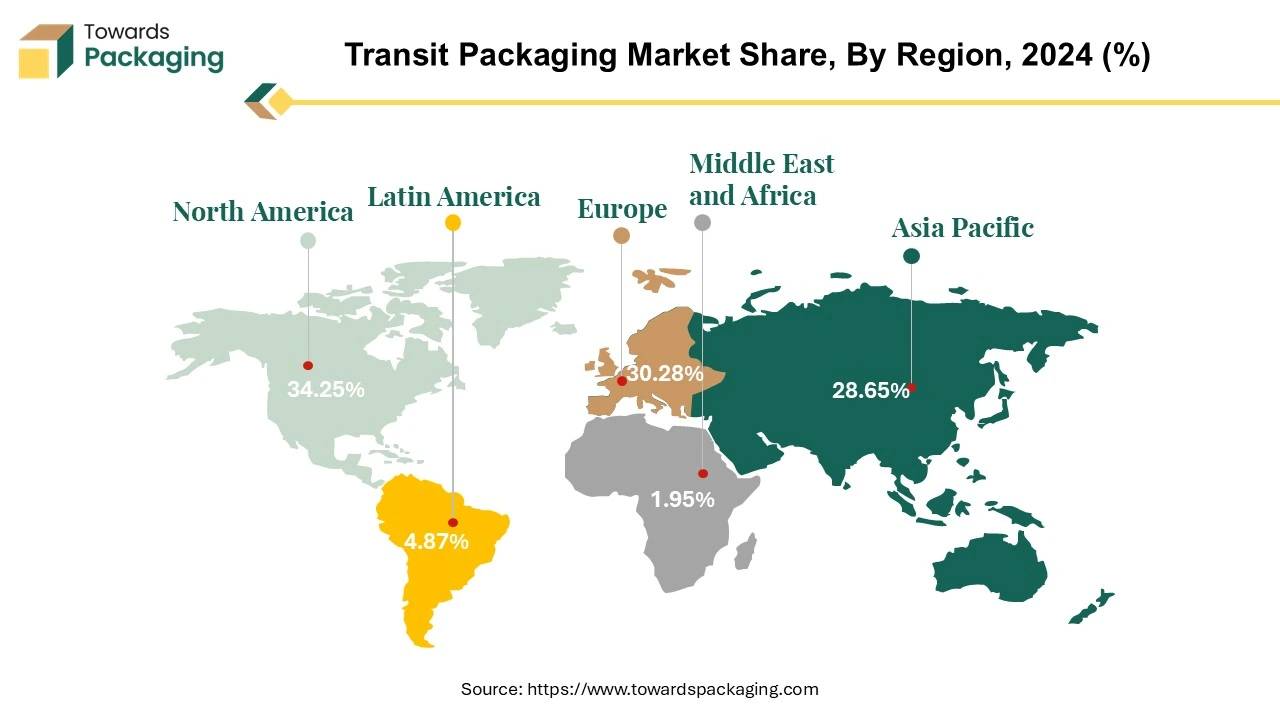

North America witnessed the largest market share in transit packaging market by 34.25% in 2024. North America is one of the largest markets globally for consumer goods and industrial products. The high consumption levels drive demand for transit packaging across various sectors including food and beverages, pharmaceuticals, electronics, and automotive industries. The region boasts a well-developed logistics and transportation infrastructure, including extensive networks of highways, railways, and ports. Efficient transit packaging is crucial to ensure goods are transported safely and securely across these networks. There is a growing awareness and emphasis on sustainable packaging practices in North America. This has led to increased demand for eco-friendly transit packaging solutions that reduce environmental impact.

The North America region is at the forefront of technological advancements in packaging materials and manufacturing processes. Innovations such as lightweight materials, sustainable packaging options, and smart packaging technologies are driving growth in the transit packaging market. The rapid growth of e-commerce in North America has significantly boosted demand for transit packaging solutions. With more goods being shipped directly to consumers, there is a need for efficient and protective packaging to ensure products arrive intact. Overall, these factors collectively contribute to North America's dominance in the transit packaging market, driving innovation and growth in the industry. Moreover, the key players operating in the market are focused on developing and introducing sustainable and environment friendly packaging solution in North America, which is estimated to drive the growth of the transit packaging market in North America over the forecast period.

For instance,

Asia Pacific is estimated to be the fastest growing region over the forecast period. With the surge in online shopping and e-commerce platforms in Asia Pacific, there is a higher demand for robust transit packaging to ensure products are shipped safely and securely over longer distances. There is a growing emphasis on optimizing supply chains in Asia Pacific to reduce costs and enhance efficiency. Transit packaging plays a crucial role in ensuring smooth logistics operations and minimizing product damage during transit.

Many countries in Asia Pacific are undergoing rapid urbanization and infrastructural development. This necessitates efficient transit packaging solutions to transport goods across cities and regions. There is an increasing awareness and regulatory pressure regarding sustainable packaging practices. Companies are adopting eco-friendly transit packaging solutions to reduce their carbon footprint and comply with environmental regulations. Innovations in materials and manufacturing processes are enabling the development of lighter, more durable, and cost-effective transit packaging solutions. This encourages adoption across various industries in the region. Consumers in Asia Pacific are becoming more demanding in terms of product quality and delivery speed. Effective transit packaging helps businesses meet these expectations by ensuring products reach customers intact and on time.

Consumers in Asia Pacific are becoming more demanding in terms of product quality and delivery speed. Effective transit packaging helps businesses meet these expectations by ensuring products reach customers intact and on time. Increasing launch of the new flexible packaging solution for the packaging of the food is expected to drive the growth of the transit packaging market in the Asia Pacific region.

Europe region is estimated to have a notable rate of growth in the transit packaging market. Efficient transit packaging helps optimize supply chain logistics by reducing transportation costs, minimizing damage to goods during transit, and improving overall operational efficiency. This is particularly crucial in a competitive market where timely delivery and cost-effectiveness are key. Innovations in packaging materials and designs, such as lightweight yet durable materials and smart packaging solutions (e.g., IoT-enabled tracking), are further driving the growth of transit packaging in Europe. Overall, the combination of these factors is contributing to the rapid growth of transit packaging in Europe, making it a dynamic and evolving sector within the packaging industry. There's a growing emphasis on sustainable packaging solutions. Many companies are shifting towards recyclable, reusable, or biodegradable transit packaging materials to reduce environmental impact, driven by both consumer demand and regulatory pressures.

For instance,

By Material

By Packaging Type

By Product Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025